Region:Asia

Author(s):Rebecca

Product Code:KRAD6251

Pages:89

Published On:December 2025

By Software Type:The segmentation of the market by software type includes Integrated Ultrasound Image Analysis Software and Standalone Ultrasound Image Analysis Software, in line with global market practice where these are the two primary categories. Integrated software solutions are increasingly preferred due to their ability to provide comprehensive functionalities within a single platform, centralised data storage, interoperability with PACS/HIS, and support for multi-user, real-time data access, which enhances workflow efficiency in clinical settings. Standalone software, while still relevant, is often chosen for specific specialty applications, research use, or budget-constrained environments where upgrading only the software stack is preferred over full system replacement. The integrated solutions are currently leading the market due to their versatility, ease of use, and alignment with hospital digitalization initiatives across APAC.

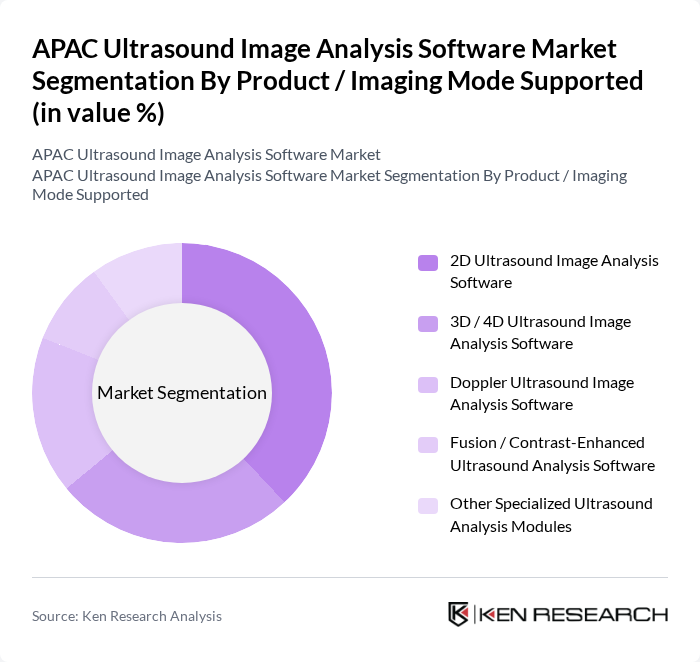

By Product / Imaging Mode Supported:The market is segmented by product or imaging mode supported, which includes 2D Ultrasound Image Analysis Software, 3D / 4D Ultrasound Image Analysis Software, Doppler Ultrasound Image Analysis Software, Fusion / Contrast-Enhanced Ultrasound Analysis Software, and Other Specialized Ultrasound Analysis Modules. The 2D ultrasound software remains the most widely used due to its established presence in routine clinical practice, broad installed base of 2D systems, and wide applicability in obstetrics, abdominal, and general imaging. 3D/4D software is gaining traction for its enhanced visualization capabilities in cardiology, obstetrics, musculoskeletal, and interventional planning, supported by falling hardware costs and better rendering algorithms. Doppler ultrasound software is also significant for vascular and cardiovascular assessments, with rising use in hypertension, peripheral artery disease, and stroke screening programs across APAC, contributing to the overall market growth. Fusion and contrast-enhanced ultrasound modules, along with other specialized analysis tools, are expanding in tertiary care and oncology centers as clinicians seek radiation-free alternatives and real-time perfusion assessment.

The APAC Ultrasound Image Analysis Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers AG, GE HealthCare Technologies Inc., Koninklijke Philips N.V., Canon Medical Systems Corporation, FUJIFILM Healthcare Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Samsung Medison Co., Ltd., Hitachi, Ltd. (Hitachi Healthcare / Hitachi Aloka Medical), Esaote S.p.A., Bracco Imaging S.p.A., Hologic, Inc., Agfa-Gevaert Group, Carestream Health, Inc., ContextVision AB, UltraSight Ltd. contribute to innovation, geographic expansion, and service delivery in this space, offering a mix of integrated and standalone, AI-enabled and conventional ultrasound image analysis solutions tailored for APAC healthcare systems.

The future of the APAC ultrasound image analysis software market appears promising, driven by ongoing technological innovations and increasing healthcare investments. As telemedicine continues to expand, the integration of ultrasound technologies into remote diagnostics will likely enhance accessibility. Furthermore, the growing emphasis on personalized medicine will drive demand for tailored ultrasound solutions, fostering collaboration between tech companies and healthcare providers. These trends indicate a dynamic market landscape poised for significant advancements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Software Type | Integrated Ultrasound Image Analysis Software Standalone Ultrasound Image Analysis Software |

| By Product / Imaging Mode Supported | D Ultrasound Image Analysis Software D / 4D Ultrasound Image Analysis Software Doppler Ultrasound Image Analysis Software Fusion / Contrast-Enhanced Ultrasound Analysis Software Other Specialized Ultrasound Analysis Modules |

| By Application | Cardiology and Vascular Imaging Obstetrics and Gynecology Radiology / General Imaging Oncology Nephrology and Urology Musculoskeletal and Sports Medicine Others |

| By End-User | Hospitals Diagnostic Imaging Centers Ambulatory Surgical Centers & Specialty Clinics Research & Academic Institutions Others |

| By Deployment Mode | On-Premise Cloud-Based Hybrid Others |

| By Country (APAC) | China Japan India South Korea Australia & New Zealand ASEAN (Indonesia, Thailand, Malaysia, Singapore, Vietnam, Others) Rest of Asia-Pacific |

| By Customer Type | Public Sector Providers Private Sector Providers Others |

| By Software Licensing & Commercial Model | Subscription-Based (SaaS) Perpetual / One-Time License Usage-Based / Pay-Per-Use Enterprise / Site Licensing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 120 | Radiologists, Imaging Technologists |

| Private Clinics and Diagnostic Centers | 90 | Clinic Owners, Medical Directors |

| Healthcare IT Decision Makers | 70 | IT Managers, Chief Information Officers |

| Medical Device Distributors | 60 | Sales Managers, Product Specialists |

| Regulatory Bodies and Health Authorities | 40 | Policy Makers, Compliance Officers |

The APAC Ultrasound Image Analysis Software Market is valued at approximately USD 260 million, reflecting significant growth driven by advancements in imaging technology and increasing demand for non-invasive diagnostic procedures across the region.