Region:Middle East

Author(s):Rebecca

Product Code:KRAA9401

Pages:81

Published On:November 2025

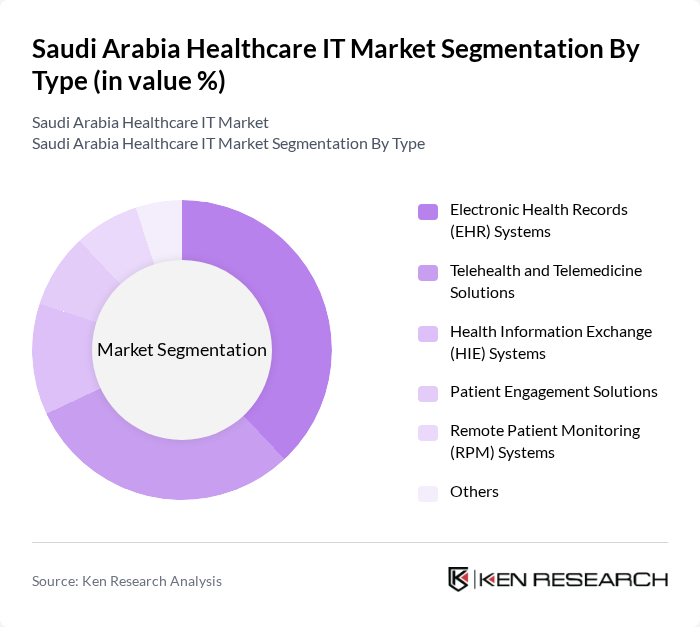

By Type:The market is segmented into Electronic Health Records (EHR) Systems, Telehealth and Telemedicine Solutions, Health Information Exchange (HIE) Systems, Patient Engagement Solutions, Remote Patient Monitoring (RPM) Systems, and Others. Among these, Electronic Health Records (EHR) Systems and Telehealth Solutions are leading, driven by their central role in digitizing patient information, enabling remote consultations, and supporting integrated care delivery. Cloud-based deployment and AI-powered analytics are increasingly prevalent across all segments .

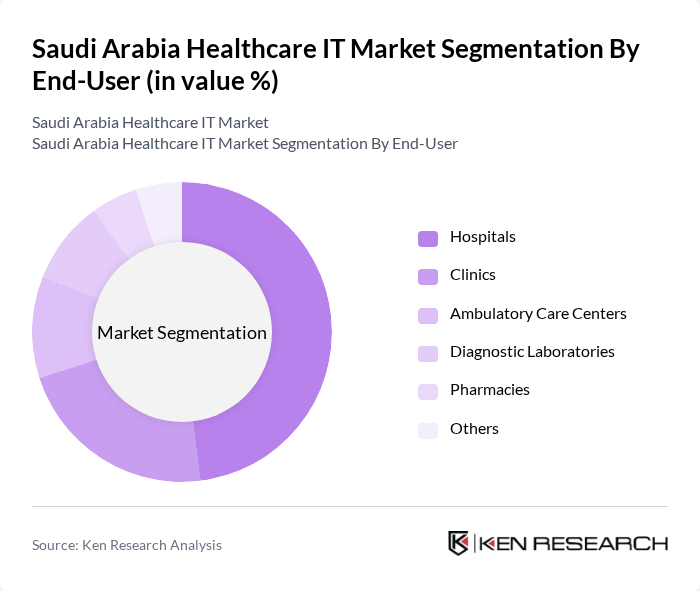

By End-User:The end-user segmentation includes Hospitals, Clinics, Ambulatory Care Centers, Diagnostic Laboratories, Pharmacies, and Others. Hospitals remain the dominant end-user segment, reflecting their need for comprehensive IT solutions to manage patient data, streamline workflows, and support advanced clinical decision-making. Clinics and ambulatory centers are rapidly increasing their adoption of telemedicine and patient engagement platforms .

The Saudi Arabia Healthcare IT Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cerner Corporation, InterSystems Corporation, Philips Healthcare, Siemens Healthineers, IBM Watson Health, GE Healthcare, Oracle Health (formerly Cerner), Epic Systems Corporation, eClinicalWorks, Medisys (Saudi Arabia), Altibbi (MENA Telehealth), Vezeeta (Digital Health Platform), King Faisal Specialist Hospital & Research Centre (KFSH&RC) Digital Health, Lean Business Services (Saudi Health IT), Advanced Electronics Company (AEC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia healthcare IT market appears promising, driven by ongoing government investments and a growing emphasis on digital health solutions. In future, the integration of advanced technologies such as AI and IoT is expected to enhance patient care and operational efficiency. Additionally, the increasing focus on personalized medicine will likely lead to more tailored healthcare solutions, improving patient outcomes and satisfaction across the healthcare system.

| Segment | Sub-Segments |

|---|---|

| By Type | Electronic Health Records (EHR) Systems Telehealth and Telemedicine Solutions Health Information Exchange (HIE) Systems Patient Engagement Solutions Remote Patient Monitoring (RPM) Systems Others |

| By End-User | Hospitals Clinics Ambulatory Care Centers Diagnostic Laboratories Pharmacies Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Cloud-Based Solutions On-Premise Solutions Artificial Intelligence Blockchain Technology Mobile Health Technology Others |

| By Application | Clinical Management Administrative Management Financial Management Patient Engagement Population Health Management Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships (PPP) International Aid Others |

| By Policy Support | Subsidies for IT Adoption Tax Incentives for Healthcare IT Investments Grants for Research and Development Regulatory Support for Innovation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital IT Infrastructure | 100 | IT Managers, Chief Information Officers |

| Telemedicine Adoption | 60 | Healthcare Providers, Telehealth Coordinators |

| Electronic Health Records (EHR) Implementation | 80 | Clinical Staff, Health Information Managers |

| Healthcare Data Analytics | 50 | Data Analysts, Healthcare Strategists |

| Patient Management Systems | 40 | Operations Managers, Patient Care Coordinators |

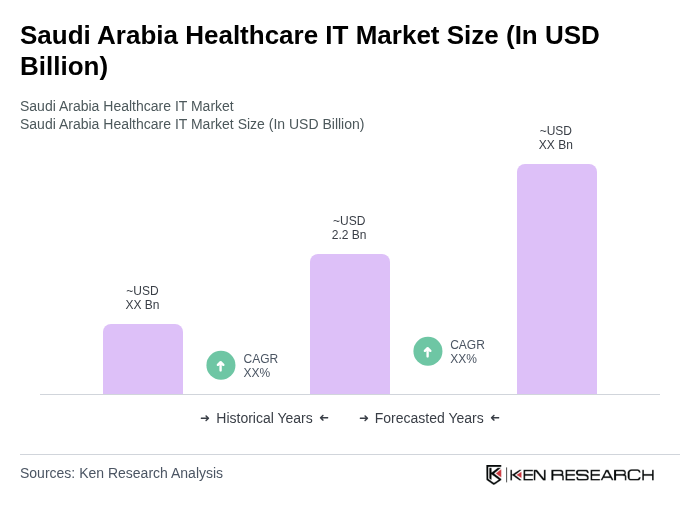

The Saudi Arabia Healthcare IT market is valued at approximately USD 2.2 billion, driven by the increasing adoption of digital health solutions and government initiatives aimed at enhancing healthcare infrastructure as part of Vision 2030.