Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA1952

Pages:93

Published On:August 2025

By Type:The market is segmented into various types of fleet management solutions, including GPS tracking devices, fleet telematics solutions, fuel management systems, maintenance management software, driver behavior monitoring tools, route optimization software, asset tracking solutions, and others. Among these, GPS tracking devices and fleet telematics solutions are leading the market due to their critical role in enhancing operational efficiency, reducing costs, and supporting compliance with safety and environmental regulations. Fuel management and maintenance management software are also gaining traction as companies focus on reducing fuel consumption and vehicle downtime through predictive analytics and automated scheduling .

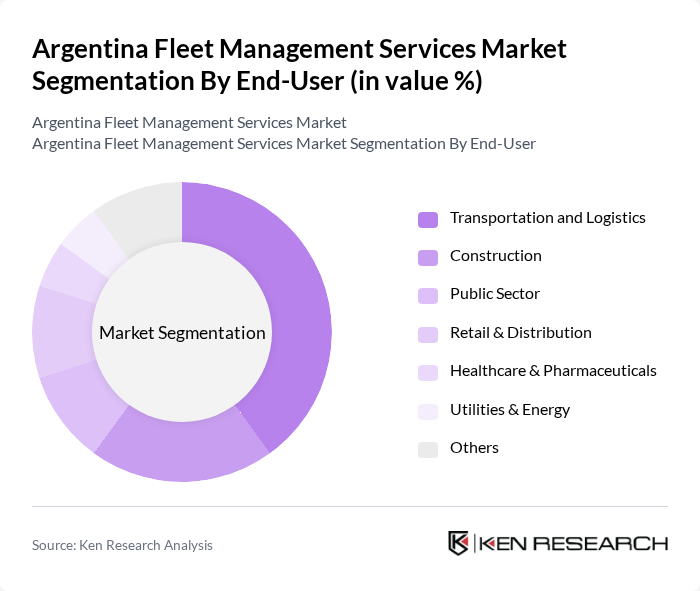

By End-User:The end-user segmentation includes transportation and logistics, construction, public sector, retail & distribution, healthcare & pharmaceuticals, utilities & energy, and others. The transportation and logistics sector dominates the market, driven by the need for efficient fleet operations, real-time tracking, and compliance with evolving safety and environmental standards. Construction and public sector fleets are increasingly adopting telematics for asset utilization and regulatory compliance, while retail, healthcare, and utilities are leveraging fleet management to optimize delivery, reduce costs, and improve service reliability , .

The Argentina Fleet Management Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fleet Complete, Geotab Inc., Teletrac Navman, Omnicomm, Verizon Connect, FleetUp, Pointer by PowerFleet, TomTom Telematics, Zubie, Samsara, MiX Telematics, Chevin Fleet Solutions, Gurtam, Navman Wireless, Ctrack, Inseego Corp., Localiza Fleet Solutions, LoJack Argentina, Ituran Argentina, Webfleet Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fleet management services market in Argentina appears promising, driven by technological advancements and a growing emphasis on sustainability. As businesses increasingly prioritize cost efficiency and environmental responsibility, the adoption of electric vehicles and telematics will likely accelerate. Furthermore, the rise of e-commerce logistics will create new opportunities for fleet optimization, enabling companies to enhance service delivery while reducing operational costs. Overall, the market is poised for significant transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | GPS Tracking Devices Fleet Telematics Solutions Fuel Management Systems Maintenance Management Software Driver Behavior Monitoring Tools Route Optimization Software Asset Tracking Solutions Others |

| By End-User | Transportation and Logistics Construction Public Sector Retail & Distribution Healthcare & Pharmaceuticals Utilities & Energy Others |

| By Fleet Size | Small Fleets (Less than 100 Vehicles) Medium Fleets (100-500 Vehicles) Large Fleets (Over 500 Vehicles) |

| By Service Type | Full-Service Fleet Management Software-as-a-Service (SaaS) Consulting & Integration Services Aftermarket Services |

| By Deployment Model | On-Premise Cloud-Based |

| By Hardware | GPS Tracking Devices Telematics Control Units Sensors & Cameras Others |

| By Payment Model | Subscription-Based Pay-Per-Use One-Time Purchase |

| By Vehicle Type | Commercial Vehicles Passenger Vehicles Electric Vehicles Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Fleet Management | 60 | Fleet Managers, Operations Directors |

| Public Transportation Services | 40 | Transport Coordinators, City Planners |

| Logistics and Supply Chain | 50 | Logistics Managers, Supply Chain Analysts |

| Technology Integration in Fleet Management | 45 | IT Managers, Fleet Technology Specialists |

| Sustainability Practices in Fleet Operations | 40 | Sustainability Officers, Compliance Managers |

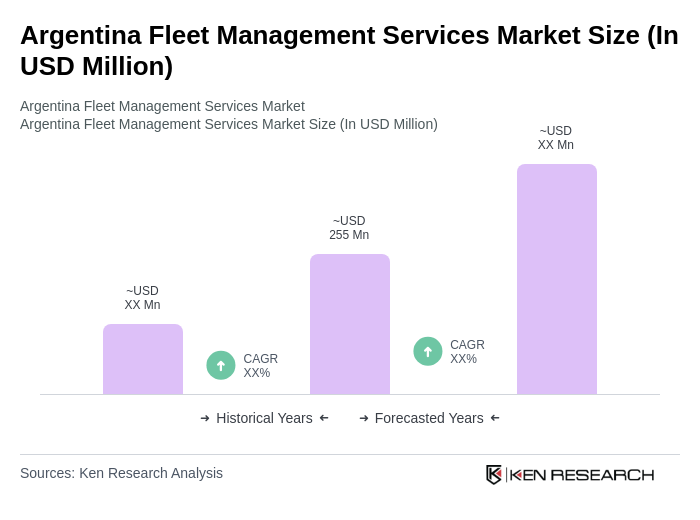

The Argentina Fleet Management Services Market is valued at approximately USD 255 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient fleet operations and the adoption of advanced telematics solutions.