Region:Africa

Author(s):Geetanshi

Product Code:KRAA1981

Pages:100

Published On:August 2025

By Offering:The market is segmented into solutions and services. Solutions include software and technology platforms that facilitate fleet management, while services encompass various operational support functions.

Theservices segmentleads the market, reflecting the growing demand for managed services, maintenance, and support in addition to core software platforms. Businesses are increasingly recognizing the value of outsourcing fleet operations, leveraging third-party expertise for compliance, analytics, and operational efficiency. The adoption of integrated solutions that combine telematics, data analytics, and real-time tracking is also rising, as companies seek to optimize their fleet performance and reduce operational costs .

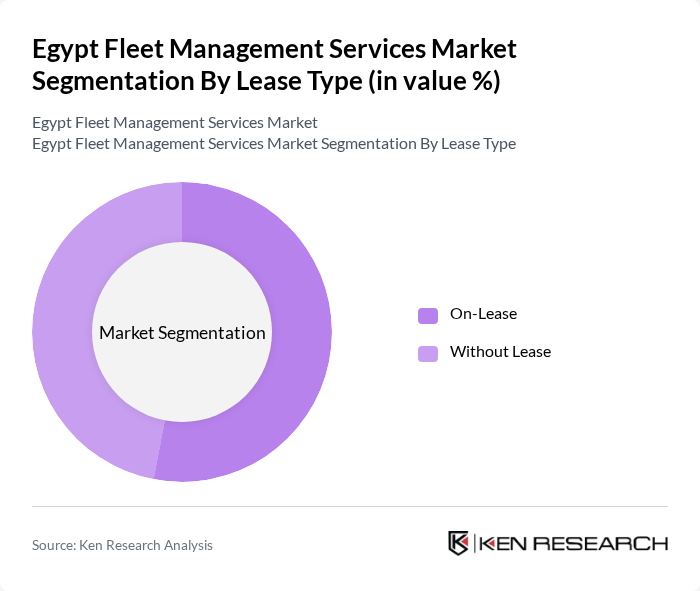

By Lease Type:The market is segmented into on-lease and without lease. On-lease refers to vehicles that are leased for a specific period, while without lease indicates ownership or usage without leasing agreements.

Theon-lease segmentholds a slight lead, as organizations increasingly prefer leasing vehicles to minimize upfront capital expenditure and maintain operational flexibility. Leasing enables access to newer vehicle models and advanced technologies, supporting efficient fleet renewal and compliance with regulatory standards. This trend is particularly notable among logistics, transportation, and distribution companies seeking to scale operations and manage variable demand .

The Egypt Fleet Management Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Masafat Logistics, Fleet Complete, Geotab, Teletrac Navman, Omnicomm, Brightskies, EgyptSat, Traccar, Gurtam, TomTom Telematics, Microlise, Chevin Fleet Solutions, ARI Fleet Management, Element Fleet Management, Wheels, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fleet management services market in Egypt appears promising, driven by technological advancements and government support. As the logistics sector continues to evolve, the integration of AI and IoT technologies will enhance operational efficiency and safety. Additionally, the shift towards electric vehicles is expected to gain momentum, aligning with global sustainability trends. These factors will likely create a dynamic environment for fleet management services, fostering innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Offering | Solutions Services |

| By Lease Type | On-Lease Without Lease |

| By Mode of Transport | Automotive Marine Rolling Stock Aircraft |

| By Vehicle Type | Internal Combustion Engine (ICE) Electric Vehicle |

| By Hardware | GPS Tracking Devices Dash Cameras Bluetooth Tracking Tags (BLE Beacons) Data Loggers Others |

| By Fleet Size | Small Fleets (1-10 Vehicles) Medium Fleets (11-50 Vehicles) Large Fleets (51+ Vehicles) |

| By End-User | Transportation and Logistics Construction Public Sector Retail Healthcare Others |

| By Deployment Model | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Purchase |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Fleet Management | 60 | Fleet Managers, Operations Directors |

| Public Transportation Services | 50 | Transport Coordinators, Fleet Supervisors |

| Logistics and Delivery Services | 70 | Logistics Managers, Supply Chain Analysts |

| Tourism and Hospitality Fleet Operations | 40 | Operations Managers, Guest Services Directors |

| Telematics and Fleet Technology Providers | 40 | Product Managers, Technology Officers |

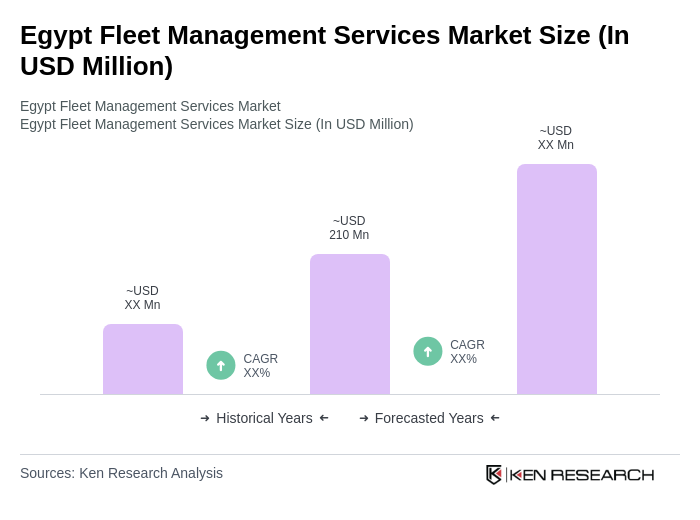

The Egypt Fleet Management Services Market is valued at approximately USD 210 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient logistics, e-commerce expansion, and advancements in fleet management technologies.