Region:Asia

Author(s):Dev

Product Code:KRAC0520

Pages:86

Published On:August 2025

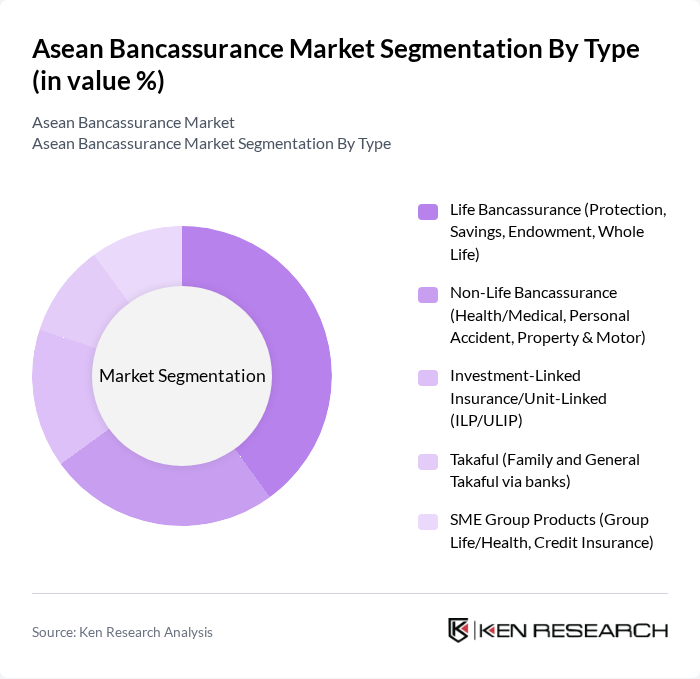

By Type:The Asean Bancassurance Market can be segmented into various types, including Life Bancassurance, Non-Life Bancassurance, Investment-Linked Insurance, Takaful, and SME Group Products. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of financial products available in the region.

The Life Bancassurance segment is currently the dominant player in the Asean Bancassurance Market, driven by demand for protection (term, health riders, critical illness) and savings/endowment solutions distributed through banks. Rising financial literacy and disposable income, combined with banks’ advisory-led sales and digital pre-qualification, are supporting strong life insurance uptake via bancassurance.

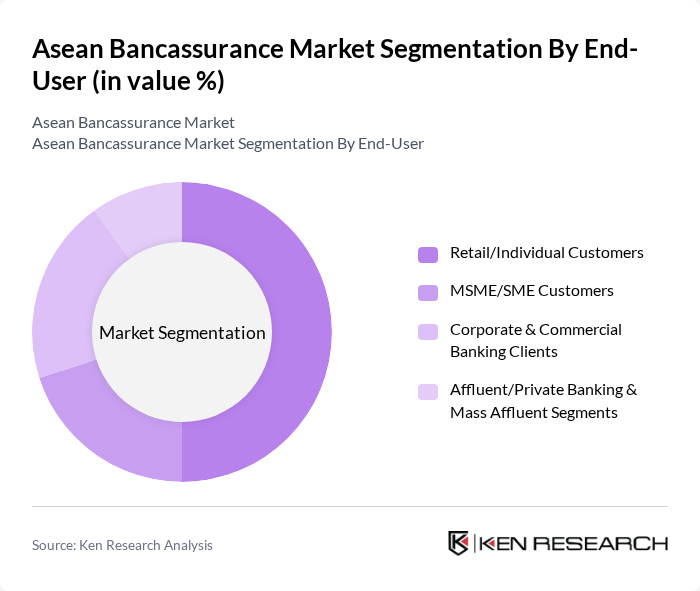

By End-User:The market can also be segmented based on end-users, which include Retail/Individual Customers, MSME/SME Customers, Corporate & Commercial Banking Clients, and Affluent/Private Banking & Mass Affluent Segments. Each of these segments has unique characteristics and requirements, influencing the types of bancassurance products offered.

The Retail/Individual Customers segment leads the Asean Bancassurance Market, accounting for a significant portion of the overall market share. Banks’ omnichannel distribution, payroll and CASA-linked offers, and simplified protection products have increased penetration among retail customers, particularly in emerging ASEAN markets where banks are principal distribution partners for insurance.

The Asean Bancassurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as DBS Bank Ltd., Oversea-Chinese Banking Corporation (OCBC Bank), United Overseas Bank (UOB), Bangkok Bank Public Company Limited, Krungthai Bank Public Company Limited, Kasikornbank Public Company Limited, Bank Rakyat Indonesia (Persero) Tbk, Bank Mandiri (Persero) Tbk, Bank Central Asia (BCA), Bank Negara Indonesia (BNI), Maybank (Malayan Banking Berhad) / Etiqa, CIMB Group Holdings Berhad, Public Bank Berhad, Hong Leong Bank Berhad / Hong Leong Assurance Berhad, RHB Bank Berhad / RHB Insurance Berhad, Prudential plc (Prudential Corporation Asia / Pru Life UK Philippines, Prudential Thailand), AIA Group Limited, Great Eastern Holdings Limited, Allianz SE (Allianz Ayudhya, Allianz Indonesia, Allianz Malaysia), Manulife Financial Corporation (Manulife Vietnam, Manulife Indonesia), Sun Life Financial Inc. (Sun Life Malaysia, Sun Life Vietnam), FWD Group Holdings Limited, Generali Group (Assicurazioni Generali S.p.A.), Chubb Limited (Chubb Life/General in ASEAN), AXA (AXA Affin Life Insurance Berhad, Philippines/Singapore operations) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ASEAN bancassurance market appears promising, driven by ongoing digital transformation and evolving consumer preferences. As financial literacy continues to improve, more individuals are expected to seek integrated financial solutions. Additionally, the increasing adoption of artificial intelligence and big data analytics will enable personalized offerings, enhancing customer engagement. The focus on sustainable investment products is also likely to shape the market, aligning with global trends towards responsible finance and ethical investing.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Bancassurance (Protection, Savings, Endowment, Whole Life) Non-Life Bancassurance (Health/Medical, Personal Accident, Property & Motor) Investment-Linked Insurance/Unit-Linked (ILP/ULIP) Takaful (Family and General Takaful via banks) SME Group Products (Group Life/Health, Credit Insurance) |

| By End-User | Retail/Individual Customers MSME/SME Customers Corporate & Commercial Banking Clients Affluent/Private Banking & Mass Affluent Segments |

| By Distribution Model | Pure Distributor Exclusive Partnership Financial Holding/Ownership Joint Venture |

| By Channel | Bank Branch/Relationship Manager Digital/Mobile and Online Banking Contact Center/Tele-bancassurance ATM/Kiosk and Embedded In-App Journeys |

| By Geography (ASEAN) | Indonesia Thailand Malaysia Singapore Vietnam Philippines Others (Brunei, Cambodia, Laos, Myanmar) |

| By Policy Duration | Short-term (?5 years) Long-term (>5 years) |

| By Claims & Servicing | Traditional/In-branch Digital/Straight-Through Processing Hybrid/Omni-channel |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bancassurance Product Awareness | 150 | Bank Customers, Insurance Policyholders |

| Consumer Preferences in Insurance Products | 100 | Financial Advisors, Insurance Agents |

| Market Trends in ASEAN Bancassurance | 80 | Bank Executives, Insurance Company Managers |

| Regulatory Impact on Bancassurance | 70 | Regulatory Officials, Compliance Officers |

| Customer Satisfaction with Bancassurance Services | 90 | End Consumers, Customer Service Representatives |

The Asean Bancassurance Market is valued at approximately USD 34 billion, reflecting significant growth driven by the integration of banking and insurance services, digital distribution channels, and strong partnerships between banks and insurers.