Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1030

Pages:95

Published On:October 2025

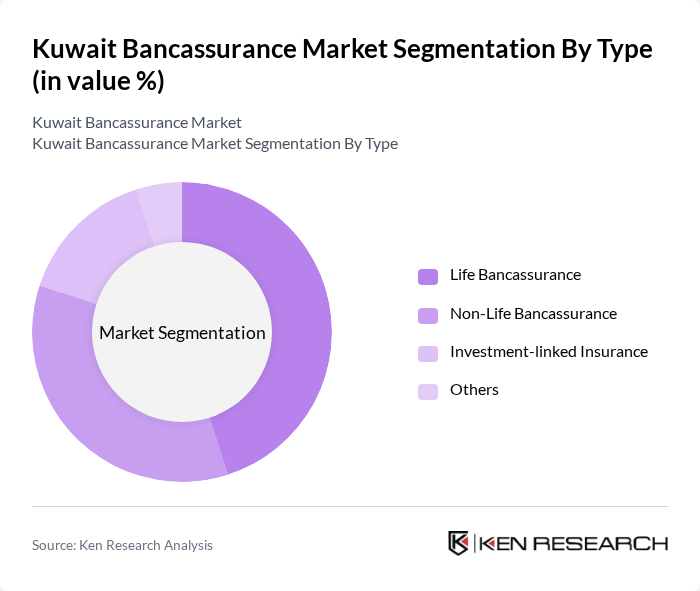

By Type:The bancassurance market can be segmented into various types, including Life Bancassurance, Non-Life Bancassurance, Investment-linked Insurance, and Others. Life Bancassurance encompasses products such as Term Life, Whole Life, Endowment, Universal Life, Group Life, and Critical Illness. Non-Life Bancassurance includes Health, Property, Motor, Travel, Marine, Liability, and other insurance products. Investment-linked Insurance products are designed to provide both insurance coverage and investment opportunities, while the Others category includes miscellaneous offerings .

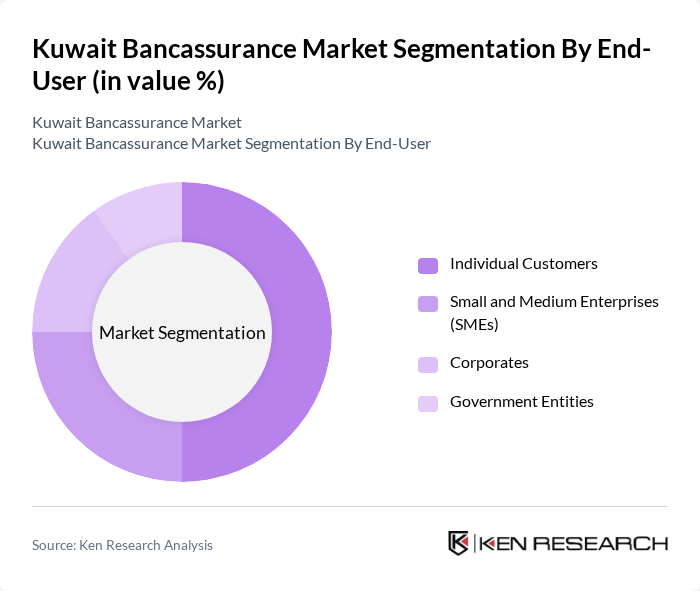

By End-User:The end-user segmentation includes Individual Customers, Small and Medium Enterprises (SMEs), Corporates, and Government Entities. Individual Customers represent a significant portion of the market, driven by the increasing need for personal financial security and the growing adoption of digital banking. SMEs and Corporates are also key players, as they seek comprehensive insurance solutions to protect their assets and manage risks. Government Entities contribute to the market by implementing policies that encourage insurance uptake among citizens .

The Kuwait Bancassurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Finance House, Gulf Bank, National Bank of Kuwait, Al Ahli Bank of Kuwait, Boubyan Bank, Warba Bank, Kuwait Insurance Company, Gulf Insurance Group, Al-Ahlia Insurance Company, Takaful International Company, Al Sagr Cooperative Insurance Company, Kuwait Reinsurance Company, KFH Takaful, Al-Ahli Takaful Company, Al-Mawashi Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bancassurance market in Kuwait appears promising, driven by technological advancements and evolving consumer preferences. The integration of digital platforms is expected to enhance customer engagement and streamline service delivery. Additionally, as banks increasingly focus on personalized insurance solutions, the market is likely to witness a surge in tailored products that meet diverse consumer needs. This evolution will create a more competitive landscape, fostering innovation and improving overall service quality.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Bancassurance (Term Life, Whole Life, Endowment, Universal Life, Group Life, Critical Illness) Non-Life Bancassurance (Health, Property, Motor, Travel, Marine, Liability, Others) Investment-linked Insurance Others |

| By End-User | Individual Customers Small and Medium Enterprises (SMEs) Corporates Government Entities |

| By Distribution Channel | Direct Sales Bank Branches Online Platforms Insurance Agents |

| By Product Bundling | Standalone Products Bundled Financial Services |

| By Customer Demographics | Age Group (Under 30, 30-50, 51+) Income Level (Low, Middle, High) |

| By Policy Duration | Short-term Policies Long-term Policies |

| By Claims Process | Manual Claims Processing Automated Claims Processing Hybrid Claims Processing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 150 | Bank Account Holders, Insurance Policyholders |

| Insurance Agents and Brokers | 100 | Insurance Sales Representatives, Financial Advisors |

| Banking Executives | 40 | Branch Managers, Product Development Heads |

| Regulatory Authorities | 40 | Insurance Regulators, Financial Supervisors |

| Consumer Focus Groups | 60 | Young Professionals, Retirees, Families |

The Kuwait Bancassurance Market is valued at approximately USD 1.7 billion, reflecting significant growth driven by the integration of banking and insurance services, increased consumer awareness, and the expansion of digital distribution channels.