Region:Asia

Author(s):Shubham

Product Code:KRAC0656

Pages:89

Published On:August 2025

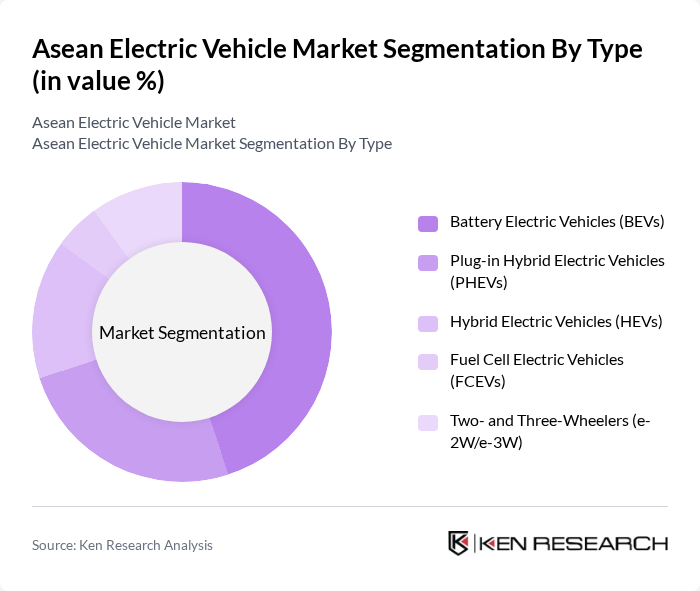

By Type:The electric vehicle market can be segmented into various types, including Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs), Fuel Cell Electric Vehicles (FCEVs), and Two- and Three-Wheelers (e-2W/e-3W). Among these, Battery Electric Vehicles (BEVs) are leading the market for light vehicles in key ASEAN markets as policy incentives favor zero-emission models and consumers increasingly adopt fully electric options. Growing charging infrastructure deployments and continued battery cost improvements are supporting BEV uptake across the region.

By Vehicle Category:The market can also be segmented by vehicle category, which includes Passenger Vehicles, Commercial Vehicles (e-buses, e-trucks, delivery vans), and Micro-mobility (e-scooters, e-mopeds). Passenger Vehicles dominate the market as consumers shift toward personal electric mobility, supported by incentives and expanding model availability; commercial vehicle electrification is gaining traction in buses and last-mile logistics, while micro-mobility remains important in dense urban contexts.

The Asean Electric Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as BYD Company Limited, Great Wall Motor Co., Ltd. (ORA), SAIC Motor – MG Motor, VinFast Auto Ltd., Toyota Motor Corporation, Honda Motor Co., Ltd., Mitsubishi Motors Corporation, Nissan Motor Co., Ltd., Hyundai Motor Company, Kia Corporation, Proton Holdings Berhad, Perusahaan Otomobil Kedua Sdn Bhd (Perodua), Geely Automobile Holdings Limited, PT Toyota Motor Manufacturing Indonesia (TMMIN), Energy Absolute Public Company Limited (EA) – E-Tuk/E-Bus contribute to innovation, geographic expansion, and service delivery in this space.

Additional notes on growth drivers and trends (kept concise and within original sections): - Government initiatives: Multiple ASEAN governments provide purchase incentives, tax relief, and manufacturing support to attract EV investment and speed adoption; Thailand and Indonesia are regional leaders in policy-driven EV manufacturing build-up. - Consumer adoption momentum: EV penetration in ASEAN-6 light vehicles has risen alongside new model launches and competitive pricing from Chinese brands, contributing to faster BEV uptake. - Ecosystem development: ASEAN leaders endorsed a regional EV ecosystem push, signaling long-term cooperation on standards, infrastructure, and supply chains.

The future of the ASEAN electric vehicle market appears promising, driven by a combination of technological advancements and increasing consumer demand for sustainable transportation. As battery costs continue to decline and charging infrastructure expands, the region is likely to see a surge in EV adoption. Additionally, government policies aimed at reducing emissions and promoting green technologies will further enhance market growth. Collaborative efforts between automotive manufacturers and tech companies will also play a pivotal role in shaping the future landscape of electric mobility in ASEAN.

| Segment | Sub-Segments |

|---|---|

| By Type | Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Hybrid Electric Vehicles (HEVs) Fuel Cell Electric Vehicles (FCEVs) Two- and Three-Wheelers (e-2W/e-3W) |

| By Vehicle Category | Passenger Vehicles Commercial Vehicles (e-buses, e-trucks, delivery vans) Micro-mobility (e-scooters, e-mopeds) |

| By End-User | Private Consumers Commercial Fleets (logistics, ride-hailing, rentals) Public Transportation Agencies Government and Municipal Entities |

| By Sales Channel | OEM-Authorized Dealerships Direct-to-Consumer (D2C) Online Platforms/Marketplaces Fleet and B2B Sales |

| By Charging Type | AC (Level 1/Level 2) Charging DC Fast Charging Battery Swapping |

| By Price Band | Entry (? US$20,000) Mid (US$20,001–US$45,000) Premium (? US$45,001) |

| By Country (ASEAN-6 focus) | Thailand Indonesia Malaysia Vietnam Philippines Singapore |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Attitudes towards EVs | 150 | General Consumers, Early Adopters |

| Automotive Industry Stakeholders | 120 | Manufacturers, Distributors, Dealers |

| Government Policy Makers | 60 | Regulatory Officials, Environmental Policy Advisors |

| Charging Infrastructure Providers | 80 | Business Development Managers, Technical Directors |

| Environmental NGOs and Advocacy Groups | 40 | Program Directors, Policy Analysts |

The ASEAN Electric Vehicle market is valued at approximately USD 1 billion, reflecting a five-year historical analysis of regional EV market sizes. This valuation aligns with independent industry assessments of the ASEAN EV market during the latest period.