Region:Middle East

Author(s):Shubham

Product Code:KRAD6580

Pages:92

Published On:December 2025

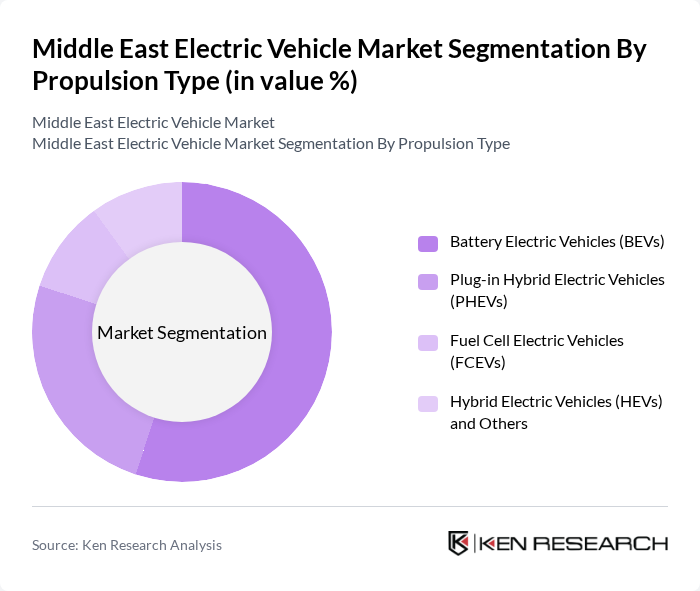

By Propulsion Type:The propulsion type segmentation includes Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Fuel Cell Electric Vehicles (FCEVs), and Hybrid Electric Vehicles (HEVs) and Others. Among these, Battery Electric Vehicles (BEVs) are leading the market due to their zero-emission capabilities and advancements in battery technology, which have improved their range and affordability. The growing consumer preference for fully electric options, coupled with government incentives such as reduced import duties, free or discounted parking, and priority registration in markets like the UAE and Saudi Arabia, has further propelled the demand for BEVs in the region.

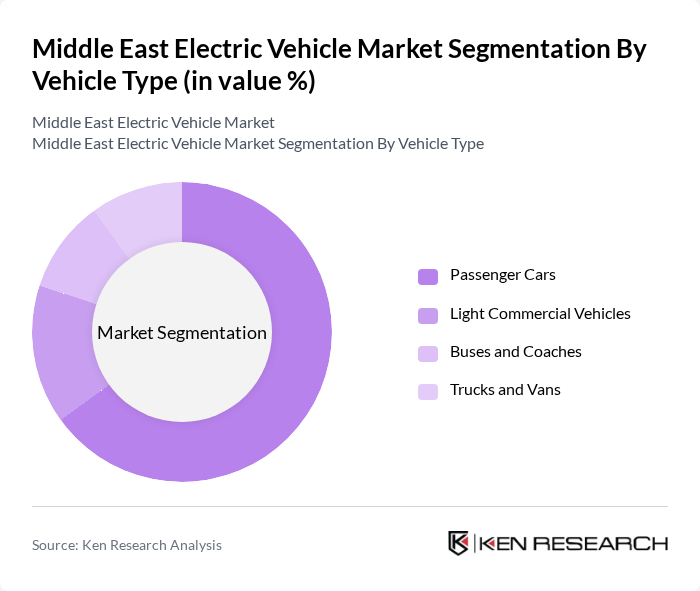

By Vehicle Type:The vehicle type segmentation encompasses Passenger Cars, Light Commercial Vehicles, Buses and Coaches, and Trucks and Vans. Passenger Cars dominate the market, driven by increasing consumer demand for personal electric vehicles and the growing availability of various models from global and Chinese OEMs across key Gulf markets. The trend towards urbanization and the need for sustainable transportation solutions, as well as government-backed initiatives to electrify ride-hailing, taxi, and private car fleets, have also contributed to the rise in electric passenger car sales, making them the preferred choice among consumers.

The Middle East Electric Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tesla, Inc., Nissan Motor Co., Ltd., BMW AG, Hyundai Motor Company, Kia Corporation, Lucid Group, Inc., Polestar Automotive Holding UK PLC, BYD Company Limited, NIO Inc., XPeng Inc., SAIC Motor Corporation Limited (MG Motor), Geely Automobile Holdings Limited, VinFast Auto Ltd., Ceer Company, and Gulf Cooperation Council (GCC) Regional OEMs and Assemblers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric vehicle market in the Middle East appears promising, driven by a combination of technological advancements and increasing consumer demand for sustainable transportation. As governments continue to implement supportive policies and invest in infrastructure, the market is expected to witness accelerated growth. Additionally, the integration of renewable energy sources into the charging infrastructure will further enhance the appeal of electric vehicles, making them a more attractive option for environmentally conscious consumers in the region.

| Segment | Sub-Segments |

|---|---|

| By Propulsion Type | Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Fuel Cell Electric Vehicles (FCEVs) Hybrid Electric Vehicles (HEVs) and Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Buses and Coaches Trucks and Vans |

| By Vehicle Class / Price Segment | Mid Priced Luxury Fleet and Utility-Oriented Others |

| By Charging Type | AC Slow/Normal Charging DC Fast Charging Ultra Fast / High Power Charging Wireless and Other Emerging Charging |

| By Battery Capacity | Below 40 kWh –70 kWh Above 70 kWh Others |

| By Country | Saudi Arabia United Arab Emirates Israel Turkey Qatar, Kuwait, Oman, Bahrain Rest of Middle East |

| By Application / End-Use | Private Ownership Corporate and Commercial Fleets Government and Municipal Fleets Mobility-as-a-Service (Ride hailing, Car sharing, Leasing) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Awareness and Adoption | 150 | General Consumers, Early Adopters |

| Fleet Management Insights | 120 | Fleet Managers, Logistics Coordinators |

| Charging Infrastructure Providers | 90 | Infrastructure Developers, Energy Providers |

| Government Policy Impact | 60 | Policy Makers, Regulatory Officials |

| Automotive Industry Stakeholders | 100 | Manufacturers, Distributors, Dealers |

The Middle East Electric Vehicle Market is valued at approximately USD 7.6 billion, reflecting significant growth driven by government initiatives, rising fuel prices, and increased consumer awareness regarding environmental sustainability.