Region:Asia

Author(s):Rebecca

Product Code:KRAA1416

Pages:97

Published On:August 2025

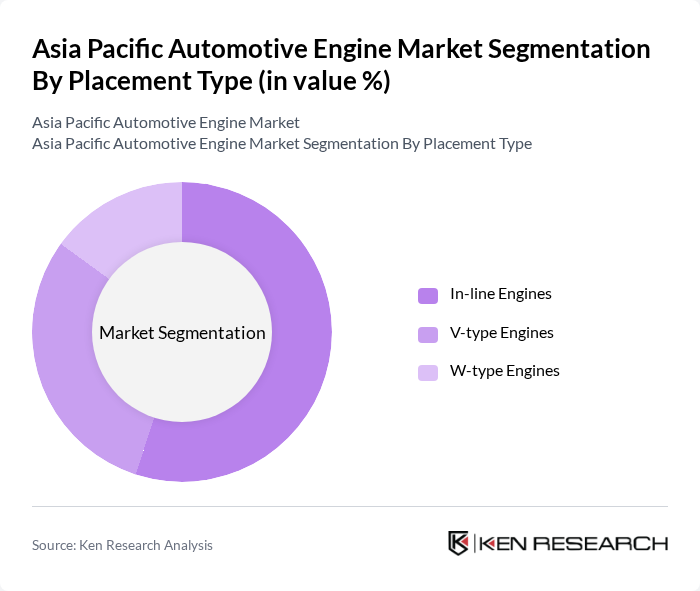

By Placement Type:The placement type of engines is a critical factor influencing the market dynamics. The primary subsegments include In-line Engines, V-type Engines, and W-type Engines. In-line engines are widely used due to their simplicity, cost-effectiveness, and efficiency, making them the most popular choice among manufacturers. V-type engines, while more complex, offer higher power outputs and are preferred in performance and premium vehicles. W-type engines, though less common, are utilized in high-end luxury vehicles due to their compact design and superior power capabilities.

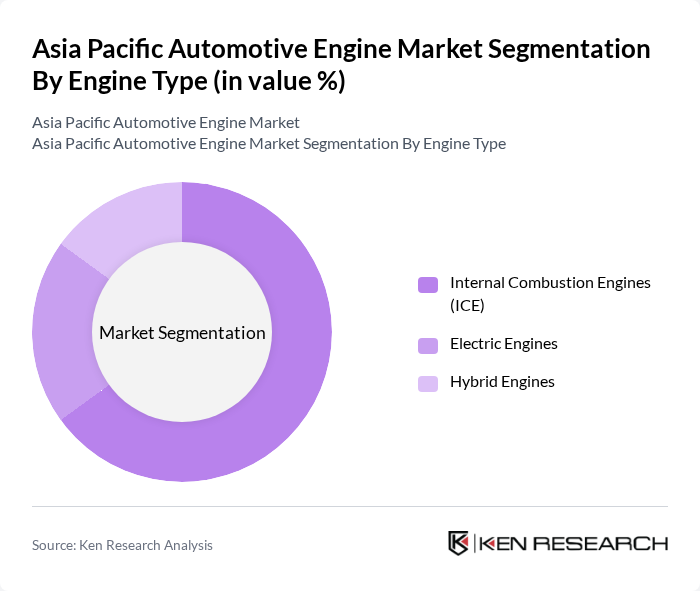

By Engine Type:The engine type segmentation includes Internal Combustion Engines (ICE), Electric Engines, and Hybrid Engines. Internal combustion engines remain the dominant choice due to their established technology, widespread infrastructure, and cost advantages. However, electric engines are rapidly gaining traction as consumers shift towards more sustainable options, driven by environmental concerns, government incentives, and expanding charging infrastructure. Hybrid engines combine the benefits of both ICE and electric engines, appealing to consumers seeking improved efficiency and reduced emissions without sacrificing performance.

The Asia Pacific Automotive Engine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, Honda Motor Co., Ltd., Nissan Motor Co., Ltd., Hyundai Motor Company, Suzuki Motor Corporation, Tata Motors Limited, Mahindra & Mahindra Ltd., Maruti Suzuki India Limited, SAIC Motor Corporation Limited, Changan Automobile Co., Ltd., Isuzu Motors Ltd., Mitsubishi Motors Corporation, Kia Corporation, Great Wall Motor Company Limited, BYD Company Limited, Geely Automobile Holdings Limited, Dongfeng Motor Corporation, FAW Group Corporation, AVL List GmbH, Hyundai Mobis Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Asia Pacific automotive engine market appears promising, driven by technological advancements and a shift towards sustainable practices. As manufacturers increasingly adopt electric and hybrid technologies, the market is expected to witness a transformation in engine design and functionality. Additionally, the integration of connected vehicle technologies will enhance engine performance and efficiency, aligning with consumer preferences for smarter, more efficient vehicles. This evolution will likely create new avenues for growth and innovation in the automotive sector.

| Segment | Sub-Segments |

|---|---|

| By Placement Type | In-line Engines V-type Engines W-type Engines |

| By Engine Type | Internal Combustion Engines (ICE) Electric Engines Hybrid Engines |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Two-Wheelers Heavy-Duty Vehicles |

| By Engine Capacity | Below 1.0L L - 2.0L L - 3.0L Above 3.0L |

| By Fuel Type | Gasoline Diesel Alternative Fuels (CNG, LPG, Ethanol, etc.) Others |

| By Application | Automotive Manufacturing Aftermarket Services Research and Development Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Country/Region | China India Japan South Korea Southeast Asia (Indonesia, Thailand, Malaysia, Vietnam, etc.) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Engine Manufacturers | 100 | Product Development Managers, R&D Engineers |

| Commercial Vehicle Engine Suppliers | 60 | Supply Chain Managers, Procurement Specialists |

| Electric Vehicle Component Manufacturers | 50 | Technical Directors, Innovation Managers |

| Aftermarket Engine Parts Distributors | 40 | Sales Managers, Operations Directors |

| Automotive Regulatory Bodies | 40 | Policy Analysts, Compliance Officers |

The Asia Pacific Automotive Engine Market is valued at approximately USD 133 billion, reflecting a robust growth trajectory driven by increasing demand for fuel-efficient vehicles and advancements in engine technology.