Region:Asia

Author(s):Dev

Product Code:KRAD3251

Pages:86

Published On:November 2025

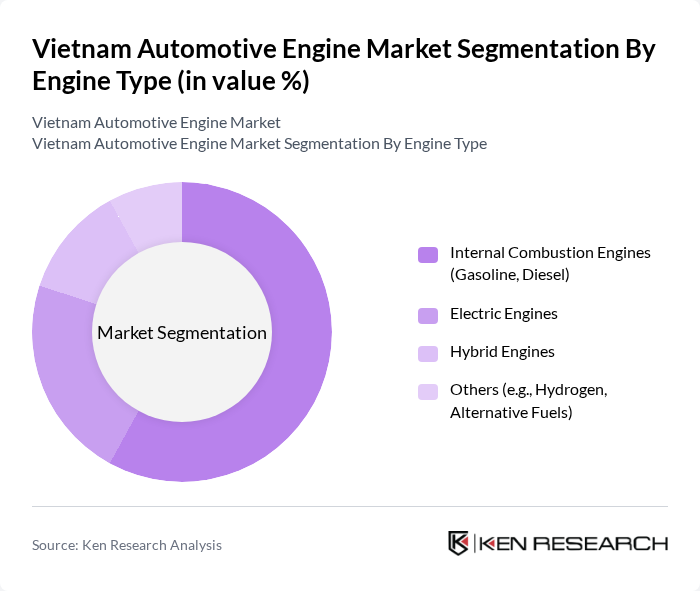

By Engine Type:The engine type segmentation includes Internal Combustion Engines (Gasoline, Diesel), Electric Engines, Hybrid Engines, and Others (e.g., Hydrogen, Alternative Fuels). Internal Combustion Engines remain the dominant segment due to their established technology and widespread use in the automotive industry. However, Electric and Hybrid Engines are rapidly gaining traction as consumers become more environmentally conscious and government policies accelerate the adoption of cleaner alternatives. The push for electrification is further supported by domestic manufacturers such as VinFast, which are expanding electric and hybrid vehicle offerings .

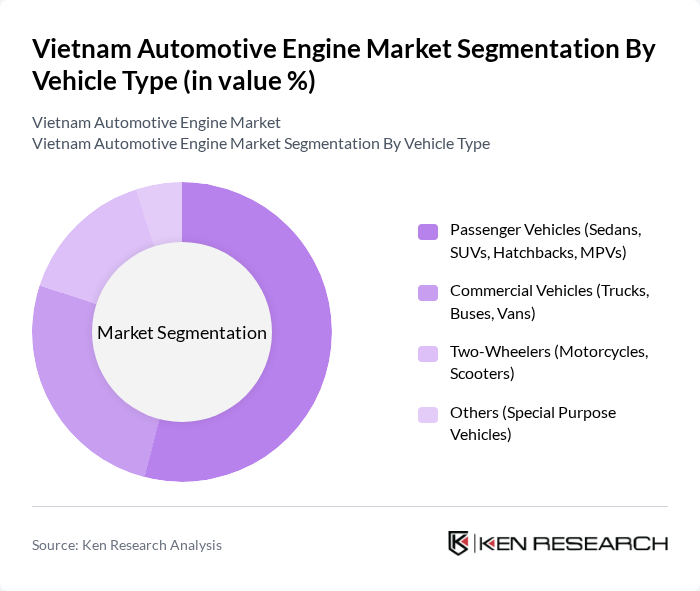

By Vehicle Type:The vehicle type segmentation covers Passenger Vehicles (Sedans, SUVs, Hatchbacks, MPVs), Commercial Vehicles (Trucks, Buses, Vans), Two-Wheelers (Motorcycles, Scooters), and Others (Special Purpose Vehicles). Passenger Vehicles continue to dominate the market, driven by the expanding middle class and rising disposable income, which fuel demand for personal mobility. Commercial Vehicles remain significant due to the rapid growth of logistics and transportation services, while Two-Wheelers represent a substantial share, reflecting Vietnam's status as one of the world's largest motorcycle markets .

The Vietnam Automotive Engine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Vietnam, Honda Vietnam, Ford Vietnam, Thaco Group (Tr??ng H?i Auto Corporation), VinFast, Isuzu Vietnam, Mitsubishi Motors Vietnam, Hino Motors Vietnam, Nissan Vietnam, Hyundai Thanh Cong Vietnam, Piaggio Vietnam, Suzuki Vietnam, Mercedes-Benz Vietnam, BMW Vietnam, Kia Motors Vietnam, Mekong Auto Corporation, SAMCO (Saigon Mechanical Engineering Corporation), AP Saigon Petro JSC, Petrolimex (PLX), PVOIL, Castrol BP Petco, Motul Vietnam, TotalEnergies Vietnam, Chevron Vietnam, Royal Dutch Shell Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam automotive engine market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As the government continues to support electric vehicle initiatives, local manufacturers are expected to invest heavily in R&D to enhance engine efficiency and reduce emissions. Additionally, the growing trend of hybrid engines and smart technologies will likely reshape consumer preferences, leading to increased demand for innovative engine solutions that align with global sustainability efforts.

| Segment | Sub-Segments |

|---|---|

| By Engine Type | Internal Combustion Engines (Gasoline, Diesel) Electric Engines Hybrid Engines Others (e.g., Hydrogen, Alternative Fuels) |

| By Vehicle Type | Passenger Vehicles (Sedans, SUVs, Hatchbacks, MPVs) Commercial Vehicles (Trucks, Buses, Vans) Two-Wheelers (Motorcycles, Scooters) Others (Special Purpose Vehicles) |

| By Engine Capacity | Below 1.0L L - 2.0L Above 2.0L Others |

| By Fuel Type | Petrol (Gasoline) Diesel CNG/LPG Others (e.g., Biofuels, Hydrogen) |

| By Application | OEM (Automotive Manufacturing) Aftermarket Services (Repair, Replacement) Research and Development Others |

| By Distribution Channel | Direct Sales Online Retail Distributors/Dealers Others |

| By Region | Northern Vietnam (Red River Delta, Hanoi) Central Vietnam (Hue, Da Nang) Southern Vietnam (Ho Chi Minh City, Mekong Delta) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Engine Manufacturers | 60 | Production Managers, Technical Directors |

| Suppliers of Engine Components | 50 | Procurement Managers, Quality Assurance Officers |

| Automotive Research Institutions | 40 | Research Scientists, Automotive Engineers |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Analysts |

| Automotive Aftermarket Service Providers | 45 | Service Managers, Parts Distributors |

The Vietnam Automotive Engine Market is valued at approximately USD 4.8 billion, driven by increasing vehicle production, consumer demand for personal mobility, and government incentives supporting the automotive sector.