Region:Asia

Author(s):Shubham

Product Code:KRAA1837

Pages:96

Published On:August 2025

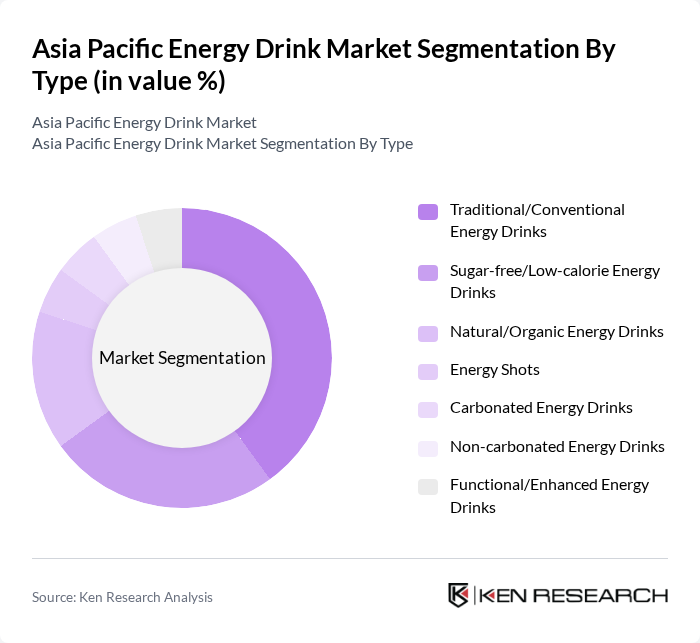

By Type:The energy drink market is segmented into various types, including Traditional/Conventional Energy Drinks, Sugar-free/Low-calorie Energy Drinks, Natural/Organic Energy Drinks, Energy Shots, Carbonated Energy Drinks, Non-carbonated Energy Drinks, and Functional/Enhanced Energy Drinks. Among these, Traditional/Conventional Energy Drinks dominate the market due to their established brand presence and consumer loyalty. However, there is a growing trend towards Sugar-free/Low-calorie and Natural/Organic variants as health-conscious consumers seek alternatives with fewer calories and natural ingredients; reduced-sugar and natural ingredient claims are increasingly emphasized in new product development and marketing.

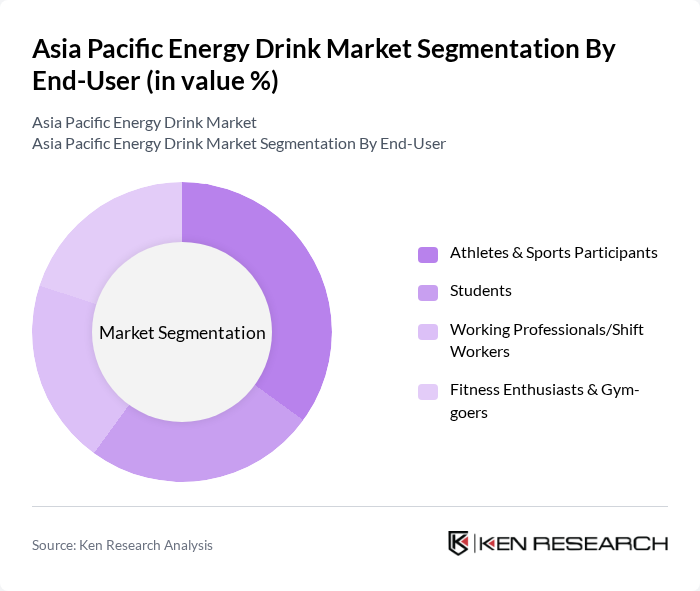

By End-User:The end-user segmentation includes Athletes & Sports Participants, Students, Working Professionals/Shift Workers, and Fitness Enthusiasts & Gym-goers. The segment of Athletes & Sports Participants is leading the market, driven by the increasing participation in sports and fitness activities. This demographic is particularly inclined towards energy drinks that enhance performance and recovery, leading to a higher consumption rate compared to other user groups; broader adoption is also supported by convenience-store availability and e-commerce growth among students and working professionals.

The Asia Pacific Energy Drink Market is characterized by a dynamic mix of regional and international players. Leading participants such as Red Bull GmbH, Monster Beverage Corporation, PepsiCo, Inc. (Sting, Rockstar), The Coca-Cola Company (Monster partner, Power Play/Glacéau energy lines in select markets), Rockstar, Inc. (a PepsiCo brand), Carabao Group Public Company Limited, Celsius Holdings, Inc., Asahi Group Holdings, Ltd. (V Energy via Frucor Suntory), Suntory Beverage & Food Limited (Lipovitan via Taisho partnership; V Energy via Frucor Suntory), Taisho Pharmaceutical Co., Ltd. (Lipovitan), LOTTE Chilsung Beverage Co., Ltd., Hangzhou Wahaha Group Co., Ltd., T.C. Pharmaceutical Industries Co., Ltd. (Krating Daeng/Red Bull Thailand), Osotspa Public Company Limited (M-150, Shark), DALI Foods Group Company Limited (Hi-Tiger) contribute to innovation, geographic expansion, and service delivery in this space.

The Asia Pacific energy drink market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As health-conscious consumers increasingly seek functional beverages, brands are likely to innovate with natural ingredients and sustainable practices. Additionally, the expansion of e-commerce will facilitate greater market penetration, allowing companies to reach diverse demographics. The focus on organic and sugar-free options will further shape product offerings, ensuring that the market remains responsive to consumer demands and regulatory changes.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional/Conventional Energy Drinks Sugar-free/Low-calorie Energy Drinks Natural/Organic Energy Drinks Energy Shots Carbonated Energy Drinks Non-carbonated Energy Drinks Functional/Enhanced Energy Drinks (with vitamins, adaptogens, amino acids) |

| By End-User | Athletes & Sports Participants Students Working Professionals/Shift Workers Fitness Enthusiasts & Gym-goers |

| By Distribution Channel | Off-trade: Supermarkets/Hypermarkets Off-trade: Convenience Stores E-commerce/Online Retail On-trade: Gyms, Clubs, Cafés, and Vending |

| By Packaging Type | Metal Cans PET Bottles Glass Bottles Multi-pack/Variety Packs |

| By Flavor | Citrus Berry Tropical Mixed Fruit/Original/Other Flavors |

| By Price Range | Economy Mid-Range Premium |

| By Region | China Japan India South Korea Australia & New Zealand Southeast Asia (Indonesia, Thailand, Vietnam, Malaysia, Singapore, Philippines) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Energy Drinks | 140 | Regular Energy Drink Consumers, Occasional Users |

| Retail Insights on Energy Drink Sales | 100 | Store Managers, Beverage Category Buyers |

| Health Perspectives on Energy Drink Consumption | 80 | Nutritionists, Health Coaches, Fitness Trainers |

| Market Trends and Innovations | 70 | Product Development Managers, Marketing Executives |

| Regulatory Impact on Energy Drink Market | 60 | Policy Makers, Regulatory Affairs Specialists |

The Asia Pacific Energy Drink Market is valued at approximately USD 15 billion, driven by increasing consumer demand for energy-boosting beverages, particularly among young adults and professionals seeking enhanced performance and alertness.