Region:Europe

Author(s):Rebecca

Product Code:KRAB0277

Pages:81

Published On:August 2025

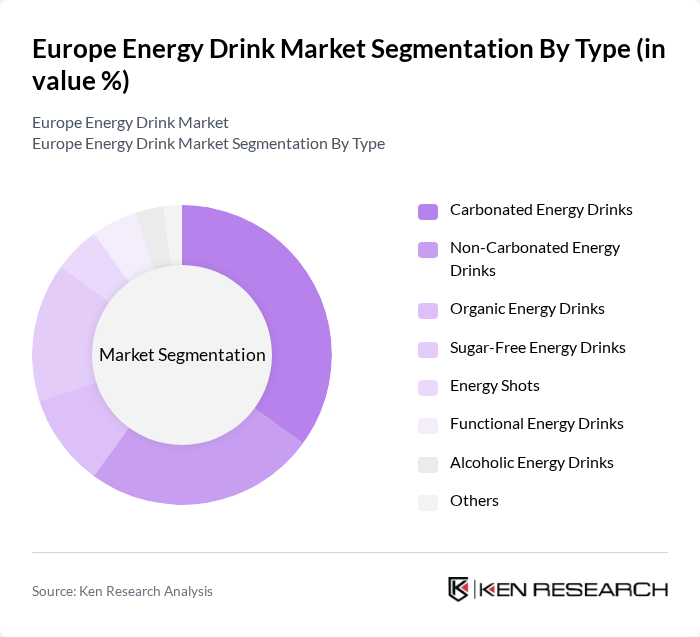

By Type:The energy drink market can be segmented into carbonated, non-carbonated, organic, sugar-free, energy shots, functional energy drinks, alcoholic energy drinks, and others. Each type caters to different consumer preferences and health trends, influencing their market performance. Carbonated and non-carbonated drinks remain the leading segments, while organic and sugar-free variants are gaining traction due to rising health consciousness. Functional energy drinks, which include added vitamins, minerals, or adaptogens, are also seeing increased demand among fitness-focused consumers .

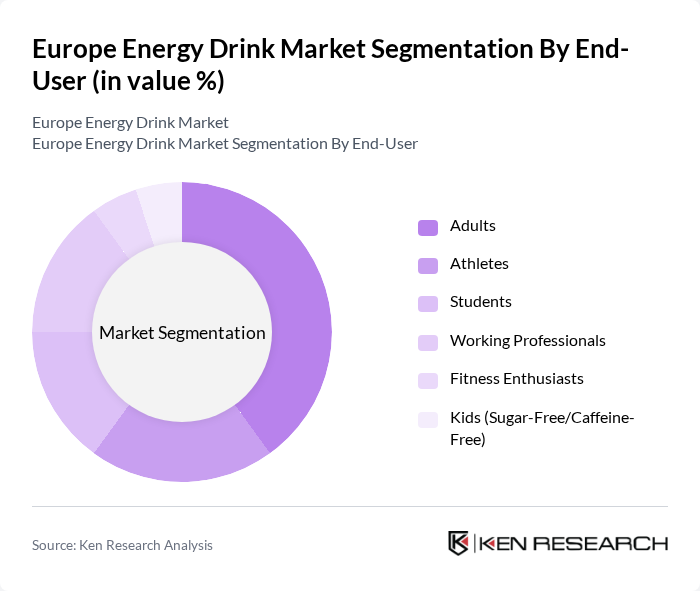

By End-User:The end-user segmentation includes adults, athletes, students, working professionals, fitness enthusiasts, and kids (sugar-free/caffeine-free). Each group has distinct consumption patterns and preferences, influencing the types of energy drinks they choose. Adults and working professionals often seek energy drinks for alertness and stamina, while athletes and fitness enthusiasts prefer functional and performance-oriented products. Students are drawn to energy drinks for cognitive and physical performance, and parents increasingly opt for sugar-free or caffeine-free options for children .

The Europe Energy Drink Market is characterized by a dynamic mix of regional and international players. Leading participants such as Red Bull GmbH, Monster Beverage Corporation, PepsiCo, Inc. (Rockstar Energy, Mountain Dew Energy), The Coca-Cola Company (Burn, Relentless, Powerade Energy), HELL Energy Magyarország Kft., MBG International Premium Brands GmbH (effect® Energy Drink, 28 BLACK), Osotspa Co., Ltd. (Shark Energy), Carabao Group Public Company Limited, Big Shock! (Al-Namura, Czech Republic), Saka Saka Energy Drink (Turkey), V Energy (Frucor Suntory, New Zealand/UK), Dark Dog (DD Europe GmbH), Celsius Holdings, Inc., Effect Energy Drink (MBG International Premium Brands GmbH), 28 BLACK (MBG International Premium Brands GmbH) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the energy drink market in Europe appears promising, driven by evolving consumer preferences and innovative product developments. As health-conscious consumers increasingly seek low-calorie and sugar-free options, brands are likely to adapt their offerings to meet these demands. Additionally, the rise of e-commerce and digital marketing strategies will enhance brand visibility and accessibility, allowing companies to reach a broader audience. Overall, the market is poised for continued growth, with a focus on health-oriented products and strategic distribution channels.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbonated Energy Drinks Non-Carbonated Energy Drinks Organic Energy Drinks Sugar-Free Energy Drinks Energy Shots Functional Energy Drinks Alcoholic Energy Drinks Others |

| By End-User | Adults Athletes Students Working Professionals Fitness Enthusiasts Kids (Sugar-Free/Caffeine-Free) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Health and Fitness Stores On-Trade (Bars, Clubs, Restaurants) |

| By Packaging Type | Cans Bottles Pouches |

| By Flavor | Citrus Berry Tropical Herbal Cola Others |

| By Price Range | Low Price Mid Price Premium Price |

| By Region | Western Europe Eastern Europe Northern Europe Southern Europe Country Analysis (Germany, UK, France, Italy, Spain, Turkey, Russia, Others) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Energy Drinks | 150 | Regular Energy Drink Consumers, Occasional Users |

| Retail Insights on Energy Drink Sales | 100 | Store Managers, Category Buyers |

| Health and Fitness Enthusiasts' Perspectives | 80 | Personal Trainers, Nutritionists |

| Market Trends from Distributors | 70 | Wholesale Distributors, Supply Chain Managers |

| Brand Perception Studies | 40 | Marketing Professionals, Brand Managers |

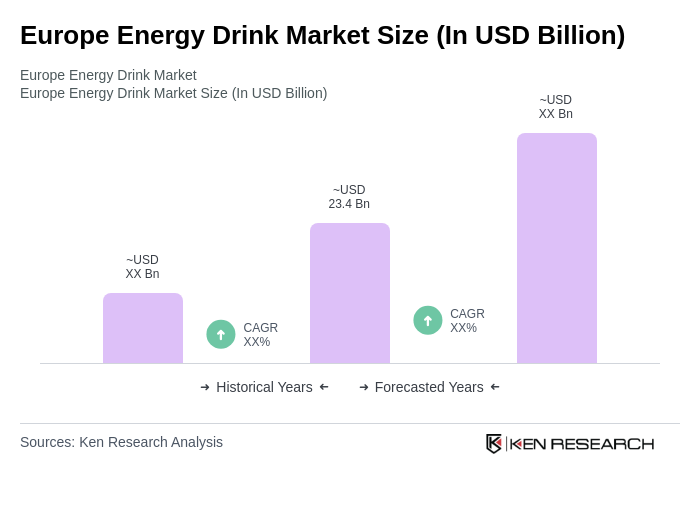

The Europe Energy Drink Market is valued at approximately USD 23.4 billion, reflecting significant growth driven by increasing consumer demand for energy-boosting beverages, particularly among young adults and athletes.