Region:Asia

Author(s):Shubham

Product Code:KRAC0633

Pages:87

Published On:August 2025

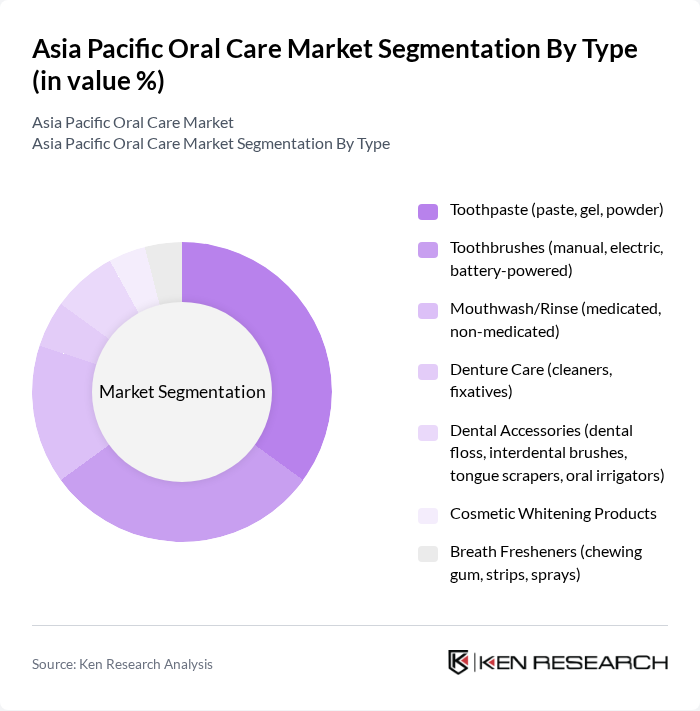

By Type:The oral care market is segmented into various types, including toothpaste, toothbrushes, mouthwash, denture care, dental accessories, cosmetic whitening products, and breath fresheners. Among these, toothpaste remains the dominant segment due to its essential role in daily oral hygiene routines. The increasing preference for specialized toothpaste formulations, such as whitening and sensitivity relief, is driving growth in this category.

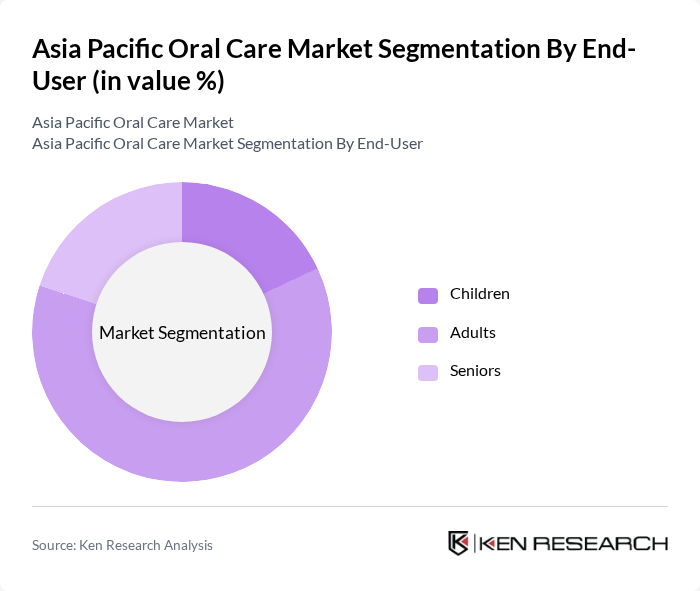

By End-User:The market is segmented by end-user demographics, including children, adults, and seniors. The adult segment dominates the market, driven by increasing awareness of oral health and the rising prevalence of dental issues among adults. Additionally, the growing trend of preventive care and the demand for premium oral care products among adults are contributing to the segment's growth.

The Asia Pacific Oral Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Colgate-Palmolive Company, Procter & Gamble Co. (Oral-B, Crest), Unilever PLC (Closeup, Pepsodent), Haleon plc (Sensodyne, Parodontax, Polident), Johnson & Johnson (Listerine), Lion Corporation (Japan), Kao Corporation, Dabur India Limited, Himalaya Wellness Company, Patanjali Ayurved Limited, Shiseido Company, Limited (Butler/Oral Care), LG Household & Health Care Ltd. (Perioe), Sunstar Suisse S.A. (GUM), GC Corporation (Japan), Koninklijke Philips N.V. (Sonicare) contribute to innovation, geographic expansion, and service delivery in this space.

The Asia Pacific oral care market is poised for transformative growth, driven by evolving consumer preferences and technological advancements. The shift towards preventive oral care is expected to gain momentum, with consumers increasingly seeking products that promote long-term dental health. Additionally, the integration of smart technology in oral care devices will likely enhance user experience and engagement, further propelling market expansion. As sustainability becomes a priority, brands that adopt eco-friendly practices will resonate with environmentally conscious consumers, shaping the future landscape of the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Toothpaste (paste, gel, powder) Toothbrushes (manual, electric, battery-powered) Mouthwash/Rinse (medicated, non-medicated) Denture Care (cleaners, fixatives) Dental Accessories (dental floss, interdental brushes, tongue scrapers, oral irrigators) Cosmetic Whitening Products Breath Fresheners (chewing gum, strips, sprays) |

| By End-User | Children Adults Seniors |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies and Drug Stores Online Retail Stores Convenience Stores Dental Clinics Other Distribution Channels |

| By Region | China Japan India South Korea Australia Southeast Asia (Indonesia, Thailand, Vietnam, Malaysia, Philippines, Singapore) Rest of Asia-Pacific |

| By Product Formulation | Fluoride-based Non-fluoride Herbal/Natural |

| By Price Range | Economy Mid-range Premium |

| By Packaging Type | Tube Pump Sachet Bottle Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Oral Care Products | 120 | General Consumers, Health-Conscious Individuals |

| Dental Professional Insights | 80 | Dentists, Dental Hygienists |

| Retail Market Trends | 60 | Retail Managers, Category Buyers |

| Market Entry Strategies | 50 | Product Managers, Marketing Managers |

| Consumer Behavior Analysis | 100 | Parents, Young Adults, Seniors |

The Asia Pacific Oral Care Market is valued at approximately USD 12.5 billion, reflecting significant growth driven by increased consumer awareness of oral hygiene, rising disposable incomes, and a higher prevalence of dental diseases in the region.