Region:Middle East

Author(s):Shubham

Product Code:KRAA8545

Pages:100

Published On:November 2025

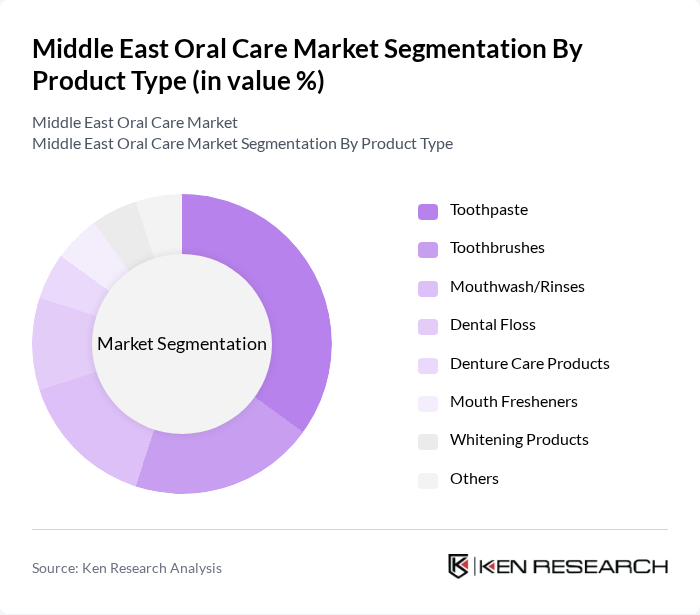

By Product Type:The product type segmentation includes various categories such as toothpaste, toothbrushes, mouthwash/rinses, dental floss, denture care products, mouth fresheners, whitening products, and others. Among these, toothpaste is the leading sub-segment, driven by its essential role in daily oral hygiene routines. The increasing consumer preference for specialized toothpaste formulations, such as those targeting sensitivity or whitening, has further solidified its dominance in the market. The demand for eco-friendly and organic toothpaste is also rising, reflecting broader consumer trends toward natural personal care products .

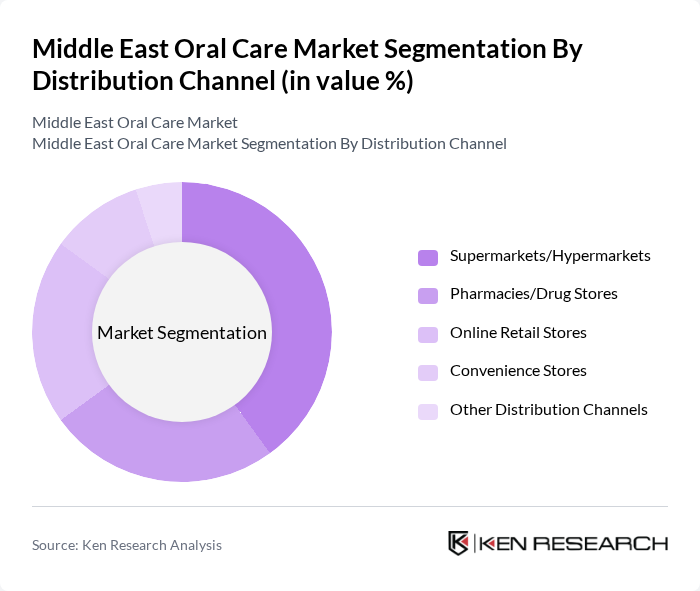

By Distribution Channel:The distribution channel segmentation encompasses supermarkets/hypermarkets, pharmacies/drug stores, online retail stores, convenience stores, and other distribution channels. Supermarkets and hypermarkets dominate this segment due to their extensive reach and ability to offer a wide variety of products under one roof. The growing trend of e-commerce has also significantly impacted the market, with online retail stores gaining traction among tech-savvy consumers seeking convenience and competitive pricing. The rise in smartphone penetration and high-speed internet access continues to drive online sales of oral care products .

The Middle East Oral Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Colgate-Palmolive, Procter & Gamble, Unilever, GlaxoSmithKline (GSK), Johnson & Johnson, Henkel AG & Co. KGaA, Church & Dwight Co., Inc., Oral-B (Procter & Gamble), Sensodyne (GlaxoSmithKline), Listerine (Johnson & Johnson), Himalaya Herbal Healthcare, Dabur, Marvis, Biotène (Johnson & Johnson), Crest (Procter & Gamble), GC Corporation, Lion Corporation, Sunstar, Signal (Unilever), Sensodyne (GSK) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East oral care market appears promising, driven by technological advancements and a growing emphasis on sustainability. As consumers increasingly seek eco-friendly products, brands are likely to innovate with biodegradable packaging and natural ingredients. Additionally, the rise of telehealth services is expected to enhance access to dental care, encouraging preventive measures. These trends will likely reshape consumer preferences, leading to a more dynamic and responsive market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Toothpaste Toothbrushes Mouthwash/Rinses Dental Floss Denture Care Products Mouth Fresheners Whitening Products Others |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies/Drug Stores Online Retail Stores Convenience Stores Other Distribution Channels |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Income Level (Low, Middle, High) Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Syria, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia) Others |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Others |

| By Product Formulation | Fluoride-Based Products Non-Fluoride Products Herbal/Natural Products Organic Products Others |

| By Packaging Type | Tube Packaging Bottle Packaging Sachets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Oral Care Preferences | 120 | General Consumers, Health-Conscious Individuals |

| Dental Professional Insights | 85 | Dentists, Dental Hygienists |

| Retail Market Trends | 65 | Retail Managers, Pharmacy Owners |

| Product Development Feedback | 50 | Product Managers, R&D Specialists |

| Market Entry Strategies | 45 | Business Development Executives, Marketing Managers |

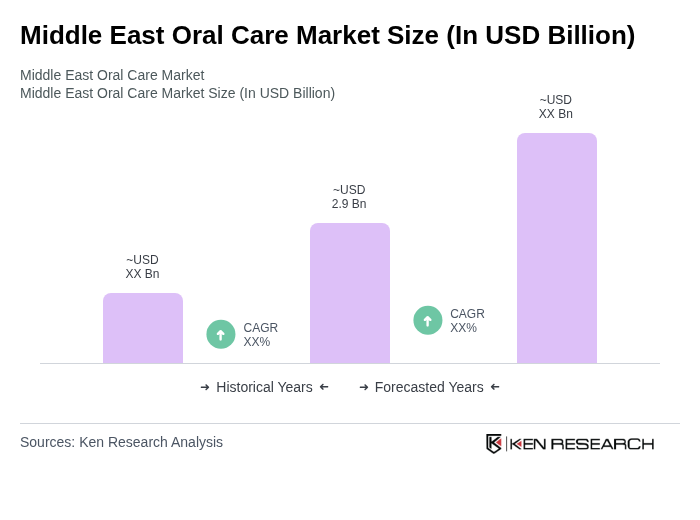

The Middle East Oral Care Market is valued at approximately USD 2.9 billion, driven by increasing awareness of oral hygiene, rising disposable incomes, and the expansion of retail distribution channels, particularly in countries like Saudi Arabia, the UAE, and Egypt.