Region:Asia

Author(s):Dev

Product Code:KRAB0517

Pages:90

Published On:August 2025

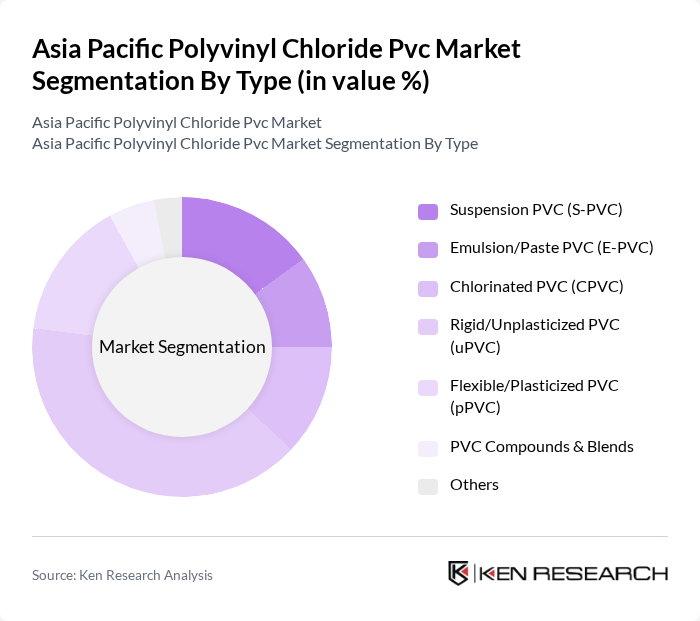

By Type:The PVC market can be segmented into various types, including Suspension PVC (S-PVC), Emulsion/Paste PVC (E-PVC), Chlorinated PVC (CPVC), Rigid/Unplasticized PVC (uPVC), Flexible/Plasticized PVC (pPVC), PVC Compounds & Blends, and Others. Among these, Rigid/Unplasticized PVC (uPVC) is the most dominant due to its extensive use in construction and plumbing applications, driven by its durability and cost-effectiveness.

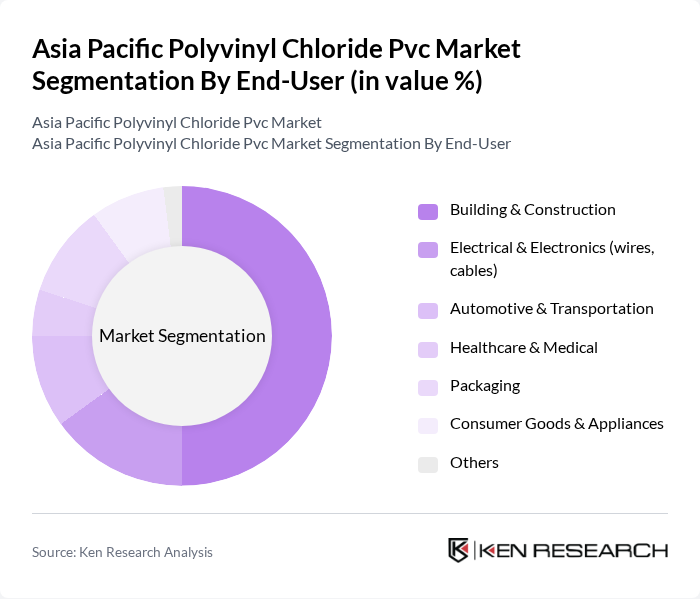

By End-User:The end-user segmentation of the PVC market includes Building & Construction, Electrical & Electronics, Automotive & Transportation, Healthcare & Medical, Packaging, Consumer Goods & Appliances, and Others. The Building & Construction sector is the leading end-user, driven by the increasing demand for PVC in pipes, fittings, and profiles, which are essential for modern infrastructure development.

The Asia Pacific Polyvinyl Chloride Pvc Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shin-Etsu Chemical Co., Ltd. (Shintech/Shin-Etsu PVC), Formosa Plastics Corporation (including Nan Ya Plastics), Westlake Corporation, INEOS Inovyn, LG Chem Ltd. (LG Chem/Kolon JV legacy; PVC assets via subsidiaries), Hanwha Solutions Corporation, Orbia Advance Corporation, S.A.B. de C.V. (Vestolit/AlphaGary), Xinjiang Zhongtai Chemical Co., Ltd., Tianjin Dagu Chemical Co., Ltd., Inner Mongolia Junzheng Energy & Chemical Group Co., Ltd., Reliance Industries Limited, Finolex Industries Ltd., Thai Plastic and Chemicals Public Company Limited (TPC, part of AGC), Formosa Plastics (Ningbo) Co., Ltd. (China subsidiary), Kaneka Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Asia Pacific PVC market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. Innovations in recycling technologies are expected to enhance the lifecycle of PVC products, while the growing emphasis on green building initiatives will further integrate PVC into eco-friendly construction. Additionally, strategic partnerships among manufacturers and technology providers will facilitate the development of bio-based PVC, aligning with global sustainability goals and enhancing market resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Suspension PVC (S-PVC) Emulsion/Paste PVC (E-PVC) Chlorinated PVC (CPVC) Rigid/Unplasticized PVC (uPVC) Flexible/Plasticized PVC (pPVC) PVC Compounds & Blends Others |

| By End-User | Building & Construction Electrical & Electronics (wires, cables) Automotive & Transportation Healthcare & Medical Packaging Consumer Goods & Appliances Others |

| By Region | China India Japan South Korea ASEAN Oceania Rest of Asia Pacific |

| By Application | Pipes & Fittings Profiles, Windows & Doors Films & Sheets Cables & Wire Insulation Flooring & Wall Coverings Medical Tubing & Bags Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support | Subsidies Tax Exemptions Extended Producer Responsibility (EPR) & Recycling Credits Others |

| By Distribution Channel | Direct Sales (Producers to OEMs/Projects) Distributors & Stockists Online B2B Platforms Retail/Trade Counters Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| PVC Construction Applications | 120 | Project Managers, Architects, Contractors |

| PVC Packaging Solutions | 100 | Product Managers, Packaging Engineers |

| PVC Automotive Components | 80 | Design Engineers, Procurement Managers |

| PVC Medical Devices | 70 | Quality Assurance Managers, Regulatory Affairs Specialists |

| PVC Consumer Goods | 90 | Marketing Managers, Supply Chain Analysts |

The Asia Pacific PVC market is valued at approximately USD 27 billion, driven by increasing demand in construction, automotive, and packaging industries, alongside urbanization and infrastructure development across the region.