Region:Middle East

Author(s):Dev

Product Code:KRAA9529

Pages:86

Published On:November 2025

Market.png)

By Application:The application segment of the PVC market includes various sub-segments such as Sewerage and Drainage, Irrigation, Plumbing, Water Supply, HVAC, and Oil & Gas. Among these, the Plumbing sub-segment is currently dominating the market due to the increasing construction activities and the need for efficient plumbing solutions in residential and commercial buildings. The demand for durable and cost-effective plumbing materials has led to a significant rise in the adoption of PVC pipes and fittings, making it a preferred choice for contractors and builders. Sewerage and drainage also represent a substantial share, reflecting the ongoing infrastructure upgrades in Bahrain .

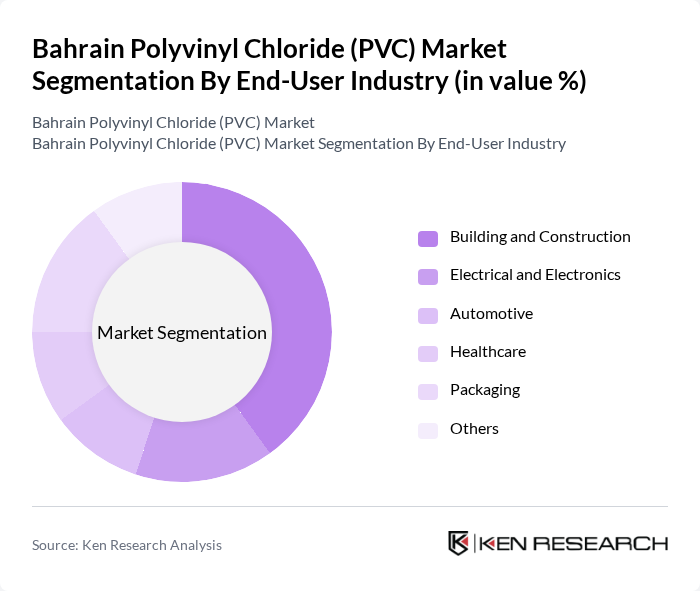

By End-User Industry:This segment encompasses Building and Construction, Electrical and Electronics, Automotive, Healthcare, Packaging, and Others. The Building and Construction sub-segment is leading the market, driven by the rapid urbanization and infrastructure development in Bahrain. The increasing investments in residential and commercial projects have significantly boosted the demand for PVC materials, particularly in construction applications such as windows, doors, and roofing, making it a vital component in the industry. Electrical and electronics applications are also growing, supported by the use of PVC in insulation and cable protection .

The Bahrain Polyvinyl Chloride (PVC) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Plastic, Bahrain National Plastics Company (BANAPCO), and Tylos Plastic Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the PVC market in Bahrain appears promising, driven by increasing demand across various sectors, including construction and automotive. As the government continues to invest in infrastructure, the need for PVC products will likely rise. Additionally, advancements in recycling technologies and a shift towards sustainable practices will enhance the market's resilience. The focus on eco-friendly solutions will also attract investments, fostering innovation and growth in the PVC industry, positioning it favorably for the coming years.

| Segment | Sub-Segments |

|---|---|

| By Application | Sewerage and Drainage Irrigation Plumbing Water Supply HVAC Oil & Gas |

| By End-User Industry | Building and Construction Electrical and Electronics Automotive Healthcare Packaging Others |

| By Product Type | Rigid PVC Flexible PVC PVC Compounds |

| By Product Form | Pipes and Fittings Sheets and Films Profiles and Molding Granules Others |

| By Distribution Channel | Direct Sales Distributors and Wholesalers Retail Online Sales |

| By Geography | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector PVC Usage | 120 | Project Managers, Procurement Officers |

| Automotive Industry PVC Applications | 90 | Product Development Engineers, Supply Chain Managers |

| Packaging Sector Insights | 70 | Marketing Managers, Operations Directors |

| Consumer Goods PVC Products | 60 | Brand Managers, Product Managers |

| Regulatory Impact on PVC Market | 40 | Compliance Officers, Industry Analysts |

The Bahrain Polyvinyl Chloride (PVC) Market is valued at approximately USD 145 million, reflecting a five-year historical analysis. This valuation is driven by increasing demand across various sectors, particularly construction, automotive, and packaging industries.