Region:Asia

Author(s):Shubham

Product Code:KRAA1125

Pages:80

Published On:August 2025

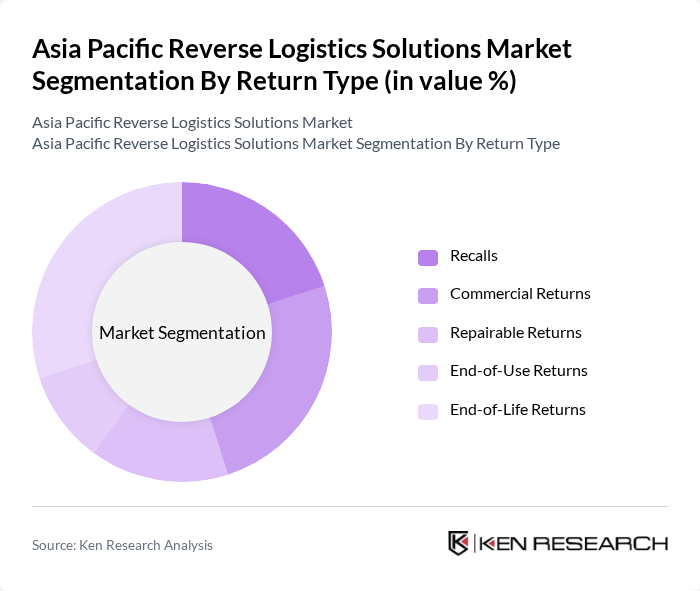

By Return Type:The return type segmentation includes various categories such as recalls, commercial returns, repairable returns, end-of-use returns, and end-of-life returns. Each of these subsegments plays a crucial role in the overall reverse logistics process, catering to different needs and scenarios in the supply chain.

The end-of-life returns subsegment is currently dominating the market due to the increasing focus on sustainability and environmental regulations. Companies are increasingly required to manage products that have reached the end of their useful life, leading to a surge in demand for effective reverse logistics solutions. This trend is driven by consumer preferences for eco-friendly practices and the need for manufacturers to comply with stringent waste management regulations .

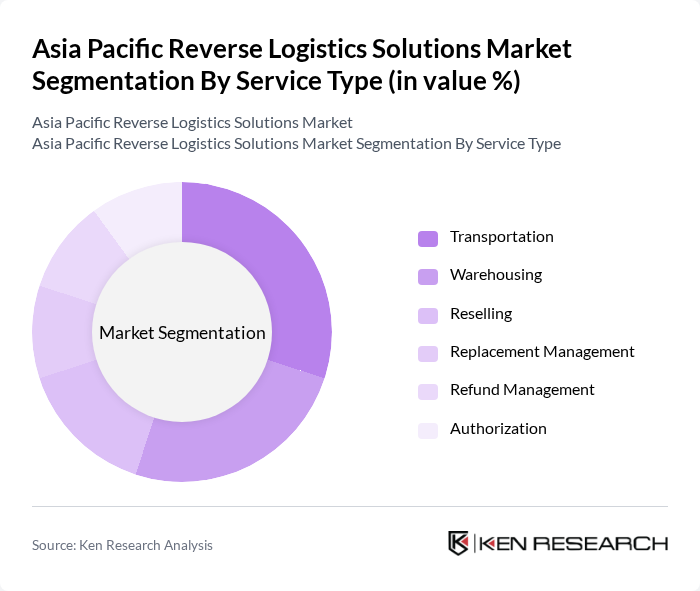

By Service Type:The service type segmentation encompasses various services such as transportation, warehousing, reselling, replacement management, refund management, and authorization. Each service type is essential for facilitating the reverse logistics process and ensuring efficient handling of returned products.

The transportation service type is leading the market due to the critical role it plays in the reverse logistics process. Efficient transportation solutions are essential for the timely movement of returned goods back to warehouses or manufacturers. As e-commerce continues to grow, the demand for reliable and fast transportation services for returns is expected to increase, making it a key focus area for logistics providers .

The Asia Pacific Reverse Logistics Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, FedEx Corporation, UPS Supply Chain Solutions, DB Schenker, Kuehne + Nagel, CEVA Logistics, Geodis, Maersk Logistics, DSV, Yusen Logistics, SF Express, Kintetsu World Express, Nippon Express, CJ Logistics, Agility Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Asia Pacific reverse logistics market appears promising, driven by increasing consumer demand for sustainable practices and technological innovations. As companies prioritize efficient return management, the adoption of automated solutions and data analytics will enhance operational efficiency. Furthermore, the rise of omnichannel retailing will necessitate robust reverse logistics frameworks, ensuring seamless returns across various platforms. This evolving landscape presents significant opportunities for businesses to innovate and improve their reverse logistics capabilities.

| Segment | Sub-Segments |

|---|---|

| By Return Type | Recalls Commercial Returns Repairable Returns End-of-Use Returns End-of-Life Returns |

| By Service Type | Transportation Warehousing Reselling Replacement Management Refund Management Authorization |

| By End-User | Retail Consumer Electronics Automotive Pharmaceuticals E-commerce Others |

| By Region | China Japan India Southeast Asia Australia & New Zealand Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 60 | Operations Managers, Customer Service Heads |

| Automotive Parts Recovery | 50 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 40 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 60 | eCommerce Managers, Fulfillment Center Supervisors |

The Asia Pacific Reverse Logistics Solutions Market is valued at approximately USD 640 billion, driven by the growth of e-commerce, sustainability awareness, and efficient supply chain management practices.