Region:Global

Author(s):Shubham

Product Code:KRAA0707

Pages:100

Published On:August 2025

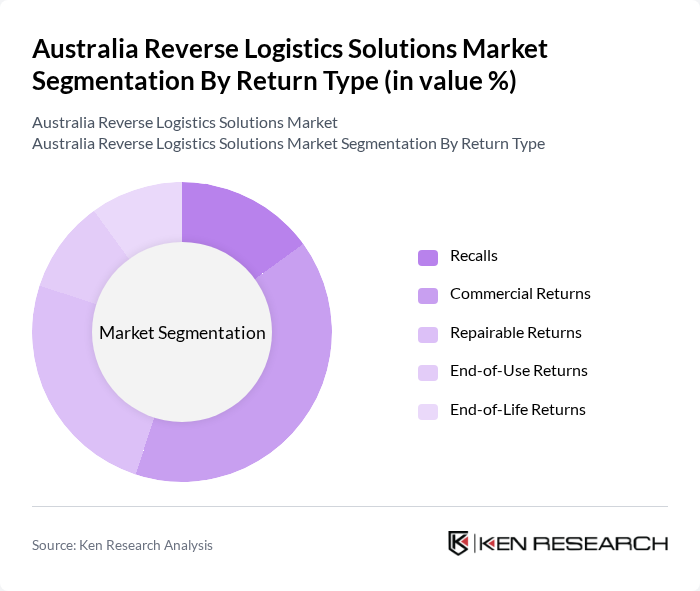

By Return Type:The return type segmentation includes various categories such as recalls, commercial returns, repairable returns, end-of-use returns, and end-of-life returns. Among these, commercial returns are currently dominating the market due to the rapid growth of e-commerce, which has led to an increase in product returns. Consumers are more inclined to return items that do not meet their expectations, thus driving the need for efficient handling of commercial returns. The repairable returns segment is also gaining traction as companies focus on refurbishing products to reduce waste and recover value .

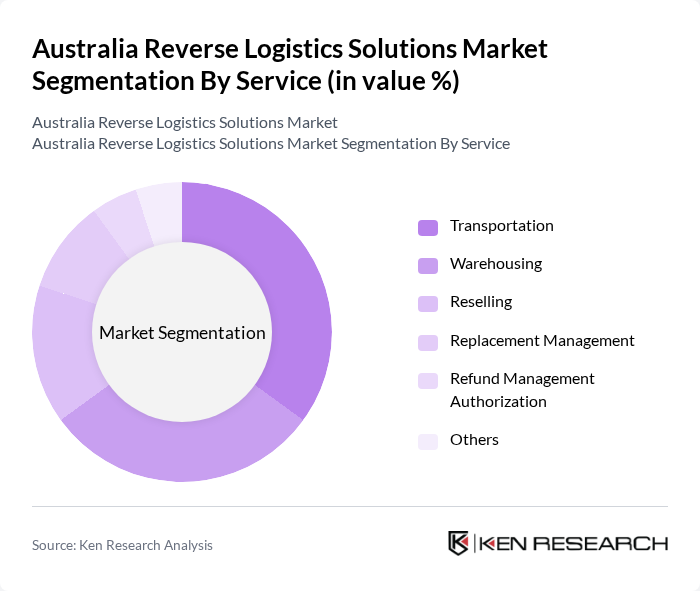

By Service:The service segmentation encompasses transportation, warehousing, reselling, replacement management, refund management authorization, and others. Transportation services are leading this segment, driven by the need for efficient logistics solutions to handle the increasing volume of returns. Companies are investing in advanced transportation management systems to streamline the return process and reduce turnaround times. Warehousing services are also significant, as businesses require dedicated facilities to manage returned products effectively .

The Australia Reverse Logistics Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toll Group, Linfox, DB Schenker, StarTrack, DHL Supply Chain, CEVA Logistics, Kuehne + Nagel, Qube Holdings, Mainfreight, Australia Post, Chariot Logistics, Allied Express, TNT Express, Agility Logistics, XPO Logistics, Suez Australia & New Zealand, Veolia Australia and New Zealand, Remondis Australia, Envirostream Australia, Close the Loop Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia reverse logistics market is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. Companies are increasingly adopting automation and AI to enhance operational efficiency, while consumer demand for eco-friendly practices continues to rise. As businesses navigate the complexities of returns, the integration of data analytics will play a crucial role in optimizing logistics processes. This evolving landscape presents opportunities for innovation and collaboration across the supply chain, ensuring a more resilient market.

| Segment | Sub-Segments |

|---|---|

| By Return Type | Recalls Commercial Returns Repairable Returns End-of-Use Returns End-of-Life Returns |

| By Service | Transportation Warehousing Reselling Replacement Management Refund Management Authorization Others |

| By End-User | E-Commerce Automotive Pharmaceutical Consumer Electronics Retail Luxury Goods Reusable Packaging |

| By Region | New South Wales Victoria Queensland South Australia Western Australia Tasmania Northern Territory |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 60 | Operations Managers, Customer Service Heads |

| Automotive Parts Recovery | 50 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 40 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 60 | eCommerce Managers, Fulfillment Center Supervisors |

The Australia Reverse Logistics Solutions Market is valued at approximately USD 13.6 billion, reflecting a significant growth trend driven by the increasing demand for efficient supply chain management and the expansion of e-commerce.