Region:Asia

Author(s):Geetanshi

Product Code:KRAD0031

Pages:99

Published On:August 2025

By Type:The smart watch market can be segmented into various types, including fitness smart watches, luxury smart watches, hybrid smart watches, kids smart watches, rugged/outdoor smart watches, and others. Among these, fitness smart watches are currently leading the market due to the growing trend of health and fitness tracking among consumers. The increasing awareness of health issues and the desire for convenient health monitoring solutions have driven the demand for fitness-oriented features in smart watches.

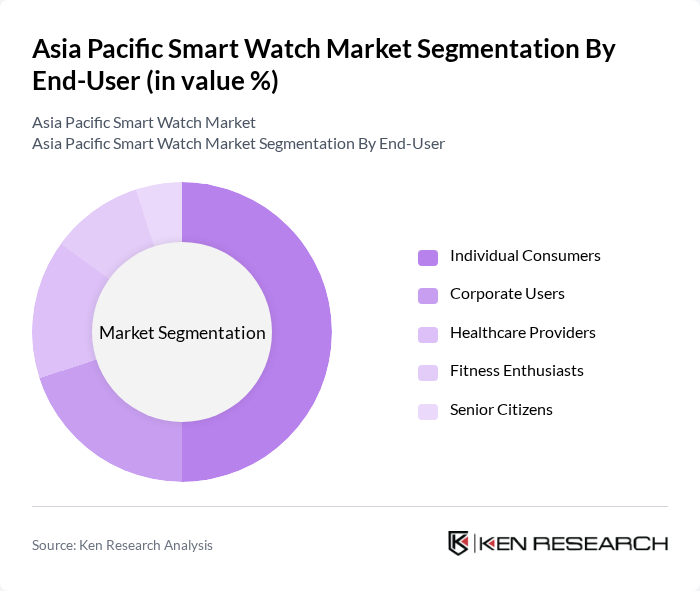

By End-User:The end-user segmentation includes individual consumers, corporate users, healthcare providers, fitness enthusiasts, and senior citizens. Individual consumers dominate the market, driven by the increasing trend of personal health management and the integration of smart watches with smartphones. The convenience and multifunctionality of smart watches appeal to a broad consumer base, making them a popular choice for everyday use.

The Asia Pacific Smart Watch Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Fitbit, Inc., Huawei Technologies Co., Ltd., Fossil Group, Inc., Amazfit (Zepp Health Corporation), Suunto (Amer Sports), TicWatch (Mobvoi Technology Co., Ltd.), Withings S.A., Xiaomi Corporation, Oppo Electronics Corp., Realme Techlife, Honor Technology Co., Ltd., Skagen Designs, Ltd., Sony Corporation, LG Electronics Inc., Lenovo Group Limited, Noise (Nexxbase Marketing Pvt. Ltd.), boAt (Imagine Marketing Limited), Fire-Boltt (Savex Technologies Pvt. Ltd.), Imoo (Shenzhen iComm Technology Co., Ltd.), Polar Electro Oy, Zeblaze contribute to innovation, geographic expansion, and service delivery in this space.

The Asia Pacific smart watch market is poised for transformative growth, driven by technological innovations and evolving consumer preferences. As health monitoring becomes increasingly integrated into daily life, smart watches will likely incorporate more advanced features, such as real-time health analytics and AI-driven insights. Additionally, the rise of subscription-based services for exclusive features will reshape consumer engagement, fostering brand loyalty. Companies that prioritize sustainability and eco-friendly practices will also gain a competitive edge, appealing to the environmentally conscious consumer base.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Smart Watches Luxury Smart Watches Hybrid Smart Watches Kids Smart Watches Rugged/Outdoor Smart Watches Others |

| By End-User | Individual Consumers Corporate Users Healthcare Providers Fitness Enthusiasts Senior Citizens |

| By Distribution Channel | Online Retail Offline Retail (Electronics Stores, Department Stores) Direct Sales (Brand Stores, Pop-up Stores) Telecom Operator Channels Others |

| By Price Range | Budget Smart Watches (Below USD 100) Mid-Range Smart Watches (USD 100–300) Premium Smart Watches (Above USD 300) |

| By Brand | Established Brands (Apple, Samsung, Huawei, Garmin, Fitbit, Xiaomi, Oppo, Realme, Amazfit, Fossil, Sony, etc.) Emerging Brands (Noise, boAt, Fire-Boltt, Zeblaze, Imoo, etc.) Private Labels (Retailer/Operator Brands) |

| By Feature Set | Health Monitoring Features (Heart Rate, SpO2, ECG, Sleep Tracking, etc.) Connectivity Features (Bluetooth, Wi-Fi, Cellular, NFC, GPS) Customization Options (Watch Faces, Straps, Apps) Voice Assistant Integration |

| By Region | China Japan South Korea India Southeast Asia Australia & New Zealand Rest of Asia Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Smart Watches | 120 | Tech-savvy Consumers, Fitness Enthusiasts |

| Retail Insights on Smart Watch Sales | 60 | Retail Managers, Sales Executives |

| Market Trends in Wearable Technology | 50 | Industry Analysts, Market Researchers |

| Feedback on Smart Watch Features | 80 | End-users, Product Reviewers |

| Adoption Barriers for Smart Watches | 40 | Potential Buyers, Non-users |

The Asia Pacific Smart Watch Market is valued at approximately USD 50 billion, driven by the increasing adoption of wearable technology, health consciousness, and advancements in smart watch functionalities.