Region:North America

Author(s):Dev

Product Code:KRAB0625

Pages:87

Published On:August 2025

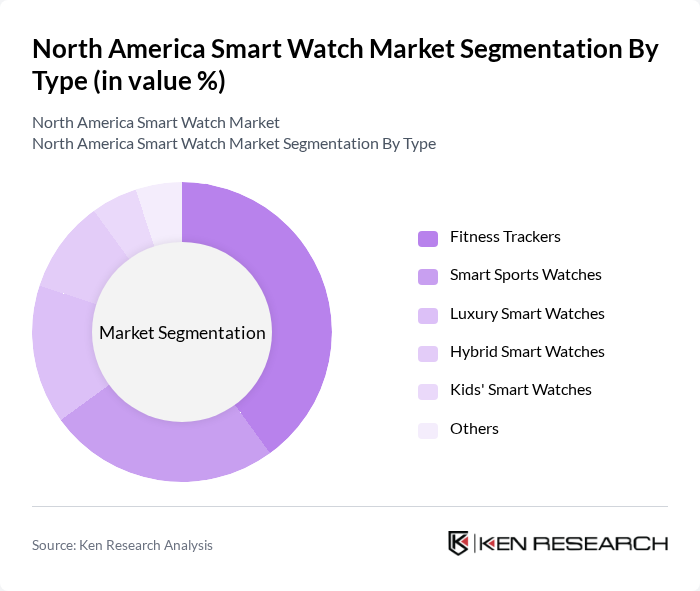

By Type:The smart watch market can be segmented into various types, including fitness trackers, smart sports watches, luxury smart watches, hybrid smart watches, kids' smart watches, and others. Among these, fitness trackers are currently leading the market due to their affordability and increasing popularity among health-conscious consumers. Smart sports watches are also gaining traction, particularly among athletes and fitness enthusiasts who seek advanced features for performance tracking. The luxury segment, while smaller, is growing as affluent consumers seek high-end models with premium features. Recent trends highlight a surge in demand for child-focused smartwatches and hybrid models that combine traditional aesthetics with smart functionalities .

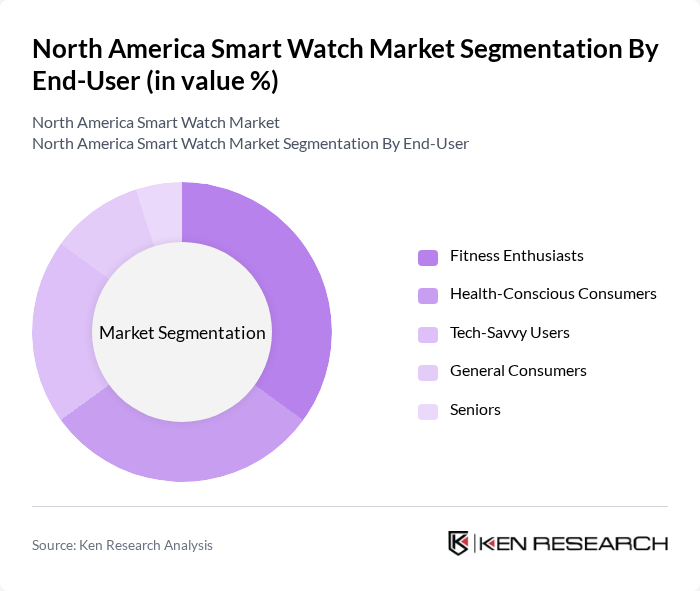

By End-User:The end-user segmentation includes fitness enthusiasts, health-conscious consumers, tech-savvy users, general consumers, and seniors. Fitness enthusiasts represent the largest segment, driven by the growing trend of health and fitness tracking. Health-conscious consumers are also a significant group, increasingly adopting smart watches for monitoring health metrics. Tech-savvy users are drawn to the latest features and technology, while seniors are gradually embracing smart watches for health monitoring and emergency features. The market is also witnessing increased adoption among women and children, reflecting the expansion of targeted functionalities such as wellness tracking and safety alerts .

The North America Smart Watch Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Fitbit LLC (Google LLC), Fossil Group, Inc., Huawei Technologies Co., Ltd., Suunto Oy, Amazfit (Zepp Health Corporation), Withings S.A., Mobvoi Inc. (TicWatch), Skagen Designs, LLC, Michael Kors (Capri Holdings Limited), Casio Computer Co., Ltd., Misfit Wearables (Fossil Group, Inc.), Polar Electro Oy contribute to innovation, geographic expansion, and service delivery in this space.

The North American smart watch market is poised for significant evolution, driven by technological innovations and changing consumer preferences. As health monitoring features become more sophisticated, consumers are likely to demand devices that offer comprehensive health insights. Additionally, the integration of AI and machine learning will enhance user experience, making smart watches more intuitive. Companies that focus on sustainability and eco-friendly materials will likely attract environmentally conscious consumers, further shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Trackers Smart Sports Watches Luxury Smart Watches Hybrid Smart Watches Kids' Smart Watches Others |

| By End-User | Fitness Enthusiasts Health-Conscious Consumers Tech-Savvy Users General Consumers Seniors |

| By Distribution Channel | Online Retail Offline Retail (Electronics Stores, Department Stores) Direct Sales (Brand Stores) Others |

| By Price Range | Budget Smart Watches (Below $150) Mid-Range Smart Watches ($150–$350) Premium Smart Watches (Above $350) |

| By Brand | Apple Samsung Garmin Fitbit (Google) Fossil Amazfit (Zepp Health) Huawei Others |

| By Feature Set | Health Monitoring (Heart Rate, SpO2, ECG) GPS Tracking Mobile Payments (NFC) Voice Assistance (Siri, Google Assistant, Bixby) Cellular Connectivity (LTE/4G) |

| By User Demographics | Age Group (18-24) Age Group (25-34) Age Group (35-44) Age Group (45-54) Age Group (55+) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Monitoring Features | 100 | Healthcare Professionals, Fitness Trainers |

| Consumer Preferences in Smart Watches | 120 | Tech Enthusiasts, General Consumers |

| Market Trends in Wearable Technology | 80 | Market Analysts, Industry Experts |

| Retail Insights on Smart Watch Sales | 60 | Retail Managers, E-commerce Executives |

| Adoption Rates Among Different Age Groups | 40 | Consumers Aged 18-65, Health-Conscious Individuals |

The North America Smart Watch Market is valued at approximately USD 45 billion, driven by the increasing adoption of wearable technology, health consciousness, and advancements in smart watch functionalities.