Region:Asia

Author(s):Rebecca

Product Code:KRAB5860

Pages:88

Published On:October 2025

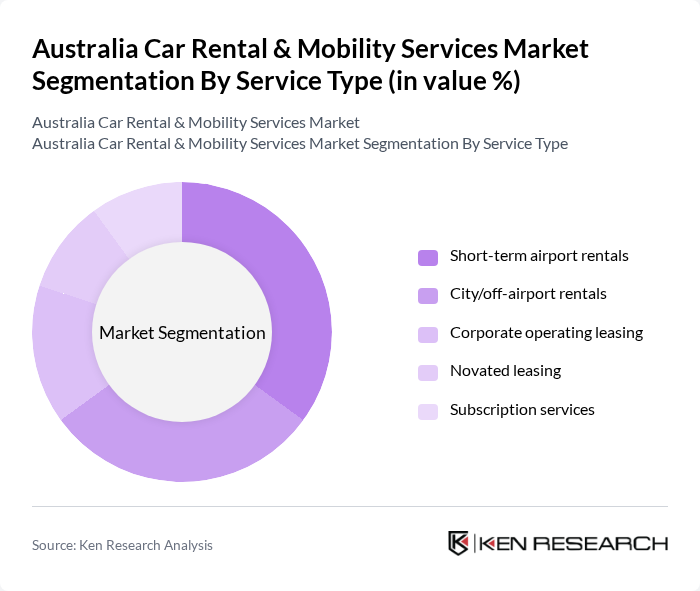

By Service Type:The service type segmentation includes a diverse range of rental options tailored to evolving consumer needs. Short-term airport rentals remain the most popular among travelers seeking immediate convenience, while city/off-airport rentals attract both local residents and tourists. Corporate operating leasing and novated leasing are favored by businesses for their flexibility, fleet management, and cost control. Subscription services are gaining momentum as consumers seek flexible, commitment-free alternatives to traditional vehicle ownership, reflecting broader shifts toward mobility-as-a-service .

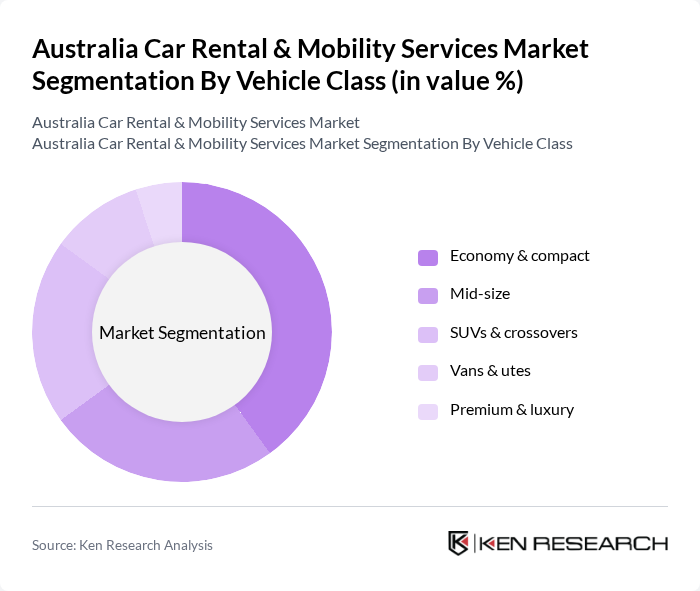

By Vehicle Class:The vehicle class segmentation highlights consumer preferences for different vehicle types. Economy and compact cars are most in demand due to their affordability and fuel efficiency. Mid-size vehicles are preferred by families and groups, while SUVs and crossovers are chosen for their versatility and suitability for both urban and regional travel. Vans and utes address commercial and group transport needs, and premium and luxury vehicles appeal to high-end clientele seeking comfort and status .

The Australia Car Rental & Mobility Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hertz Australia, Avis Australia, Budget Rent a Car, Europcar Australia, Thrifty Car Rental, Redspot Car Rentals, Sixt Australia, GoGet Carshare, Car Next Door, East Coast Car Rentals, Apollo Car Rentals, Jucy Rentals, Ace Rental Cars, Bayswater Car Rental, Alpha Car Hire contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia car rental and mobility services market appears promising, driven by technological advancements and changing consumer preferences. The integration of electric vehicles into rental fleets is expected to gain momentum, aligning with sustainability goals. Additionally, the rise of subscription-based models will likely reshape consumer engagement, offering flexible options that cater to diverse mobility needs. As urbanization continues, the demand for innovative mobility solutions will further enhance market dynamics, fostering growth and adaptation in the industry.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Short-term airport rentals City/off-airport rentals Corporate operating leasing Novated leasing Subscription services |

| By Vehicle Class | Economy & compact Mid-size SUVs & crossovers Vans & utes Premium & luxury |

| By Powertrain | Petrol Diesel Hybrid Battery electric Plug-in hybrid |

| By Tenure | Daily Weekly Monthly/mid-term Long-term operating lease Finance/balloon & novated |

| By End User | Leisure individuals Corporate SME Corporate enterprise Government & public sector Insurance replacement Rideshare programs |

| By Booking Type | Online booking Offline booking |

| By Region | NSW VIC QLD WA SA TAS ACT NT |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Leisure Car Rentals | 120 | Frequent Travelers, Vacation Planners |

| Corporate Mobility Solutions | 90 | Corporate Travel Managers, HR Managers |

| Ride-Sharing Services | 60 | Urban Commuters, Ride-Sharing Users |

| Long-term Vehicle Leasing | 50 | Fleet Managers, Business Owners |

| Electric Vehicle Rentals | 40 | Environmentally Conscious Consumers, Tech Enthusiasts |

The Australia Car Rental & Mobility Services Market is valued at approximately AUD 3.8 billion, reflecting a significant rebound in both domestic and international tourism, increased business travel, and a growing demand for flexible transportation options.