Region:Central and South America

Author(s):Dev

Product Code:KRAB0955

Pages:96

Published On:October 2025

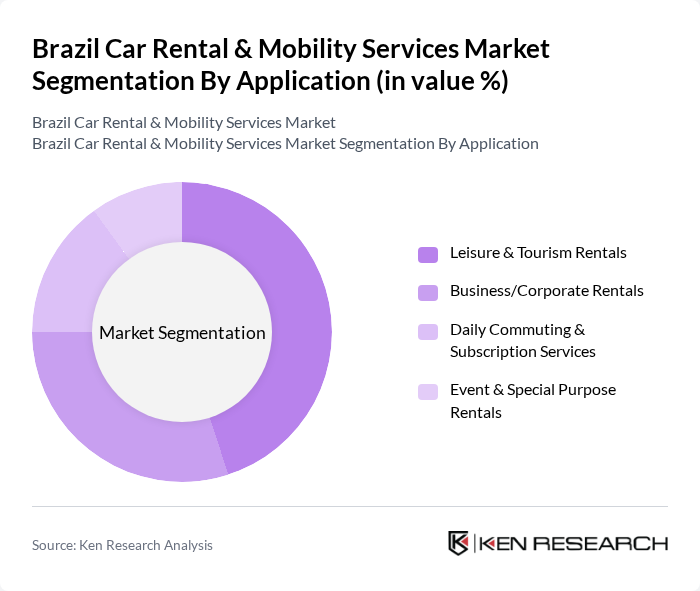

By Application:The application segment includes various sub-segments such as Leisure & Tourism Rentals, Business/Corporate Rentals, Daily Commuting & Subscription Services, and Event & Special Purpose Rentals. Among these, Leisure & Tourism Rentals dominate the market, supported by Brazil's vibrant tourism sector, which attracts millions of visitors annually. The demand for rental cars for sightseeing, travel convenience, and access to remote destinations significantly contributes to this segment's growth.

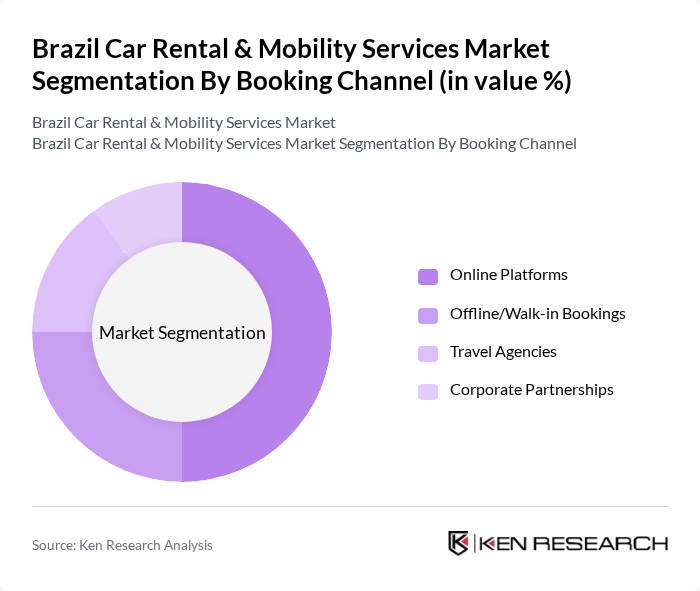

By Booking Channel:The booking channel segment encompasses Online Platforms, Offline/Walk-in Bookings, Travel Agencies, and Corporate Partnerships. Online Platforms are leading this segment, driven by the increasing penetration of smartphones, widespread internet access, and the adoption of digital payment solutions. Consumers increasingly prefer booking rentals through mobile apps and websites, reflecting a broader shift towards digitalization in the travel and mobility sectors.

The Brazil Car Rental & Mobility Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Localiza Rent a Car S.A., Movida Participações S.A., Unidas (now part of Localiza&Co), Hertz Brasil (Hertz Global Holdings, Inc.), Avis Budget Group, Inc., Sixt SE, Europcar Mobility Group, Rentcars.com, 99 (formerly 99 Táxi, now part of Didi Chuxing), Cabify Brasil, BlaBlaCar Brasil, Zipcar (Avis Budget Group), Tembici (Bike and Micro-mobility), Kovi, and Turbi contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's car rental and mobility services market appears promising, driven by urbanization and technological advancements. As cities expand, the demand for flexible transportation options will likely increase. Additionally, the integration of electric vehicles into rental fleets is expected to gain traction, aligning with global sustainability trends. Companies that leverage technology to enhance customer experience and operational efficiency will be well-positioned to capitalize on emerging opportunities in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Application | Leisure & Tourism Rentals Business/Corporate Rentals Daily Commuting & Subscription Services Event & Special Purpose Rentals |

| By Booking Channel | Online Platforms Offline/Walk-in Bookings Travel Agencies Corporate Partnerships |

| By Vehicle Type | Economy Cars Executive Cars SUVs Vans & MUVs Luxury Cars Electric Vehicles |

| By Rental Duration | Short-term Rentals (Daily/Weekly) Long-term Rentals (Monthly/Annual) Subscription-based Rentals |

| By End-User | Individual Consumers Corporate Clients Government Agencies Tour Operators Event Organizers |

| By Region | Southeast Brazil South Brazil Northeast Brazil Central-West Brazil North Brazil |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Leisure Car Rentals | 100 | Travel Agency Managers, Vacation Rental Coordinators |

| Corporate Car Rental Services | 80 | Corporate Travel Managers, HR Executives |

| Long-term Rental Solutions | 60 | Fleet Managers, Business Development Executives |

| Mobility-as-a-Service (MaaS) Providers | 40 | Product Managers, Technology Officers |

| Consumer Preferences in Car Rentals | 90 | Frequent Travelers, Urban Commuters |

The Brazil Car Rental & Mobility Services Market is valued at approximately USD 4.9 billion, reflecting a significant growth trend driven by urbanization, tourism, and the rise of digital booking platforms.