Region:Asia

Author(s):Dev

Product Code:KRAA4665

Pages:94

Published On:September 2025

By Type:The market can be segmented into various types, including Waste Management Solutions, Recycling Equipment, Circular Economy Consulting Services, Waste-to-Energy Technologies, Biodegradable Materials, Upcycling Solutions, and Others. Each of these segments plays a crucial role in the overall market dynamics, catering to different aspects of waste management and recycling.

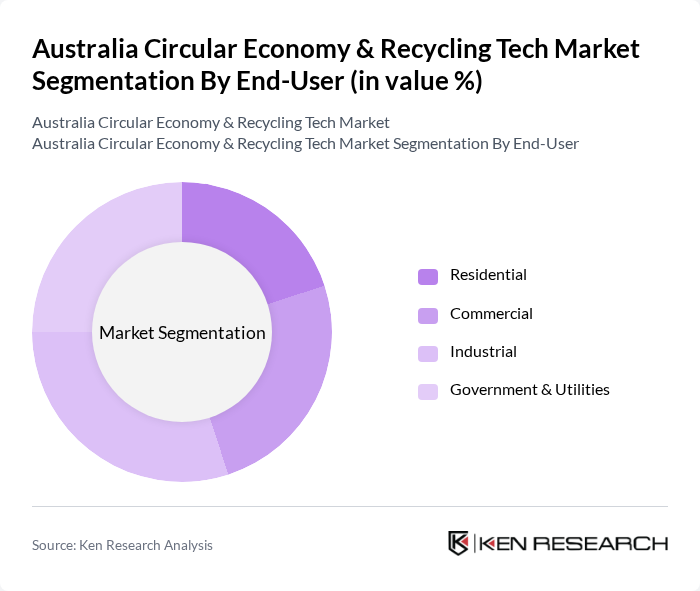

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. Each segment has unique requirements and contributes differently to the overall market, reflecting the diverse applications of circular economy and recycling technologies.

The Australia Circular Economy & Recycling Tech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cleanaway Waste Management Limited, Veolia Environmental Services Australia, SUEZ Recycling & Recovery Australia, Bingo Industries, ResourceCo, Toxfree Solutions, J.J. Richards & Sons, Waste Management Association of Australia (WMAA), Re.Group, Planet Ark Environmental Foundation, Eco Activist, The Green Guys, Clean Earth Technologies, EnviroWaste Services, Circular Economy Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia Circular Economy and Recycling Tech market appears promising, driven by ongoing government support and increasing consumer demand for sustainable practices. As technological advancements continue to evolve, the sector is likely to see enhanced efficiency and effectiveness in recycling processes. Furthermore, the integration of digital solutions will facilitate better tracking and management of waste, fostering a more robust circular economy. This evolving landscape presents significant opportunities for innovation and collaboration among stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Waste Management Solutions Recycling Equipment Circular Economy Consulting Services Waste-to-Energy Technologies Biodegradable Materials Upcycling Solutions Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Municipal Waste Management Industrial Waste Recycling E-Waste Recycling Construction & Demolition Waste |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants |

| By Policy Support | Subsidies Tax Exemptions Recycling Credits Compliance Incentives |

| By Distribution Channel | Direct Sales Online Platforms Distributors Retail Outlets |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Discount Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management | 100 | City Waste Managers, Environmental Planners |

| Recycling Technology Providers | 80 | Product Development Managers, Technical Directors |

| Corporate Sustainability Initiatives | 75 | Sustainability Officers, Corporate Social Responsibility Managers |

| Consumer Recycling Behavior | 150 | General Public, Eco-conscious Consumers |

| Industry Associations and NGOs | 60 | Policy Advocates, Research Analysts |

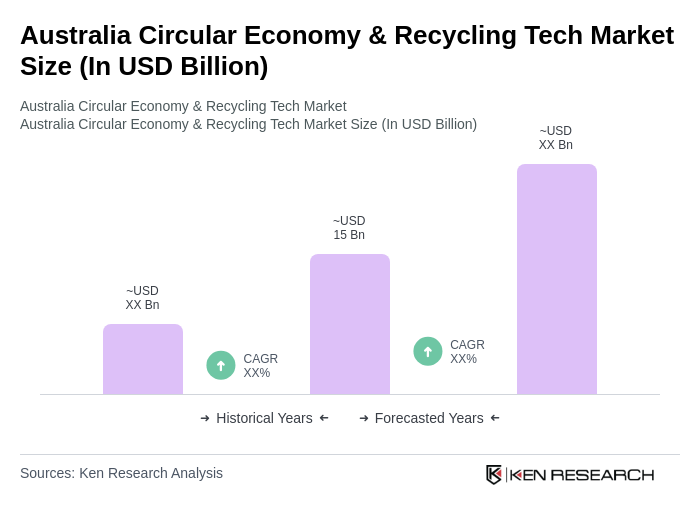

The Australia Circular Economy & Recycling Tech Market is valued at approximately USD 15 billion, reflecting a significant growth driven by government initiatives, consumer awareness, and demand for innovative recycling technologies.