Region:Europe

Author(s):Shubham

Product Code:KRAB5055

Pages:93

Published On:October 2025

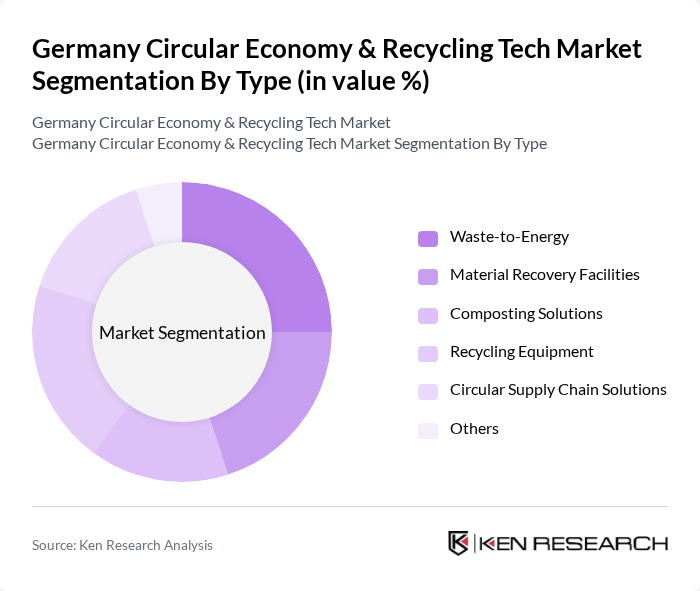

By Type:The market is segmented into various types, including Waste-to-Energy, Material Recovery Facilities, Composting Solutions, Recycling Equipment, Circular Supply Chain Solutions, and Others. Each of these segments plays a crucial role in the overall recycling ecosystem, addressing different aspects of waste management and resource recovery .

The Waste-to-Energy segment is currently leading the market due to its dual role in waste management and renewable energy generation. This segment is gaining momentum as municipalities and industry seek sustainable solutions to manage rising waste volumes, comply with landfill reduction targets, and contribute to energy transition goals. The integration of digital monitoring and emissions reduction technologies further drives adoption of Waste-to-Energy solutions .

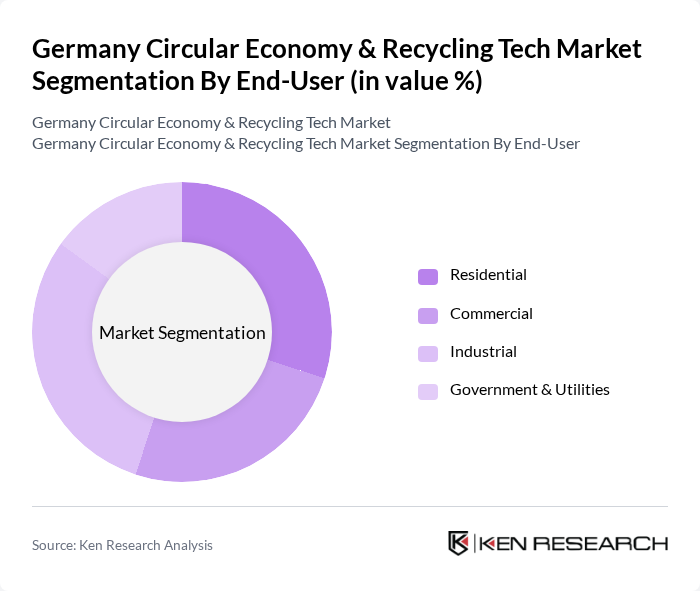

By End-User:The market is segmented by end-users, including Residential, Commercial, Industrial, and Government & Utilities. Each segment has unique requirements and contributes differently to the overall recycling ecosystem .

The Residential segment is the largest contributor to the market, driven by widespread adoption of recycling practices, mandatory municipal waste separation, and strong public engagement in sustainability initiatives. Local government programs, digital recycling platforms, and increased accessibility of collection services have further accelerated household participation in recycling and composting .

The Germany Circular Economy & Recycling Tech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Umweltservice GmbH, ALBA Group plc & Co. KG, Remondis SE & Co. KG, SUEZ Recycling and Recovery Deutschland GmbH, BSR (Berliner Stadtreinigungsbetriebe), Interseroh Dienstleistungs GmbH, RWE AG, TOMRA Systems ASA, DSD – Duales System Deutschland GmbH, Ecoloop GmbH, GreenCycle GmbH, Recup GmbH, TerraCycle Germany GmbH, KIKKM International, and Bartenbach Werbemittel GmbH & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany Circular Economy and Recycling Tech market appears promising, driven by increasing consumer demand for sustainable products and robust government support. As technological advancements continue to evolve, the integration of smart recycling solutions and AI will enhance operational efficiencies. Furthermore, the growing emphasis on zero waste initiatives will likely lead to innovative business models, fostering collaboration among stakeholders and creating a more cohesive market environment that supports sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Waste-to-Energy Material Recovery Facilities Composting Solutions Recycling Equipment Circular Supply Chain Solutions Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Construction Waste Management Electronic Waste Recycling Plastic Waste Management Organic Waste Recycling Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Recycling Credits (RECs) Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Retail Outlets |

| By Technology | Mechanical Recycling Chemical Recycling Biological Recycling Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management | 100 | City Waste Managers, Environmental Policy Makers |

| Recycling Technology Providers | 60 | CEOs, Product Development Managers |

| Corporate Sustainability Initiatives | 50 | Sustainability Officers, Corporate Social Responsibility Managers |

| Consumer Recycling Behavior | 120 | General Public, Eco-conscious Consumers |

| Industry Associations and NGOs | 40 | Association Leaders, Environmental Advocates |

The Germany Circular Economy & Recycling Tech Market is valued at approximately USD 25 billion, driven by regulatory frameworks, consumer focus on sustainability, and advancements in recycling technologies. This valuation reflects a five-year historical analysis of market growth.