Region:Global

Author(s):Geetanshi

Product Code:KRAE7904

Pages:92

Published On:December 2025

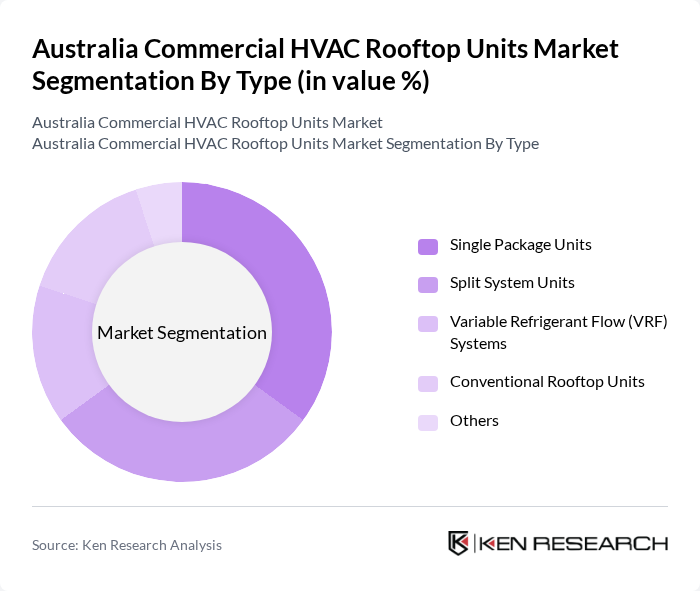

By Type:The market is segmented into various types of HVAC rooftop units, including Single Package Units, Split System Units, Variable Refrigerant Flow (VRF) Systems, Conventional Rooftop Units, and Others. Among these, Single Package Units are gaining traction due to their compact design and ease of installation, making them a preferred choice for small to medium-sized commercial spaces. Split System Units are also popular for their flexibility and efficiency, catering to diverse customer needs. Conventional Rooftop Units maintain significant presence for their reliability and cost-effectiveness in standard applications.

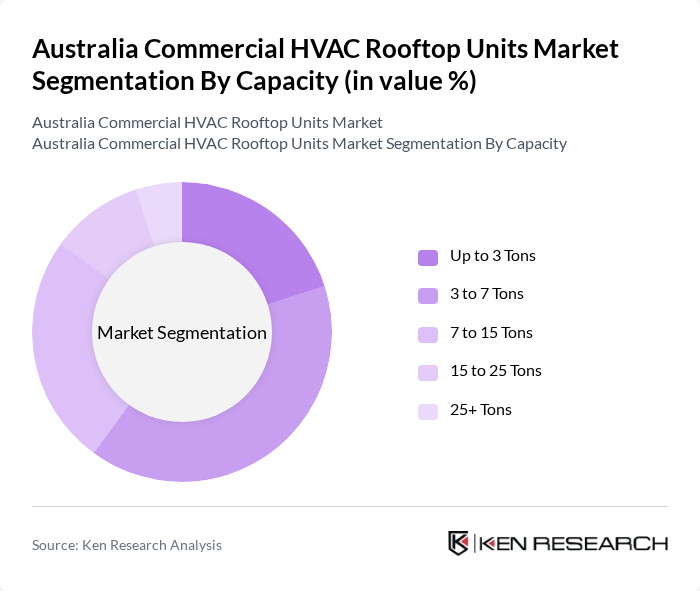

By Capacity:The capacity segmentation includes units categorized as Up to 3 Tons, 3 to 7 Tons, 7 to 15 Tons, 15 to 25 Tons, and 25+ Tons. The 3 to 7 Tons segment is currently leading the market due to its suitability for a wide range of commercial applications, providing an optimal balance between performance and energy efficiency. The demand for larger units (15 to 25 Tons) is also increasing, particularly in larger commercial buildings and industrial facilities.

The Australia Commercial HVAC Rooftop Units Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daikin Australia, Carrier Australia, Mitsubishi Electric Australia, Trane Australia, Lennox Australia, Fujitsu General Australia, ActronAir, Rinnai Australia, Bosch Thermotechnology, Panasonic Australia, Hitachi Air Conditioning, York International, Swegon Australia, Aermec Australia, Biddle Air Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia Commercial HVAC Rooftop Units market appears promising, driven by a strong emphasis on sustainability and technological innovation. As businesses increasingly prioritize energy efficiency, the demand for advanced HVAC solutions is expected to rise. Additionally, the integration of smart technologies and IoT capabilities will enhance system performance and user experience. With government support and a growing awareness of indoor air quality, the market is poised for significant advancements in the coming years, fostering a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Single Package Units Split System Units Variable Refrigerant Flow (VRF) Systems Conventional Rooftop Units Others |

| By Capacity | Up to 3 Tons to 7 Tons to 15 Tons to 25 Tons + Tons |

| By End-User | Retail Hospitality Healthcare Education Offices |

| By Application | Commercial Buildings Industrial Facilities Data Centers Others |

| By Energy Source | Electric Gas Hybrid Systems Others |

| By Installation Type | New Installations Retrofits Replacements Others |

| By Region | New South Wales Victoria Queensland Western Australia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Buildings | 120 | Facility Managers, Building Owners |

| Retail Spaces | 100 | Store Managers, Operations Directors |

| Industrial Facilities | 80 | Plant Managers, Maintenance Supervisors |

| Healthcare Facilities | 70 | Facility Directors, HVAC Technicians |

| Educational Institutions | 90 | Campus Facility Managers, Energy Managers |

The Australia Commercial HVAC Rooftop Units Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the demand for energy-efficient HVAC solutions in commercial buildings and ongoing urbanization and infrastructure development.