Region:Africa

Author(s):Geetanshi

Product Code:KRAE7906

Pages:98

Published On:December 2025

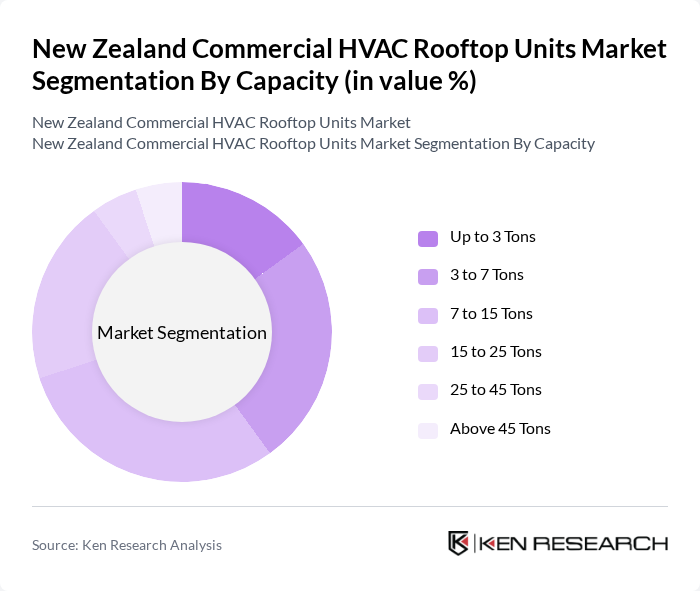

By Capacity:The capacity segmentation of the market includes various subsegments that cater to different cooling and heating needs. The subsegments are as follows: Up to 3 Tons, 3 to 7 Tons, 7 to 15 Tons, 15 to 25 Tons, 25 to 45 Tons, and Above 45 Tons. The demand for rooftop units varies significantly based on the capacity required for different commercial applications.

By End-User:The end-user segmentation includes Commercial Offices, Retail Spaces, Educational Institutions, Healthcare Facilities, Hospitality, and Others. Each of these segments has unique requirements for HVAC systems, influenced by factors such as occupancy levels, energy efficiency needs, and regulatory compliance.

The New Zealand Commercial HVAC Rooftop Units Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daikin New Zealand, Fujitsu General (NZ) Limited, Mitsubishi Electric, Carrier New Zealand, Trane New Zealand, ActronAir, Rinnai New Zealand, Panasonic New Zealand, Lennox International, York International, BOC Limited, Airedale International, Swegon Group, Johnson Controls, Honeywell International Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand commercial HVAC rooftop units market appears promising, driven by a strong emphasis on sustainability and technological innovation. As businesses increasingly prioritize energy efficiency, the integration of smart technologies and IoT solutions is expected to enhance system performance and user experience. Furthermore, the ongoing expansion of the green building sector will likely create new opportunities for HVAC providers, fostering a competitive landscape that encourages continuous improvement and innovation in energy-efficient solutions.

| Segment | Sub-Segments |

|---|---|

| By Capacity | Up to 3 Tons 3 to 7 Tons 7 to 15 Tons 15 to 25 Tons 25 to 45 Tons Above 45 Tons |

| By End-User | Commercial Offices Retail Spaces Educational Institutions Healthcare Facilities Hospitality Others |

| By Application | New Construction Retrofit/Replacement Others |

| By Type | Packaged Terminal Air Conditioners (PTAC) Single Packaged Units Split Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Buildings | 45 | Facility Managers, Building Owners |

| Retail Outlets | 40 | Store Managers, Operations Directors |

| Industrial Facilities | 50 | Plant Managers, Maintenance Supervisors |

| Healthcare Institutions | 45 | Facility Directors, HVAC Technicians |

| Educational Institutions | 50 | Campus Facility Managers, Energy Managers |

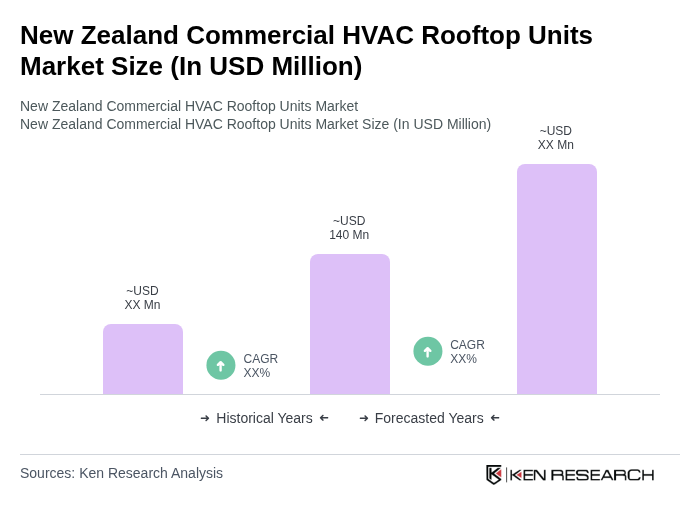

The New Zealand Commercial HVAC Rooftop Units Market is valued at approximately USD 140 million, reflecting a five-year historical analysis driven by the demand for energy-efficient HVAC systems and increased construction activities across the country.