Australia Construction Machinery Market Overview

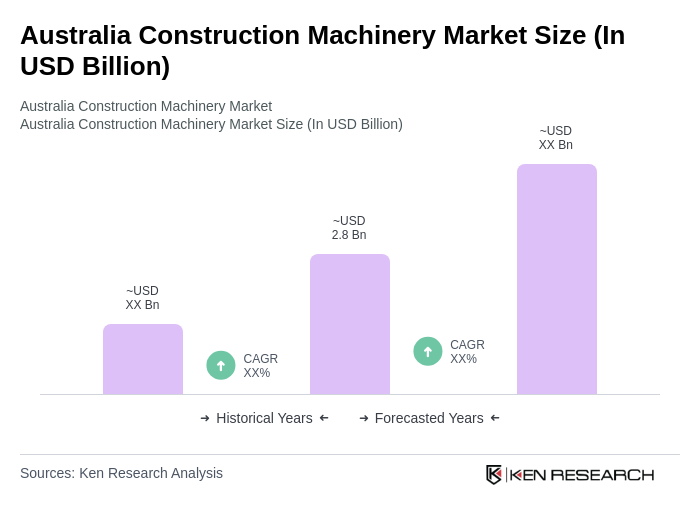

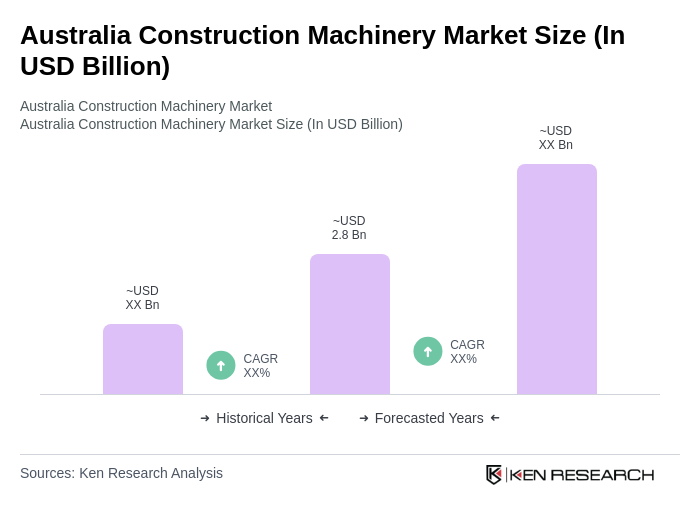

- The Australia Construction Machinery Market is valued at USD 2.8 billion, based on a five-year historical analysis. This market is primarily driven by rising infrastructure development, rapid urbanization, and technological advancements in construction equipment. Increased adoption of telematics, IoT, and eco-friendly machinery is enhancing operational efficiency and sustainability, contributing to robust demand from both public and private sectors .

- Key cities such as Sydney, Melbourne, and Brisbane continue to dominate the market, supported by large-scale infrastructure projects and urban development initiatives. Significant population growth in these regions is driving expansion in residential and commercial spaces, further fueling demand for advanced construction machinery .

- The Australian government’s National Infrastructure Plan allocates AUD 110 billion for infrastructure projects over the next decade, focusing on transportation networks, public facilities, and economic growth. This initiative is expected to sustain high demand for construction machinery across the country .

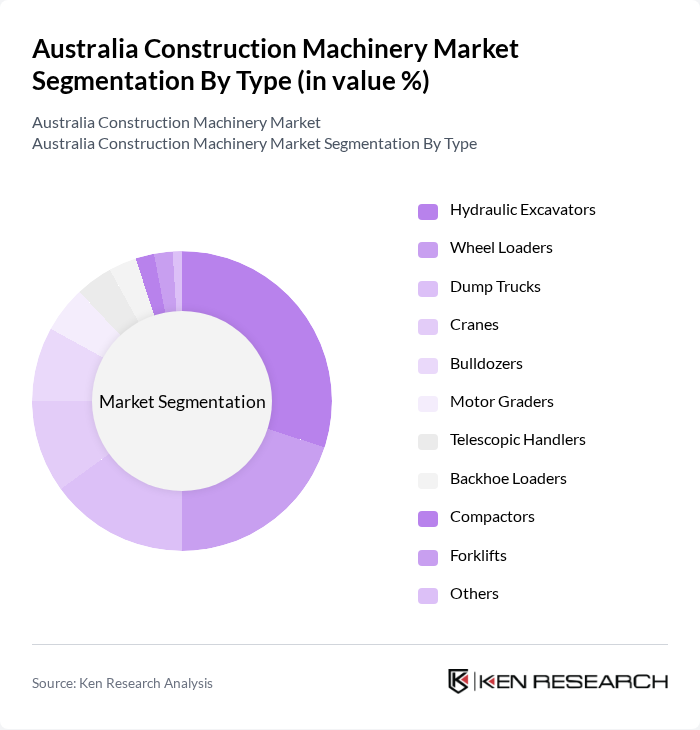

Australia Construction Machinery Market Segmentation

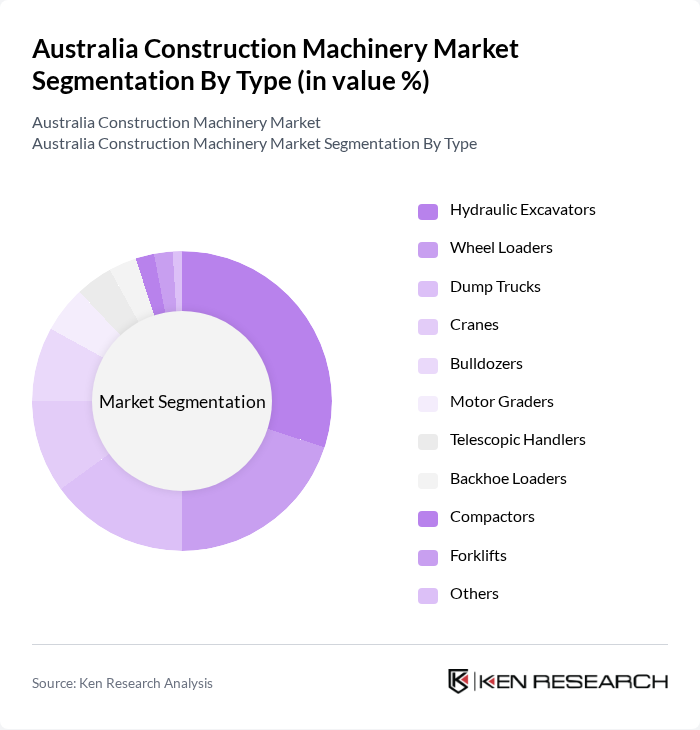

By Type:The construction machinery market in Australia is segmented into hydraulic excavators, wheel loaders, dump trucks, cranes, bulldozers, motor graders, telescopic handlers, backhoe loaders, compactors, forklifts, and others. Hydraulic excavators remain the most dominant segment due to their versatility, efficiency, and adaptability across a wide range of construction applications. The ongoing shift toward mechanization and digital asset tracking continues to drive demand for hydraulic excavators, making them the preferred choice for contractors .

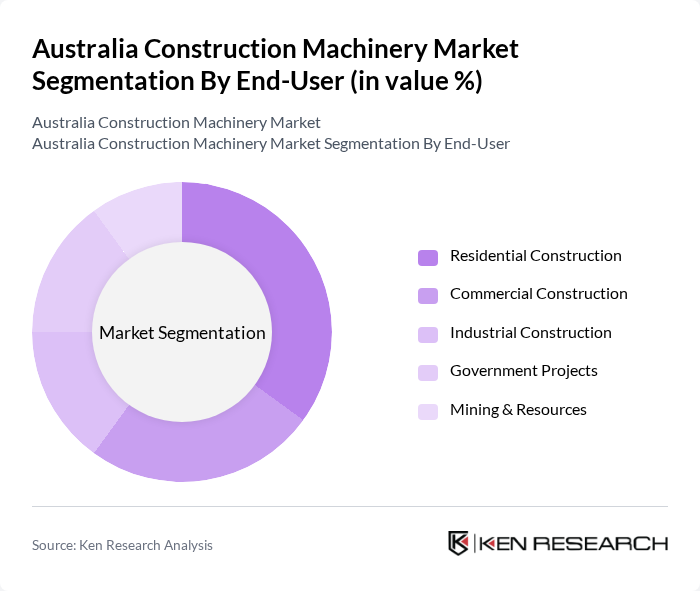

By End-User:The end-user segmentation includes residential construction, commercial construction, industrial construction, government projects, and mining & resources. Residential construction leads the market, driven by ongoing housing development and renovation activity in major cities. The expansion of commercial and government infrastructure, as well as continued investment in mining and resources, supports demand for a broad range of construction machinery .

Australia Construction Machinery Market Competitive Landscape

The Australia Construction Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., JCB, Liebherr Group, Doosan Infracore, Terex Corporation, SANY Group, XCMG Group, CASE Construction Equipment, Hyundai Construction Equipment, Wacker Neuson SE, Manitou Group, Bobcat Company, Clark Equipment Australia Pty Ltd, Tutt Bryant Group Limited, WesTrac Pty Ltd, CJD Equipment Pty Ltd, Komatsu Australia Pty Ltd contribute to innovation, geographic expansion, and service delivery in this space.

Australia Construction Machinery Market Industry Analysis

Growth Drivers

- Increased Infrastructure Investment:The Australian government allocated AUD 120 billion for infrastructure projects over the next decade, significantly boosting demand for construction machinery. Major projects include the Sydney Metro and Melbourne's Suburban Rail Loop, which are expected to create thousands of jobs and stimulate economic growth. This investment is projected to increase machinery utilization rates, driving sales and rental demand in the construction sector, which is crucial for maintaining competitive advantage in the market.

- Technological Advancements:The construction machinery sector is witnessing rapid technological advancements, with investments in automation and smart machinery. In future, the Australian construction industry is expected to invest approximately AUD 2.5 billion in digital technologies, enhancing operational efficiency. Innovations such as telematics and machine learning are improving equipment performance and reducing downtime, which is vital for contractors aiming to optimize project timelines and costs, thereby increasing market competitiveness.

- Urbanization Trends:Australia’s urban population is projected to reach 25 million in future, driving demand for residential and commercial construction. This urbanization trend is expected to increase the need for construction machinery, with an estimated 15% rise in machinery sales to meet the growing infrastructure demands. Cities like Sydney and Melbourne are expanding rapidly, necessitating advanced machinery for efficient construction processes, thus creating a robust market environment for construction equipment manufacturers.

Market Challenges

- High Initial Capital Investment:The construction machinery market faces significant challenges due to high initial capital investments, which can exceed AUD 500,000 for advanced equipment. This financial barrier limits access for smaller contractors and startups, hindering market entry and competition. Additionally, the need for ongoing maintenance and operational costs further strains budgets, making it difficult for companies to invest in new technologies and equipment, ultimately affecting market growth.

- Regulatory Compliance Issues:The construction machinery industry in Australia is subject to stringent regulatory compliance, including safety and environmental standards. In future, compliance costs are expected to rise by 10%, impacting profit margins for manufacturers and contractors. Navigating these regulations requires significant resources and expertise, which can be particularly challenging for smaller firms. Non-compliance can lead to hefty fines and project delays, further complicating market dynamics and operational efficiency.

Australia Construction Machinery Market Future Outlook

The future of the Australia construction machinery market appears promising, driven by ongoing infrastructure investments and technological innovations. As urbanization accelerates, demand for advanced machinery will likely increase, fostering a competitive landscape. Companies are expected to focus on sustainability and digitalization, enhancing operational efficiency. Furthermore, the integration of electric machinery and IoT technologies will reshape the market, providing opportunities for growth and improved productivity in construction projects across the nation.

Market Opportunities

- Green Construction Practices:The shift towards green construction practices presents a significant opportunity for the machinery market. With the Australian government aiming for a substantial reduction in carbon emissions in future, demand for eco-friendly machinery is expected to rise. This trend will encourage manufacturers to innovate and develop sustainable equipment, aligning with environmental regulations and attracting eco-conscious clients.

- Rental Market Growth:The construction machinery rental market is projected to grow significantly, with an estimated value of AUD 3 billion in future. This growth is driven by contractors seeking cost-effective solutions and flexibility in equipment usage. The increasing preference for renting over purchasing machinery allows companies to access the latest technology without the burden of ownership costs, creating a lucrative opportunity for rental service providers in the industry.