Region:Middle East

Author(s):Dev

Product Code:KRAA2573

Pages:91

Published On:August 2025

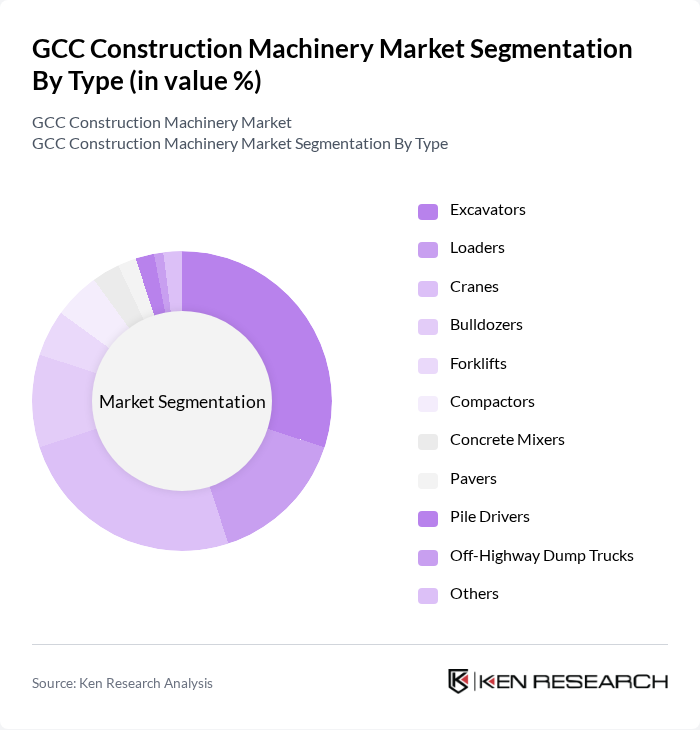

By Type:The construction machinery market is segmented into excavators, loaders, cranes, bulldozers, forklifts, compactors, concrete mixers, pavers, pile drivers, off-highway dump trucks, and others. Excavators and cranes remain the most dominant categories, reflecting their versatility and essential roles in earthmoving and lifting operations for large-scale projects. The market is also witnessing increased adoption of electric and hybrid machinery, driven by environmental regulations and a focus on sustainability .

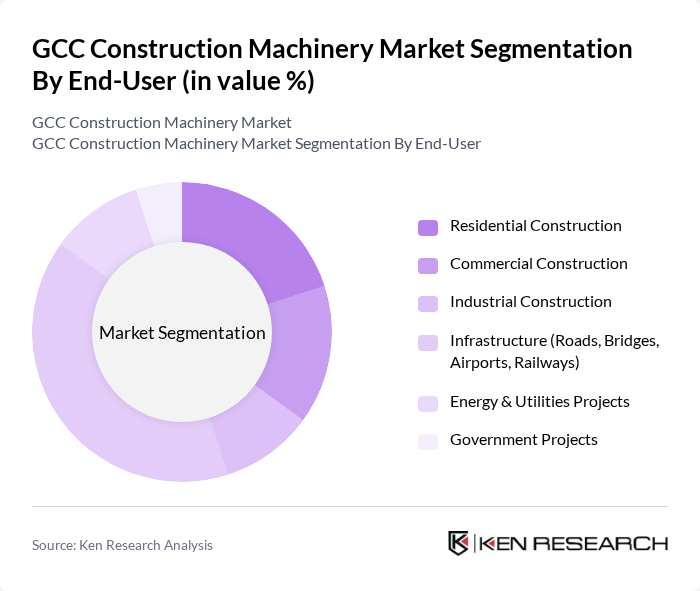

By End-User:The market is segmented by end-user into residential construction, commercial construction, industrial construction, infrastructure projects (including roads, bridges, airports, and railways), energy and utilities projects, and government projects. Infrastructure projects account for the largest share, supported by ongoing investments in public works and urban development. The segment is further propelled by government initiatives to expand transportation networks and utilities, as well as private sector participation in large-scale developments .

The GCC Construction Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., JCB, Liebherr Group, Doosan Infracore, Terex Corporation, SANY Group, XCMG Group, CASE Construction Equipment, Hyundai Construction Equipment, Wacker Neuson SE, Manitou Group, Bobcat Company, Al-Bahar (Mohamed Abdulrahman Al-Bahar), FAMCO (Al-Futtaim Auto & Machinery Company LLC), United Al Saqer Heavy Equipment, Kanoo Machinery, Arabian Jerusalem Equipment Trading Company contribute to innovation, geographic expansion, and service delivery in this space.

The GCC construction machinery market is poised for significant transformation, driven by technological advancements and sustainability initiatives. As governments prioritize eco-friendly construction practices, the demand for energy-efficient machinery is expected to rise. Additionally, the integration of smart technologies, such as IoT and automation, will enhance operational efficiency. These trends indicate a shift towards more innovative and sustainable construction practices, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Excavators Loaders Cranes Bulldozers Forklifts Compactors Concrete Mixers Pavers Pile Drivers Off-Highway Dump Trucks Others |

| By End-User | Residential Construction Commercial Construction Industrial Construction Infrastructure (Roads, Bridges, Airports, Railways) Energy & Utilities Projects Government Projects |

| By Application | Road Construction Building Construction Mining Operations Demolition Material Handling |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Propulsion Type | Internal Combustion Engine (ICE) Electric/Hybrid |

| By Distribution Mode | Retail Outlets Wholesale Rental Services |

| By Price Range | Low-End Machinery Mid-Range Machinery High-End Machinery |

| By Brand Preference | International Brands Local Brands Emerging Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Supervisors |

| Commercial Construction Equipment Usage | 80 | Procurement Managers, Equipment Rental Specialists |

| Infrastructure Development Machinery | 70 | Construction Engineers, Operations Managers |

| Heavy Machinery Rental Market | 50 | Rental Company Owners, Fleet Managers |

| Technological Adoption in Construction | 60 | IT Managers, Innovation Officers |

The GCC Construction Machinery Market is valued at approximately USD 7 billion, driven by rapid urbanization, significant infrastructure investments, and a robust construction sector across the Gulf Cooperation Council countries.