Region:Asia

Author(s):Shubham

Product Code:KRAA6486

Pages:95

Published On:September 2025

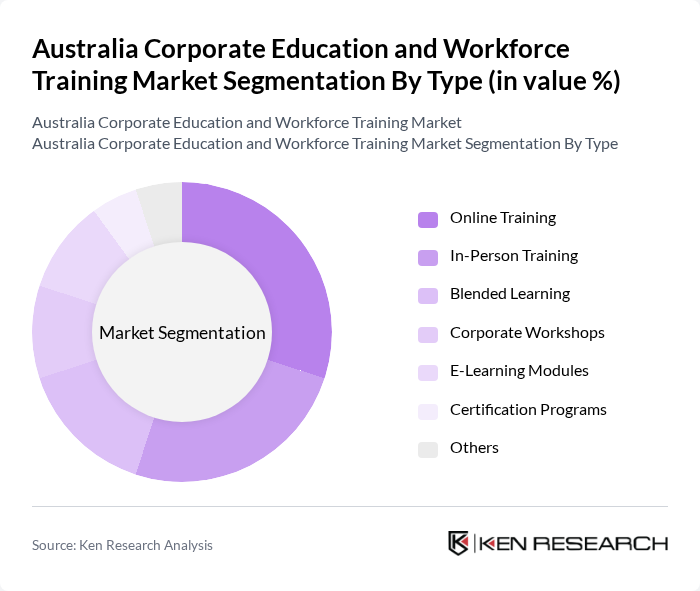

By Type:The market can be segmented into various types of training methods, including Online Training, In-Person Training, Blended Learning, Corporate Workshops, E-Learning Modules, Certification Programs, and Others. Each of these sub-segments caters to different learning preferences and organizational needs.

The Online Training sub-segment is currently dominating the market due to its flexibility and accessibility, allowing employees to learn at their own pace and convenience. The rise of digital platforms and the increasing acceptance of remote learning have further accelerated this trend. Organizations are increasingly adopting online training solutions to reduce costs and enhance employee engagement, making it a preferred choice for many.

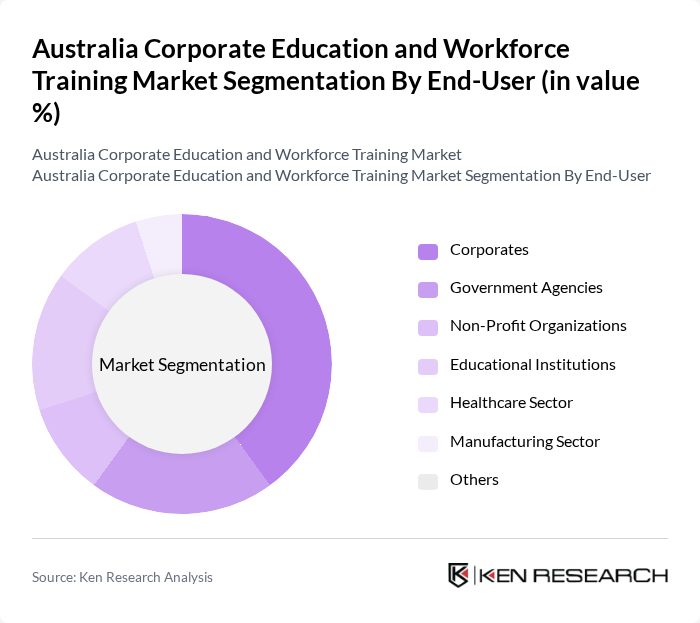

By End-User:The market is segmented based on end-users, including Corporates, Government Agencies, Non-Profit Organizations, Educational Institutions, Healthcare Sector, Manufacturing Sector, and Others. Each end-user category has distinct training requirements and objectives.

Corporates are the leading end-user segment, accounting for a significant portion of the market. This dominance is attributed to the increasing need for workforce development and the competitive nature of the business environment. Companies are investing heavily in training programs to enhance employee skills, improve productivity, and adapt to technological changes, making them the primary consumers of corporate education and workforce training services.

The Australia Corporate Education and Workforce Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as TAFE Queensland, Open Colleges, Upskilled, Australian Institute of Management, Learning Tree International, Navitas, Pearson Australia, SEEK Learning, Coursera, Udemy for Business, Skillsoft, APM Training, RMIT Online, The Learning Network, Australian College of Commerce and Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corporate education and workforce training market in Australia appears promising, driven by technological advancements and evolving workforce needs. As organizations increasingly embrace hybrid learning models, the integration of artificial intelligence and personalized learning experiences will enhance training effectiveness. Furthermore, the focus on soft skills development is expected to grow, addressing the demand for well-rounded employees. These trends indicate a shift towards more adaptive and responsive training solutions, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Training In-Person Training Blended Learning Corporate Workshops E-Learning Modules Certification Programs Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions Healthcare Sector Manufacturing Sector Others |

| By Delivery Mode | Virtual Classrooms On-Site Training Mobile Learning Self-Paced Learning Hybrid Models Others |

| By Industry Focus | IT and Software Finance and Banking Retail Hospitality Construction Others |

| By Training Duration | Short Courses (Less than 1 month) Medium Courses (1-3 months) Long Courses (More than 3 months) Intensive Workshops Others |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications Compliance Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Free Courses Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Needs Assessment | 150 | HR Managers, Training Coordinators |

| Digital Learning Adoption Trends | 100 | IT Managers, Learning & Development Specialists |

| Employee Engagement in Training Programs | 80 | Employees, Team Leaders |

| Impact of Government Initiatives on Workforce Training | 70 | Policy Makers, Industry Experts |

| Evaluation of Training Providers | 90 | Procurement Officers, Training Managers |

The Australia Corporate Education and Workforce Training Market is valued at approximately USD 5 billion, reflecting a significant investment by organizations in training programs to enhance employee productivity and adapt to evolving market demands.