Region:Africa

Author(s):Shubham

Product Code:KRAA6447

Pages:88

Published On:September 2025

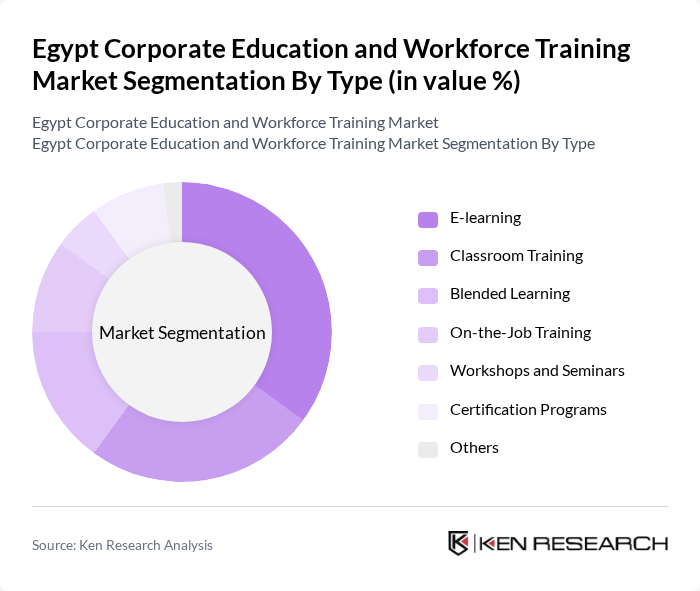

By Type:The market is segmented into various types of training methods, including E-learning, Classroom Training, Blended Learning, On-the-Job Training, Workshops and Seminars, Certification Programs, and Others. E-learning has gained significant traction due to its flexibility and accessibility, while Classroom Training remains popular for hands-on learning experiences. Blended Learning combines both methods, catering to diverse learning preferences. On-the-Job Training is essential for practical skill development, and Workshops and Seminars provide targeted knowledge enhancement. Certification Programs are increasingly sought after for professional development, while other methods encompass various niche training solutions.

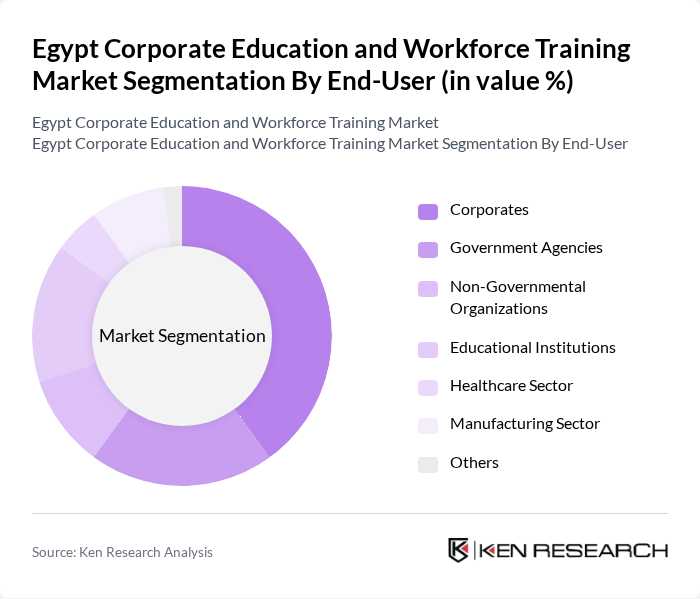

By End-User:The market is segmented by end-users, including Corporates, Government Agencies, Non-Governmental Organizations, Educational Institutions, Healthcare Sector, Manufacturing Sector, and Others. Corporates are the largest end-users, driven by the need for continuous employee development and skill enhancement. Government Agencies are increasingly investing in workforce training to improve public sector efficiency. Non-Governmental Organizations focus on capacity building in various communities, while Educational Institutions provide foundational training. The Healthcare Sector requires specialized training for medical professionals, and the Manufacturing Sector emphasizes technical skills development.

The Egypt Corporate Education and Workforce Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as New Horizons Egypt, ITI (Information Technology Institute), AUC (American University in Cairo), RITI (Regional IT Institute), E-Training Egypt, Knowledge Academy, Al-Ahram Training Center, Future Academy, Talent Academy, Skills Academy, Cairo University Training Center, Giza Systems, E-Learning Egypt, EduTech Egypt, MHR (Ministry of Human Resources) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's corporate education and workforce training market appears promising, driven by technological advancements and a growing emphasis on skill development. As companies increasingly recognize the importance of continuous learning, the integration of AI and blended learning approaches will likely reshape training methodologies. Furthermore, government support for vocational training and partnerships with international providers will enhance the quality and accessibility of training programs, fostering a more skilled workforce aligned with market needs.

| Segment | Sub-Segments |

|---|---|

| By Type | E-learning Classroom Training Blended Learning On-the-Job Training Workshops and Seminars Certification Programs Others |

| By End-User | Corporates Government Agencies Non-Governmental Organizations Educational Institutions Healthcare Sector Manufacturing Sector Others |

| By Training Methodology | Instructor-Led Training Self-Paced Learning Virtual Instructor-Led Training Simulation-Based Training Peer Learning Others |

| By Industry | Information Technology Finance and Banking Retail Telecommunications Hospitality Construction Others |

| By Duration | Short-Term Courses Medium-Term Courses Long-Term Programs Ongoing Training Others |

| By Delivery Channel | Online Platforms In-Person Training Centers Corporate Training Departments Mobile Learning Applications Others |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications Compliance Certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 150 | HR Managers, Training Coordinators |

| Workforce Development Initiatives | 100 | Policy Makers, Educational Administrators |

| Skill Development Workshops | 80 | Training Facilitators, Industry Experts |

| Online Learning Platforms | 70 | eLearning Managers, Content Developers |

| Vocational Training Programs | 90 | Vocational Trainers, Program Directors |

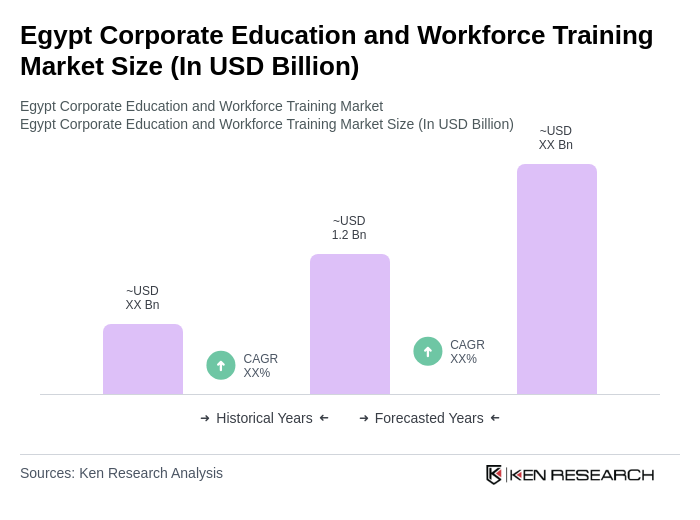

The Egypt Corporate Education and Workforce Training Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the demand for skilled labor and government initiatives aimed at enhancing workforce capabilities.