Region:Asia

Author(s):Geetanshi

Product Code:KRAB5168

Pages:94

Published On:October 2025

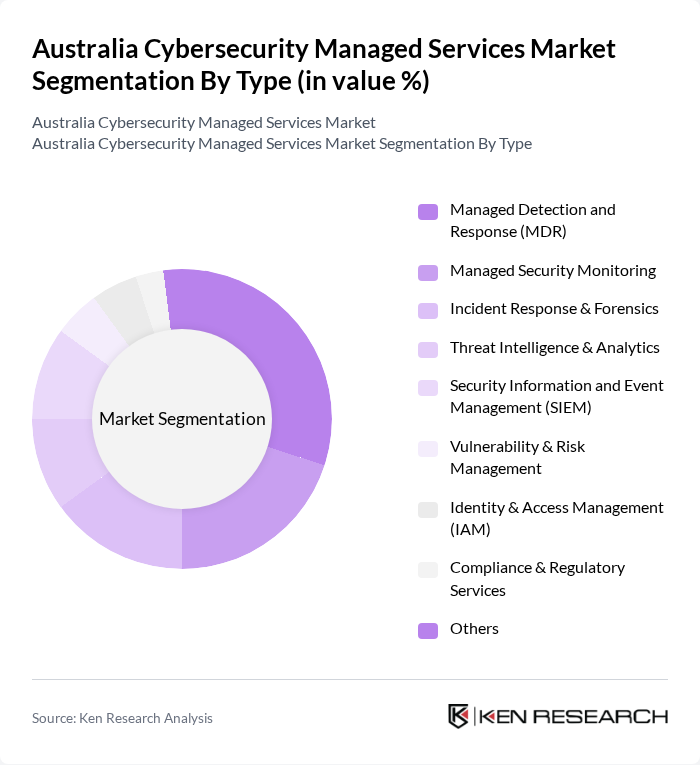

By Type:The market is segmented into various types of services that address a spectrum of cybersecurity needs. The subsegments include Managed Detection and Response (MDR), Managed Security Monitoring, Incident Response & Forensics, Threat Intelligence & Analytics, Security Information and Event Management (SIEM), Vulnerability & Risk Management, Identity & Access Management (IAM), Compliance & Regulatory Services, and Others. Among these, Managed Detection and Response (MDR) is gaining traction due to its proactive, real-time approach in identifying and mitigating advanced threats, leveraging behavioral analytics and automated remediation .

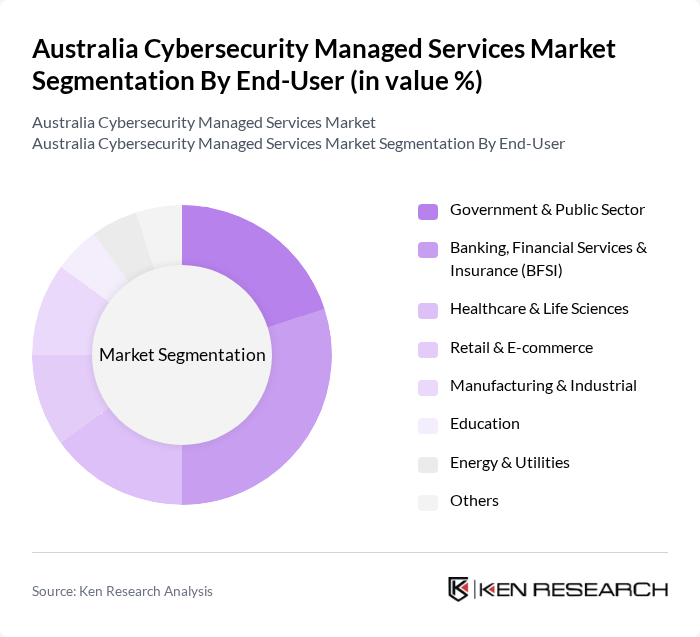

By End-User:The end-user segmentation includes Government & Public Sector, Banking, Financial Services & Insurance (BFSI), Healthcare & Life Sciences, Retail & E-commerce, Manufacturing & Industrial, Education, Energy & Utilities, and Others. The BFSI sector is particularly dominant due to stringent regulatory requirements, the high value of sensitive data, and the sector’s exposure to targeted cybercrime, driving the demand for comprehensive managed cybersecurity solutions .

The Australia Cybersecurity Managed Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telstra Corporation Limited, Optus Business, Macquarie Telecom Group, CyberCX, Trustwave, Secureworks, IBM Security, Palo Alto Networks, Fortinet, Check Point Software Technologies, Cisco Systems, CrowdStrike, Trend Micro, Sophos, and Accenture contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia Cybersecurity Managed Services Market is poised for significant transformation, driven by technological advancements and evolving threats. Organizations are increasingly adopting integrated security solutions that combine AI and machine learning to enhance threat detection and response capabilities. Additionally, the shift towards remote work is expected to accelerate the demand for cloud-based security services, as businesses seek to protect their digital assets in a decentralized environment while ensuring compliance with regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed Detection and Response (MDR) Managed Security Monitoring Incident Response & Forensics Threat Intelligence & Analytics Security Information and Event Management (SIEM) Vulnerability & Risk Management Identity & Access Management (IAM) Compliance & Regulatory Services Others |

| By End-User | Government & Public Sector Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Retail & E-commerce Manufacturing & Industrial Education Energy & Utilities Others |

| By Industry Vertical | BFSI Information Technology & Telecom Healthcare Government Energy & Utilities Retail Manufacturing Others |

| By Service Model | On-Premises Cloud-Based Hybrid |

| By Deployment Type | Managed Services Professional Services |

| By Security Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity Security |

| By Pricing Model | Subscription-Based Pay-As-You-Go Fixed Pricing Outcome-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cybersecurity | 100 | IT Security Managers, Compliance Officers |

| Healthcare Managed Security Services | 80 | Healthcare IT Directors, Risk Management Officers |

| Government Cybersecurity Initiatives | 70 | Government IT Administrators, Cybersecurity Policy Makers |

| Retail Sector Cyber Risk Management | 50 | Retail IT Managers, Data Protection Officers |

| SME Cybersecurity Solutions | 60 | Small Business Owners, IT Consultants |

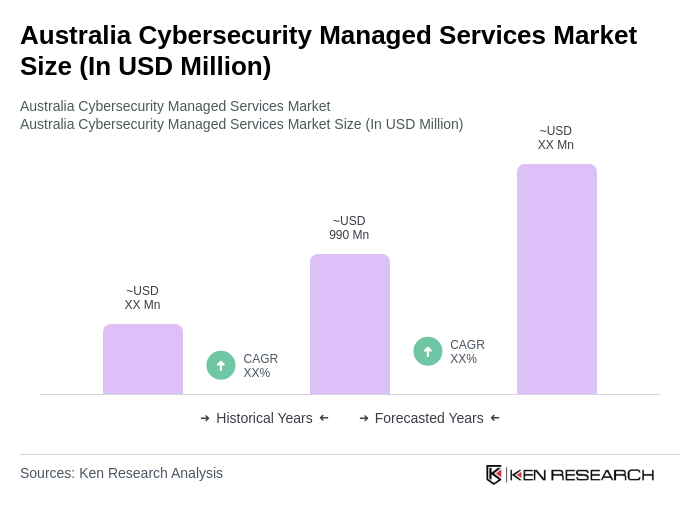

The Australia Cybersecurity Managed Services Market is valued at approximately USD 990 million, reflecting significant growth driven by increasing cyber threats, a shortage of skilled professionals, and the rapid adoption of cloud services across various sectors.