Region:North America

Author(s):Dev

Product Code:KRAC2074

Pages:95

Published On:October 2025

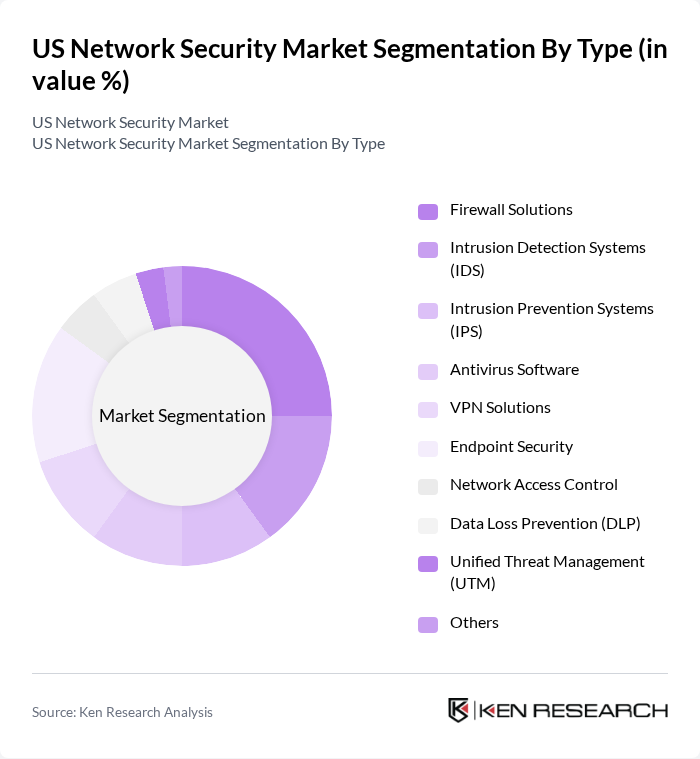

By Type:The market is segmented into various types of network security solutions, including Firewall Solutions, Intrusion Detection Systems (IDS), Intrusion Prevention Systems (IPS), Antivirus Software, VPN Solutions, Endpoint Security, Network Access Control, Data Loss Prevention (DLP), Unified Threat Management (UTM), and Others. Each of these sub-segments addresses specific security needs, such as perimeter defense, threat detection, malware prevention, secure remote access, and data protection. The adoption of cloud-based and AI-driven security solutions is accelerating across all segments as organizations seek scalable, adaptive protection against evolving threats .

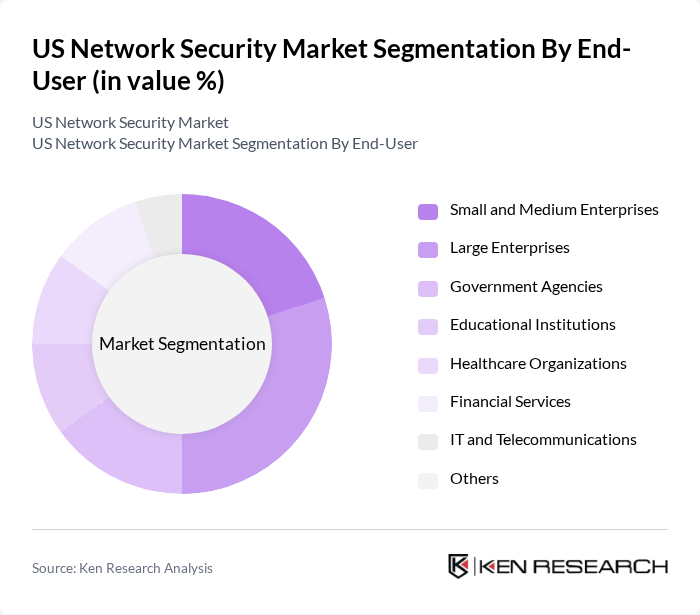

By End-User:The end-user segmentation includes Small and Medium Enterprises, Large Enterprises, Government Agencies, Educational Institutions, Healthcare Organizations, Financial Services, IT and Telecommunications, and Others. Each segment has unique security requirements, driving the demand for tailored solutions. Large enterprises and government agencies lead adoption due to higher risk exposure and regulatory obligations, while SMEs increasingly invest in managed security services to address resource constraints .

The US Network Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Palo Alto Networks, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., McAfee Corp., Trend Micro Incorporated, IBM Corporation, FireEye, Inc., Sophos Group plc, CrowdStrike Holdings, Inc., NortonLifeLock Inc., RSA Security LLC, Zscaler, Inc., Barracuda Networks, Inc., CyberArk Software Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The US network security market is poised for transformative growth as organizations increasingly adopt advanced technologies to combat evolving cyber threats. The shift towards zero trust security models is expected to redefine security architectures, emphasizing continuous verification and minimizing trust assumptions. Additionally, the integration of artificial intelligence and machine learning into security solutions will enhance threat detection and response capabilities, enabling organizations to proactively address vulnerabilities and safeguard sensitive data against sophisticated attacks.

| Segment | Sub-Segments |

|---|---|

| By Type | Firewall Solutions Intrusion Detection Systems (IDS) Intrusion Prevention Systems (IPS) Antivirus Software VPN Solutions Endpoint Security Network Access Control Data Loss Prevention (DLP) Unified Threat Management (UTM) Others |

| By End-User | Small and Medium Enterprises Large Enterprises Government Agencies Educational Institutions Healthcare Organizations Financial Services IT and Telecommunications Others |

| By Component | Hardware Software Services |

| By Deployment Mode | On-Premises Cloud-Based |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Industry Vertical | IT and Telecommunications Retail Manufacturing Energy and Utilities Transportation and Logistics Healthcare Financial Services Government Others |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Network Security Solutions | 120 | IT Security Managers, Chief Information Officers |

| Cloud Security Services | 80 | Cloud Architects, Security Compliance Officers |

| Endpoint Security Management | 60 | Endpoint Security Analysts, IT Administrators |

| Threat Intelligence Platforms | 50 | Threat Analysts, Cybersecurity Researchers |

| Network Monitoring Solutions | 70 | Network Engineers, Security Operations Center Managers |

The US Network Security Market is valued at approximately USD 5 billion, driven by increasing cyber threats, the rise of remote work, and the need for compliance with data protection regulations. This market is expected to grow significantly as organizations invest in advanced security solutions.