Region:Asia

Author(s):Rebecca

Product Code:KRAD2854

Pages:85

Published On:November 2025

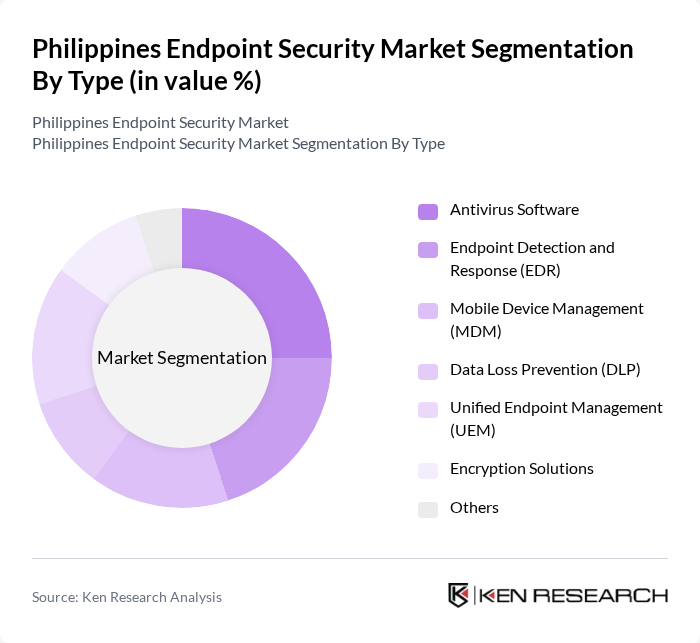

By Type:The segmentation by type includes various solutions that cater to different security needs. The subsegments are Antivirus Software, Endpoint Detection and Response (EDR), Mobile Device Management (MDM), Data Loss Prevention (DLP), Unified Endpoint Management (UEM), Encryption Solutions, and Others. Each of these solutions plays a crucial role in protecting endpoints from cyber threats, with specific functionalities tailored to different organizational requirements. Antivirus Software remains widely adopted for baseline protection, while EDR and UEM are increasingly favored for their advanced detection, response, and centralized management capabilities, reflecting the market’s shift toward integrated and AI-driven security platforms .

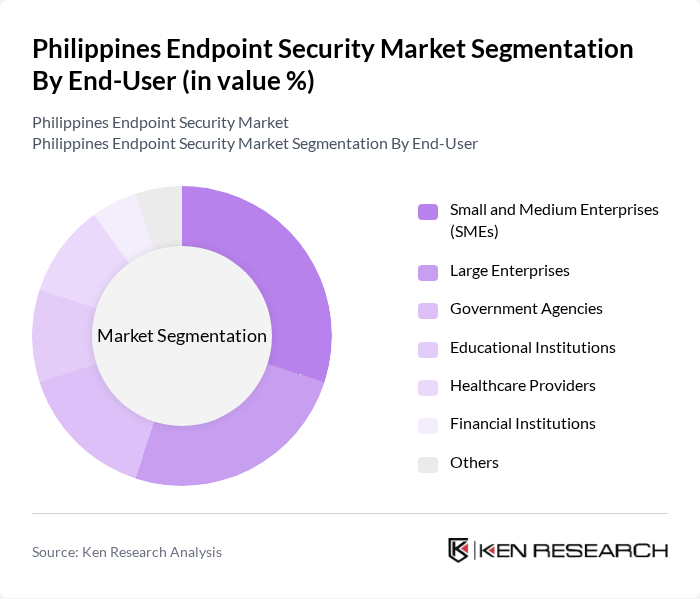

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, Educational Institutions, Healthcare Providers, Financial Institutions, and Others. Each end-user category has distinct security needs, with SMEs increasingly adopting endpoint security solutions to protect their limited resources, while large enterprises focus on comprehensive security frameworks to safeguard vast amounts of data. Government agencies and financial institutions are also significant adopters due to strict compliance requirements and the critical nature of their data operations .

The Philippines Endpoint Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trend Micro Philippines, Inc., Fortinet, Inc., McAfee Corp., Broadcom Inc. (Symantec Enterprise Division), Kaspersky Lab, Palo Alto Networks, Inc., Sophos Ltd., Check Point Software Technologies Ltd., CrowdStrike Holdings, Inc., Bitdefender LLC, ESET, spol. s r.o., Webroot Inc. (OpenText), Avast Software s.r.o. (Gen Digital Inc.), Cisco Systems, Inc., Microsoft Corporation, F5, Inc., IBM Philippines, Inc., RSA Security LLC, AhnLab, Inc., Cybersecurity Philippines CERT™ contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines endpoint security market is poised for significant growth as organizations increasingly recognize the importance of robust cybersecurity measures. With the rise of sophisticated cyber threats and the ongoing digital transformation, businesses are expected to invest more in advanced security solutions. The integration of artificial intelligence and machine learning into security frameworks will enhance threat detection capabilities. Additionally, the focus on compliance with data privacy regulations will drive further investments, ensuring that organizations remain resilient against emerging cyber risks while protecting sensitive information.

| Segment | Sub-Segments |

|---|---|

| By Type | Antivirus Software Endpoint Detection and Response (EDR) Mobile Device Management (MDM) Data Loss Prevention (DLP) Unified Endpoint Management (UEM) Encryption Solutions Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Educational Institutions Healthcare Providers Financial Institutions Others |

| By Industry Vertical | Financial Services Healthcare Retail Manufacturing Government & Public Sector IT & Telecom Education Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Region | Luzon Visayas Mindanao |

| By Security Type | Network Security Application Security Endpoint Security Cloud Security Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Endpoint Security | 45 | IT Security Managers, Compliance Officers |

| Healthcare Sector Cybersecurity | 40 | Chief Information Officers, IT Administrators |

| Retail Industry Security Solutions | 35 | IT Directors, Operations Managers |

| Government Agency Cyber Defense | 30 | Cybersecurity Analysts, Risk Management Officers |

| Education Sector IT Security | 25 | Network Administrators, IT Support Managers |

The Philippines Endpoint Security Market is valued at approximately USD 1.3 billion, driven by the increasing digital transformation of businesses, the expansion of cloud and IoT environments, and the rising frequency of cyber threats.