Region:Global

Author(s):Rebecca

Product Code:KRAC0306

Pages:81

Published On:August 2025

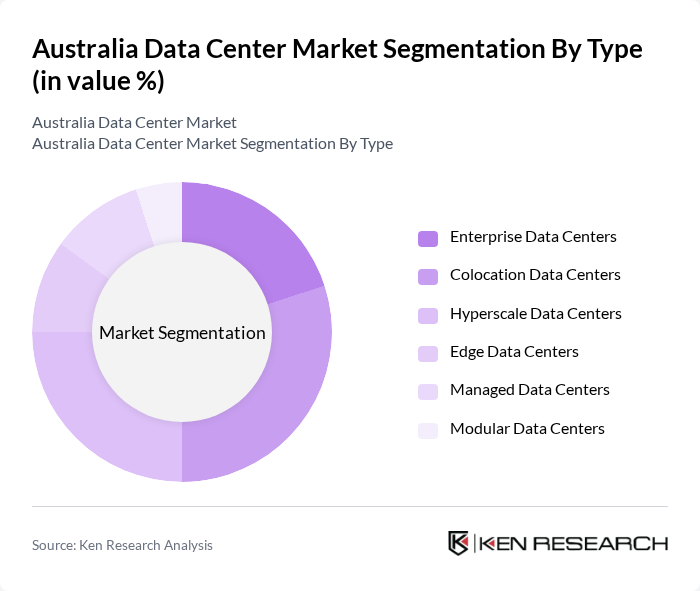

By Type:The market is segmented into various types of data centers, including Enterprise Data Centers, Colocation Data Centers, Hyperscale Data Centers, Edge Data Centers, Managed Data Centers, and Modular Data Centers. Each type serves different business needs, with colocation and hyperscale data centers gaining significant traction due to the increasing demand for scalable, flexible, and energy-efficient solutions. The rise of edge data centers is also notable, supporting low-latency applications and distributed computing for IoT and AI workloads .

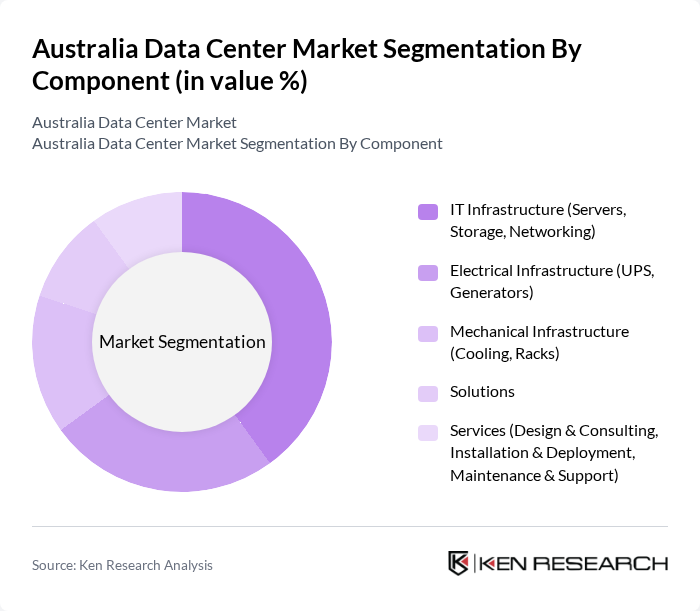

By Component:The market is also segmented by components, which include IT Infrastructure (Servers, Storage, Networking), Electrical Infrastructure (UPS, Generators), Mechanical Infrastructure (Cooling, Racks), Solutions, and Services (Design & Consulting, Installation & Deployment, Maintenance & Support). The IT Infrastructure segment is particularly crucial as it forms the backbone of data center operations. Recent trends highlight increased investment in energy-efficient cooling and backup power systems, as well as advanced networking solutions to support high-density workloads and hybrid cloud environments .

The Australia Data Center Market is characterized by a dynamic mix of regional and international players. Leading participants such as NEXTDC Limited, Equinix, Inc., Digital Realty Trust, Inc., Macquarie Data Centres, Vocus Group Limited, Australian Data Centres, TPG Telecom Limited, Telstra Corporation Limited, Optus Networks Pty Limited, Canberra Data Centres, AirTrunk Operating Pty Ltd, Global Switch Holdings Limited, DCI Data Centers, STACK Infrastructure, Keppel Data Centres, Amazon Web Services, Inc. (AWS), Microsoft Corporation, Google LLC, Alibaba Cloud, NTT Communications Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia data center market appears promising, driven by technological advancements and increasing digitalization across sectors. The rise of edge computing is expected to enhance data processing capabilities closer to end-users, reducing latency and improving service delivery. Additionally, the ongoing development of 5G infrastructure will facilitate faster data transmission, further boosting demand for data center services. As businesses continue to prioritize digital transformation, the market is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Enterprise Data Centers Colocation Data Centers Hyperscale Data Centers Edge Data Centers Managed Data Centers Modular Data Centers |

| By Component | IT Infrastructure (Servers, Storage, Networking) Electrical Infrastructure (UPS, Generators) Mechanical Infrastructure (Cooling, Racks) Solutions Services (Design & Consulting, Installation & Deployment, Maintenance & Support) |

| By End-User | IT and Telecommunications BFSI Government Healthcare Energy and Utilities Retail & E-commerce Others |

| By Application | Cloud Computing Big Data Analytics Disaster Recovery Content Delivery AI & Machine Learning Workloads Others |

| By Investment Source | Private Investments Public Funding Foreign Direct Investment (FDI) Government Grants |

| By Location | Urban Areas Suburban Areas Rural Areas Others |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Colocation Services | 100 | Data Center Managers, IT Infrastructure Directors |

| Hyperscale Data Centers | 80 | Cloud Service Providers, Operations Managers |

| Edge Computing Solutions | 50 | Network Engineers, IT Strategists |

| Data Center Energy Efficiency | 60 | Facility Managers, Sustainability Officers |

| Disaster Recovery Services | 40 | Risk Management Officers, IT Security Managers |

The Australia Data Center Market is valued at approximately USD 6.8 billion, reflecting significant growth driven by increasing demand for cloud services, data storage, and digital transformation initiatives across various sectors.