Region:Global

Author(s):Geetanshi

Product Code:KRAB4033

Pages:83

Published On:October 2025

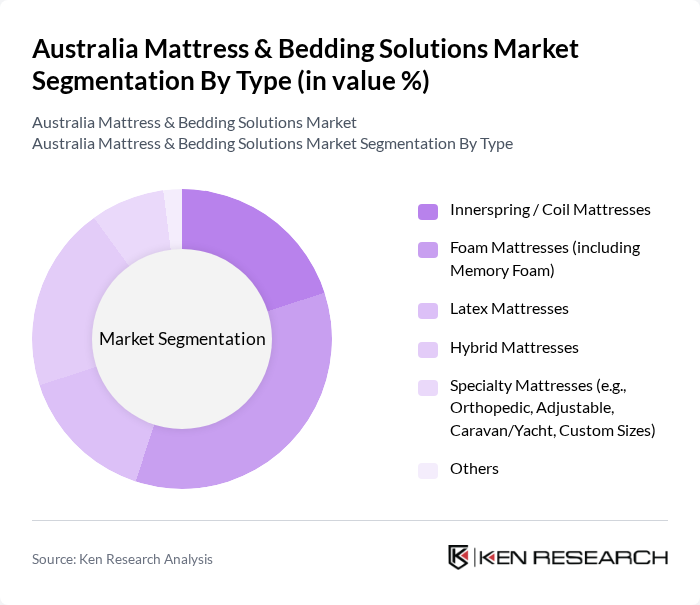

By Type:The market is segmented into various types of mattresses, including Innerspring / Coil Mattresses, Foam Mattresses (including Memory Foam), Latex Mattresses, Hybrid Mattresses, Specialty Mattresses (e.g., Orthopedic, Adjustable, Caravan/Yacht, Custom Sizes), and Others. Among these, Foam Mattresses, particularly memory foam variants, have gained significant popularity due to their comfort and support features. The trend towards personalized sleep solutions has also led to an increase in demand for Specialty Mattresses, catering to specific health needs.

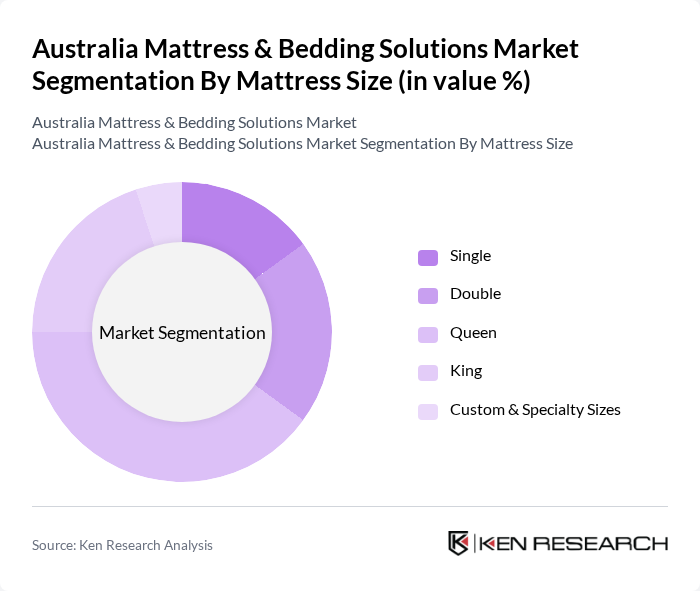

By Mattress Size:The mattress size segmentation includes Single, Double, Queen, King, and Custom & Specialty Sizes. The Queen size mattresses dominate the market due to their balance of space and comfort, making them a popular choice for couples and individuals seeking more sleeping area. Additionally, the trend towards larger beds in modern homes has contributed to the increasing demand for King size mattresses.

The Australia Mattress & Bedding Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International, Inc., Sleep Number Corporation, Serta Simmons Bedding, LLC, King Koil, Sealy Australia, Ecosa, Koala, Emma Sleep, Zinus, Inc., Snooze, IKEA, Forty Winks, Bambi Enterprises, SleepMaker (part of Comfort Group), A.H. Beard contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia mattress and bedding solutions market appears promising, driven by evolving consumer preferences and technological advancements. As more Australians prioritize sleep health, the demand for innovative products, such as smart mattresses integrated with sleep technology, is expected to rise. Additionally, the trend towards eco-friendly materials will likely shape product development, encouraging brands to adopt sustainable practices. This evolving landscape presents opportunities for growth and differentiation in a competitive market.

| Segment | Sub-Segments |

|---|---|

| By Type | Innerspring / Coil Mattresses Foam Mattresses (including Memory Foam) Latex Mattresses Hybrid Mattresses Specialty Mattresses (e.g., Orthopedic, Adjustable, Caravan/Yacht, Custom Sizes) Others |

| By Mattress Size | Single Double Queen King Custom & Specialty Sizes |

| By End-User | Residential Commercial Hospitality Healthcare Others |

| By Distribution Channel | Online Retail Offline Retail (Specialty Mattress Stores, Mass Merchandisers) Direct Sales Wholesale/B2B/Project Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Material | Foam (including Memory Foam, Plant-Based Foam) Latex (Natural & Synthetic) Fabric/Textiles (including Organic Cotton, Bamboo, Wool) Metal (Springs/Coils) Others |

| By Brand Positioning | Luxury Brands Mid-Tier Brands Budget Brands Others |

| By Customer Segment | First-Time Buyers Repeat Customers Corporate Clients Institutional Buyers (e.g., Hotels, Hospitals, Student Housing) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Mattress Sales | 80 | Store Managers, Sales Representatives |

| Bedding Manufacturing Insights | 60 | Production Managers, Quality Control Supervisors |

| Consumer Preferences in Bedding | 120 | Homeowners, Renters, Interior Designers |

| Online Mattress Retail Trends | 70 | E-commerce Managers, Digital Marketing Specialists |

| Market Trends in Sustainable Bedding | 40 | Sustainability Officers, Product Development Managers |

The Australia Mattress & Bedding Solutions Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increased consumer awareness of sleep health and rising disposable incomes, which encourage spending on quality bedding products.