Poland Mattress & Bedding Solutions Market Overview

- The Poland Mattress & Bedding Solutions Market is valued at USD 530 million, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness regarding sleep health, rising disposable incomes, and a growing trend towards home improvement and interior design. The demand for high-quality bedding solutions has surged as consumers prioritize comfort and wellness in their purchasing decisions. Recent trends also highlight the adoption of innovative materials such as memory foam and hybrid designs, as well as the integration of smart technologies and sustainable materials in mattress production.

- Key cities such as Warsaw, Kraków, and Wroc?aw dominate the market due to their large populations and urbanization trends. These cities are experiencing significant growth in the real estate sector, leading to increased demand for mattresses and bedding solutions in both residential and commercial spaces. The concentration of retail outlets and e-commerce platforms in these urban areas further enhances market accessibility.

- In 2023, the Polish government implemented the Regulation of the Minister of Development and Technology on the requirements for mattresses and other bedding products, issued under the Act on General Product Safety. This regulation mandates that all mattresses sold in Poland must comply with strict safety standards, including certification for materials to ensure they are free from harmful substances such as formaldehyde and certain flame retardants. Manufacturers and importers are required to provide conformity assessments and technical documentation, and non-compliant products are subject to market withdrawal. This initiative is part of a broader effort to promote consumer safety and environmental sustainability within the industry.

Poland Mattress & Bedding Solutions Market Segmentation

By Type:The market is segmented into various types of mattresses, including Innerspring Mattresses, Memory Foam Mattresses, Latex Mattresses, Hybrid Mattresses, Adjustable Mattresses, Specialty Mattresses, and Others. Among these, Memory Foam Mattresses are currently leading the market due to their popularity for providing superior comfort and support. Consumers are increasingly opting for these mattresses as they conform to body shapes, offering pressure relief and promoting better sleep quality. Hybrid and latex mattresses are also gaining traction, driven by consumer demand for durability and eco-friendly options. Innovations such as cooling gel infusions, zoned support, and modular designs are further differentiating product offerings in the market.

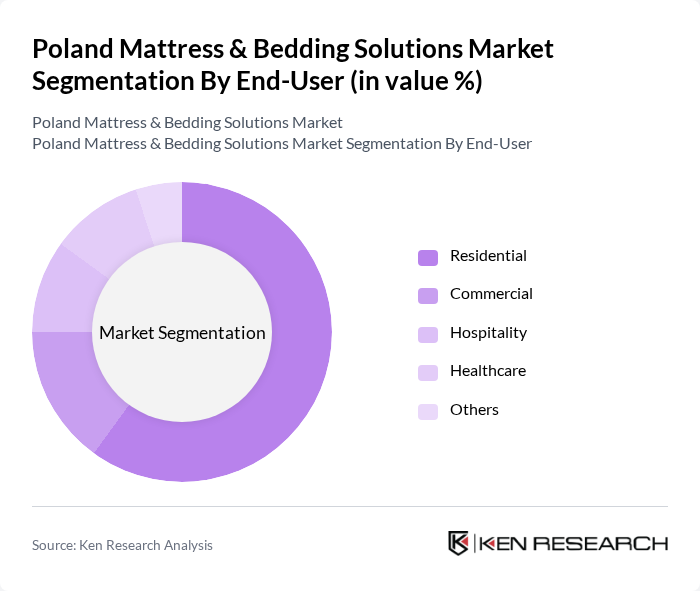

By End-User:The market is segmented by end-users into Residential, Commercial, Hospitality, Healthcare, and Others. The Residential segment dominates the market, driven by the increasing number of households and the growing trend of home renovations. Consumers are investing in quality sleep solutions, leading to a surge in demand for mattresses in residential settings. The focus on comfort and health has made this segment a priority for manufacturers and retailers alike. The commercial segment, including hospitality and healthcare, is also expanding as these sectors seek ergonomic and hygienic bedding solutions to meet elevated standards.

Poland Mattress & Bedding Solutions Market Competitive Landscape

The Poland Mattress & Bedding Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International, Inc., IKEA, Hilding Anders, Serta Simmons Bedding, LLC, Sleep Number Corporation, Magniflex, Materasso, Ko?o, Meble Wójcik, D?bowe Wzgórze, Meble Vox, JYSK, Alvi, Sleepmed, Emma Mattress, Zinus, Inc., DORMEO contribute to innovation, geographic expansion, and service delivery in this space.

Poland Mattress & Bedding Solutions Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness about Sleep Health:The growing recognition of sleep's impact on overall health is driving demand for quality mattresses. In Poland, approximately 60% of adults report sleep issues, prompting a shift towards products that enhance sleep quality. The health and wellness market in Poland is projected to reach €6.1 billion, indicating a strong consumer focus on sleep health. This trend is encouraging manufacturers to innovate and market sleep-enhancing products effectively.

- Rising Disposable Income:Poland's GDP per capita is expected to rise to €19,000 in purchasing power parity terms, reflecting a growing middle class with increased purchasing power. This economic growth is leading to higher disposable incomes, allowing consumers to invest in premium bedding solutions. As disposable income rises, the demand for high-quality mattresses and bedding products is anticipated to increase, with consumers willing to spend more on comfort and durability.

- Growth in the E-commerce Sector:The e-commerce market in Poland is projected to reach €20 billion, driven by increased internet penetration and consumer preference for online shopping. This shift is particularly significant in the mattress sector, where online sales are expected to account for 30% of total sales. The convenience of online shopping, coupled with competitive pricing and home delivery options, is enhancing consumer access to a wider range of mattress products.

Market Challenges

- Intense Competition among Local and International Brands:The Polish mattress market is characterized by fierce competition, with over 200 brands vying for market share. This saturation leads to price wars, which can erode profit margins. Local brands are increasingly challenged by international players who offer innovative products and aggressive marketing strategies. As a result, companies must differentiate themselves through quality, branding, and customer service to maintain market presence.

- Fluctuating Raw Material Prices:The mattress manufacturing industry is heavily reliant on raw materials such as foam, fabric, and springs, which are subject to price volatility. Recently, the price of polyurethane foam increased by 15% due to supply chain disruptions and rising oil prices. Such fluctuations can significantly impact production costs, forcing manufacturers to either absorb costs or pass them onto consumers, potentially affecting sales and profitability.

Poland Mattress & Bedding Solutions Market Future Outlook

The Poland mattress and bedding solutions market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, manufacturers are likely to focus on developing innovative products that cater to sleep health. Additionally, the integration of smart technology into mattresses is expected to gain traction, enhancing user experience. The market will also see a shift towards sustainable practices, aligning with consumer demand for eco-friendly products, which will shape future product offerings and marketing strategies.

Market Opportunities

- Expansion of Online Retail Channels:With the e-commerce sector booming, there is a significant opportunity for mattress brands to enhance their online presence. By investing in digital marketing and user-friendly websites, companies can reach a broader audience. This shift not only increases sales potential but also allows for better customer engagement and feedback, fostering brand loyalty and repeat purchases.

- Introduction of Smart Mattresses:The demand for smart mattresses, equipped with sleep tracking and temperature control features, is on the rise. As technology becomes more integrated into daily life, consumers are increasingly interested in products that enhance their sleep experience. This presents a lucrative opportunity for manufacturers to innovate and capture a segment of tech-savvy consumers looking for advanced bedding solutions.