Australia Online Grocery and Quick Commerce Market Overview

- The Australia Online Grocery and Quick Commerce Market is valued at USD 5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital platforms for grocery shopping, coupled with changing consumer preferences towards convenience and time-saving solutions. The rise in smartphone penetration and improved internet connectivity have further accelerated the shift towards online grocery shopping.

- Key cities dominating this market include Sydney, Melbourne, and Brisbane. These urban centers benefit from a high population density, diverse demographics, and a strong infrastructure that supports efficient logistics and delivery systems. The concentration of tech-savvy consumers in these cities also drives demand for online grocery services, making them pivotal in the market landscape.

- In 2023, the Australian government implemented regulations to enhance food safety standards in online grocery sales. This includes mandatory compliance with the Food Standards Australia New Zealand (FSANZ) guidelines, ensuring that all online grocery retailers adhere to strict hygiene and safety protocols. Such regulations aim to protect consumers and maintain the integrity of food products sold online.

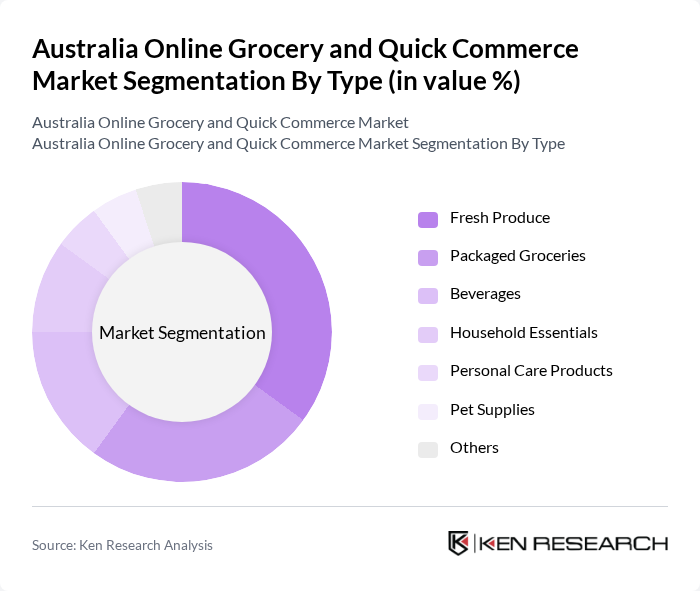

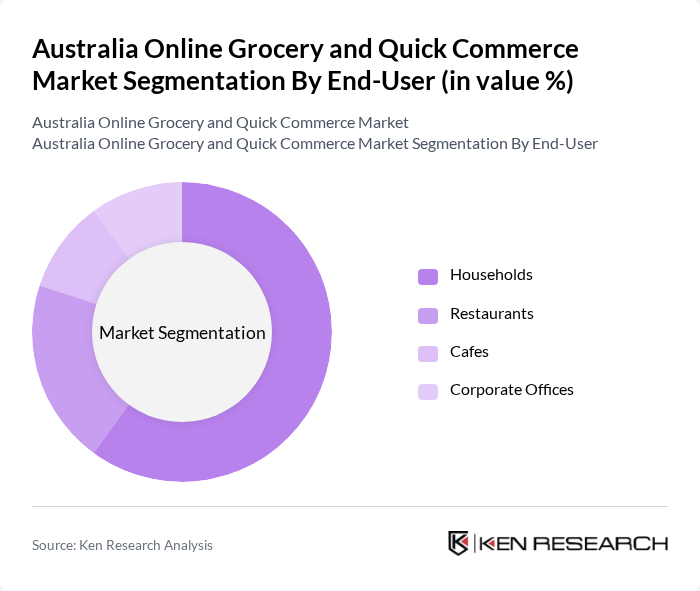

Australia Online Grocery and Quick Commerce Market Segmentation

By Type:The market is segmented into various types, including Fresh Produce, Packaged Groceries, Beverages, Household Essentials, Personal Care Products, Pet Supplies, and Others. Among these, Fresh Produce is currently the leading sub-segment, driven by the increasing consumer preference for fresh and organic food options. The demand for healthy eating habits has surged, leading to a significant rise in online purchases of fruits, vegetables, and other perishable goods.

By End-User:The end-user segmentation includes Households, Restaurants, Cafes, and Corporate Offices. Households represent the largest segment, as the convenience of online grocery shopping appeals to busy families and individuals. The trend of cooking at home has gained momentum, especially post-pandemic, leading to increased online grocery orders from households seeking to stock up on essentials.

Australia Online Grocery and Quick Commerce Market Competitive Landscape

The Australia Online Grocery and Quick Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Woolworths Group Limited, Coles Group Limited, Aldi Stores Australia, IGA (Independent Grocers of Australia), Amazon Australia, HelloFresh SE, Menulog, Uber Eats, DoorDash, Harris Farm Markets, Costco Wholesale Australia, Foodora, FreshDirect, Sendle, Youfoodz contribute to innovation, geographic expansion, and service delivery in this space.

Australia Online Grocery and Quick Commerce Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Convenience:The Australian online grocery market is experiencing a surge in consumer demand for convenience, with 60% of Australians preferring online shopping for groceries. This shift is driven by busy lifestyles, with 45% of consumers indicating they value time-saving solutions. The convenience factor is further supported by the Australian Bureau of Statistics reporting a 15% increase in online retail sales in the future, highlighting a growing trend towards digital shopping platforms.

- Rise of Mobile Shopping:Mobile shopping is rapidly transforming the Australian grocery landscape, with 50% of online grocery purchases made via mobile devices in the future. The Australian Communications and Media Authority reported that 85% of Australians own smartphones, facilitating easy access to grocery apps. This trend is expected to continue, as mobile commerce is projected to account for 30% of total e-commerce sales in the future, further driving the online grocery market's growth.

- Expansion of Delivery Services:The expansion of delivery services is a significant growth driver in the Australian online grocery market. In the future, the number of grocery delivery services is expected to increase by 25%, with major players like Coles and Woolworths enhancing their logistics capabilities. According to IBISWorld, the grocery delivery segment is expected to generate $1.5 billion in revenue in the future, reflecting the increasing consumer preference for home delivery options and the convenience they provide.

Market Challenges

- Intense Competition:The Australian online grocery market faces intense competition, with over 50 players vying for market share. Major retailers like Coles and Woolworths dominate, but new entrants are emerging, increasing pressure on pricing and service quality. According to MarketLine, the competitive landscape is expected to intensify, with smaller players capturing 20% of the market in the future, challenging established brands to innovate and differentiate their offerings.

- Supply Chain Disruptions:Supply chain disruptions pose a significant challenge to the online grocery sector in Australia. The COVID-19 pandemic highlighted vulnerabilities, with 40% of retailers reporting delays in product availability in the future. The Australian Logistics Council noted that logistics costs have risen by 10% due to increased demand and supply chain inefficiencies. These disruptions can lead to stock shortages, impacting customer satisfaction and overall market growth.

Australia Online Grocery and Quick Commerce Market Future Outlook

The future of the Australian online grocery and quick commerce market appears promising, driven by technological advancements and evolving consumer preferences. As more Australians embrace digital shopping, the integration of AI and machine learning will enhance personalized shopping experiences. Additionally, sustainability initiatives are expected to gain traction, with consumers increasingly favoring eco-friendly practices. The market is likely to see further innovations in delivery methods, including drone deliveries, which could revolutionize the logistics landscape in the future.

Market Opportunities

- Growth of Subscription Services:Subscription services present a lucrative opportunity in the Australian online grocery market. With 30% of consumers expressing interest in subscription models for regular grocery deliveries, companies can capitalize on this trend. This model not only ensures customer loyalty but also stabilizes revenue streams, making it an attractive option for retailers looking to enhance their market presence.

- Expansion into Rural Areas:Expanding into rural areas offers significant growth potential for online grocery retailers. Approximately 25% of Australians living in rural regions have limited access to grocery stores, creating a demand for online solutions. By targeting these underserved markets, companies can tap into a new customer base, driving sales and enhancing service accessibility across the country.