Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA8045

Pages:93

Published On:September 2025

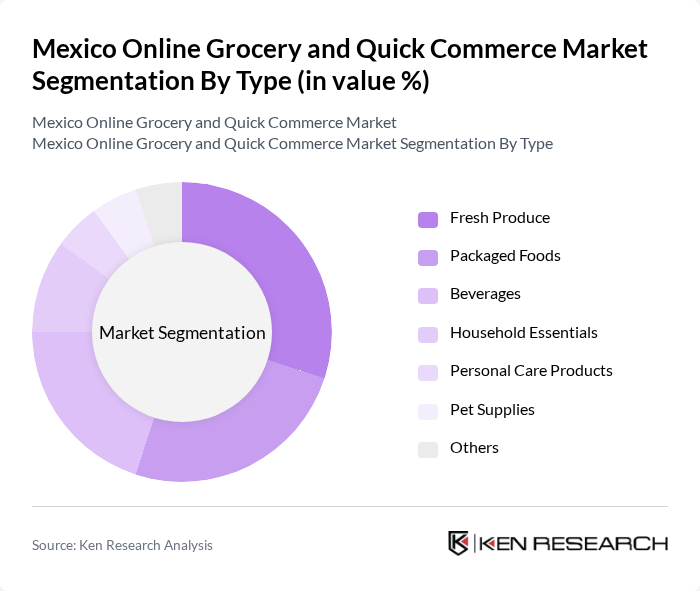

By Type:The market is segmented into various types, including Fresh Produce, Packaged Foods, Beverages, Household Essentials, Personal Care Products, Pet Supplies, and Others. Among these, Fresh Produce is gaining traction due to the increasing consumer preference for healthy eating and organic products. Packaged Foods also hold a significant share as they offer convenience and longer shelf life, appealing to busy consumers. The demand for Beverages, particularly non-alcoholic drinks, is also on the rise, driven by health-conscious choices.

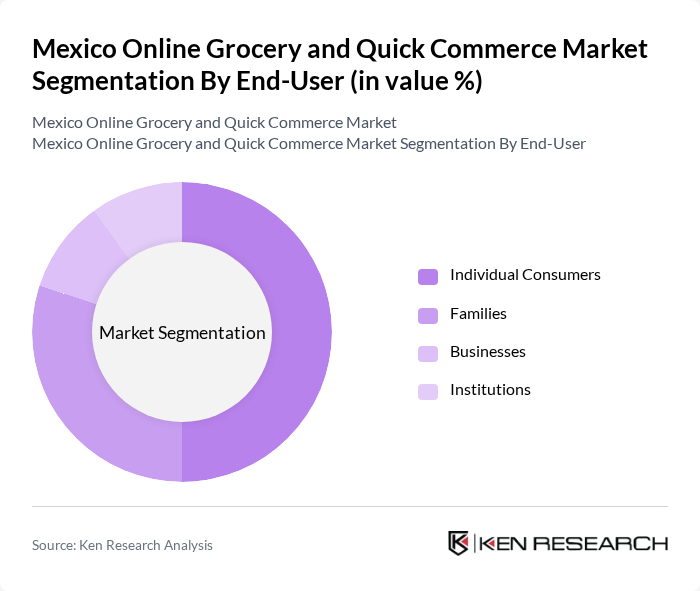

By End-User:The end-user segmentation includes Individual Consumers, Families, Businesses, and Institutions. Individual Consumers dominate the market as they increasingly turn to online platforms for convenience and time savings. Families also represent a significant segment, often purchasing in bulk to meet household needs. Businesses and Institutions are emerging segments, leveraging online grocery services for operational efficiency and cost savings.

The Mexico Online Grocery and Quick Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Walmart de Mexico y Centroamerica, Grupo Bodega Aurrera, Amazon Mexico, Mercado Libre, Chedraui, Superama, Rappi, Cornershop, Jüsto, 7-Eleven Mexico, OXXO, Farmacias similares, La Comer, Tienda de Abarrotes, Domicilios.com contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online grocery and quick commerce market in Mexico appears promising, driven by technological advancements and changing consumer preferences. As more consumers embrace digital shopping, companies are likely to invest in enhancing user experiences through personalized services and improved logistics. Additionally, the integration of AI and data analytics will streamline operations, making it easier to meet consumer demands. This evolving landscape presents significant opportunities for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Produce Packaged Foods Beverages Household Essentials Personal Care Products Pet Supplies Others |

| By End-User | Individual Consumers Families Businesses Institutions |

| By Sales Channel | Direct-to-Consumer Third-Party Platforms Subscription Services Others |

| By Distribution Mode | Home Delivery Click and Collect Same-Day Delivery Scheduled Delivery |

| By Price Range | Budget Mid-Range Premium |

| By Consumer Demographics | Age Group Income Level Urban vs Rural |

| By Product Origin | Local Products Imported Products Organic Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Grocery Consumers | 150 | Frequent online shoppers, age 18-45 |

| Logistics Providers | 100 | Operations Managers, Delivery Coordinators |

| Retail Executives | 80 | CEOs, Marketing Directors of grocery chains |

| Market Analysts | 60 | Industry Analysts, Research Consultants |

| Consumer Behavior Experts | 50 | Behavioral Scientists, Marketing Researchers |

The Mexico Online Grocery and Quick Commerce Market is valued at approximately USD 5 billion, reflecting significant growth driven by digital payment adoption, mobile commerce, and changing consumer preferences for convenience, especially accelerated by the pandemic.