Region:Global

Author(s):Geetanshi

Product Code:KRAB5831

Pages:91

Published On:October 2025

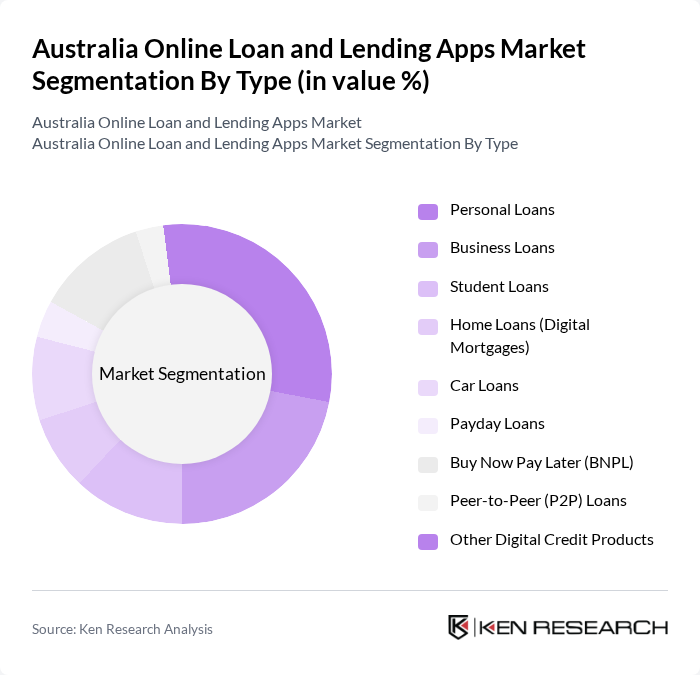

By Type:The market is segmented into various types of loans, including personal loans, business loans, student loans, home loans (digital mortgages), car loans, payday loans, buy now pay later (BNPL), peer-to-peer (P2P) loans, and other digital credit products. Each type serves different consumer needs and preferences, contributing to the overall market dynamics. Personal loans remain the most popular, followed by business loans and BNPL, reflecting consumer demand for flexible and fast credit solutions .

The personal loans segment is currently dominating the market due to its versatility and appeal to a wide range of consumers. Individuals often seek personal loans for purposes such as debt consolidation, home improvements, and unexpected expenses. The ease of application and rapid approval processes offered by online platforms further enhance their attractiveness. The increasing trend of financial literacy and digital adoption among consumers has led to greater understanding and uptake of personal finance products .

By End-User:The market is segmented by end-users, including individuals (salaried and self-employed), small and medium enterprises (SMEs), corporates, students, and non-profit organizations. Each segment has unique borrowing needs and preferences, influencing the types of loans they seek. Individuals, especially those in urban areas, are the primary users of online lending platforms, followed by SMEs seeking fast and flexible funding solutions .

The individuals segment, particularly salaried and self-employed borrowers, is the largest in the market. This is largely due to the increasing number of people seeking personal loans for purposes such as home renovations, travel, and debt consolidation. The convenience of online applications and the ability to compare different loan options have made personal loans a popular choice. The rise of the gig economy has also led to more self-employed individuals seeking flexible loan options to manage their finances .

The Australia Online Loan and Lending Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Afterpay Limited, Zip Co Limited, Prospa Group Limited, MoneyMe Limited, SocietyOne, Wisr Limited, Harmoney Corp Limited, Cash Converters International Limited, Credit Union Australia (Great Southern Bank), ANZ Banking Group, Commonwealth Bank of Australia, Westpac Banking Corporation, National Australia Bank, Bendigo and Adelaide Bank, Suncorp Group, Latitude Financial Services, Plenti Group Limited, Nimble Australia, Pepper Money Limited, Brighte Capital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online loan and lending apps market in Australia appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy increases, more Australians are likely to embrace mobile-first lending solutions. Additionally, the integration of artificial intelligence in credit scoring is expected to enhance the accuracy of loan assessments, making lending more inclusive. These trends indicate a shift towards more personalized and efficient lending experiences, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Home Loans (Digital Mortgages) Car Loans Payday Loans Buy Now Pay Later (BNPL) Peer-to-Peer (P2P) Loans Other Digital Credit Products |

| By End-User | Individuals (Salaried, Self-Employed) Small and Medium Enterprises (SMEs) Corporates Students Non-Profit Organizations |

| By Loan Amount | Micro Loans (? AUD 5,000) Small Loans (AUD 5,001–20,000) Medium Loans (AUD 20,001–100,000) Large Loans (> AUD 100,000) |

| By Loan Duration | Short-Term Loans (? 1 year) Medium-Term Loans (1–5 years) Long-Term Loans (> 5 years) |

| By Application | Emergency Funding Business Expansion Education Financing Home Improvement Vehicle Purchase Debt Consolidation |

| By Distribution Channel | Mobile Apps Websites Third-Party Platforms/Aggregators |

| By Customer Segment | First-Time Borrowers Repeat Borrowers High-Risk Borrowers Low-Risk Borrowers Millennials/Gen Z Seniors |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Users | 100 | Individuals aged 25-45, employed, with prior loan experience |

| Small Business Loan Applicants | 60 | Small business owners, entrepreneurs seeking funding |

| Payday Loan Users | 40 | Individuals in urgent financial need, typically aged 18-35 |

| Fintech Industry Experts | 40 | Financial analysts, fintech consultants, and market researchers |

| Regulatory Stakeholders | 40 | Policy makers, compliance officers, and legal advisors in finance |

The Australia Online Loan and Lending Apps Market is valued at approximately AUD 6.3 billion, driven by the rapid adoption of digital financial services and increasing consumer demand for quick and accessible loan options.