France Online Loan and Lending Apps Market Overview

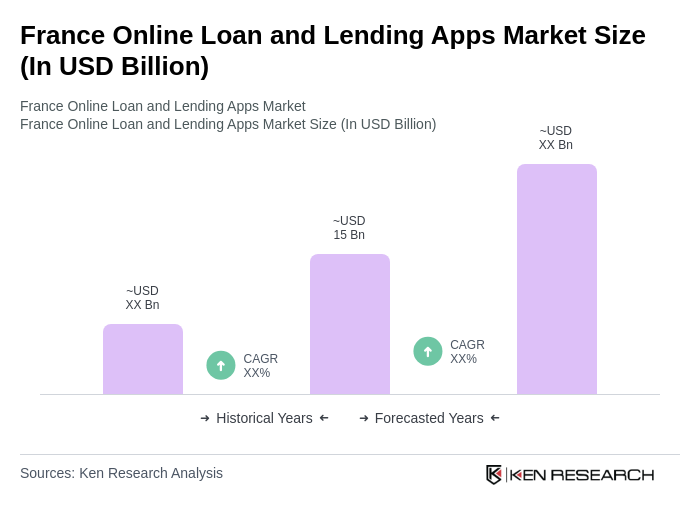

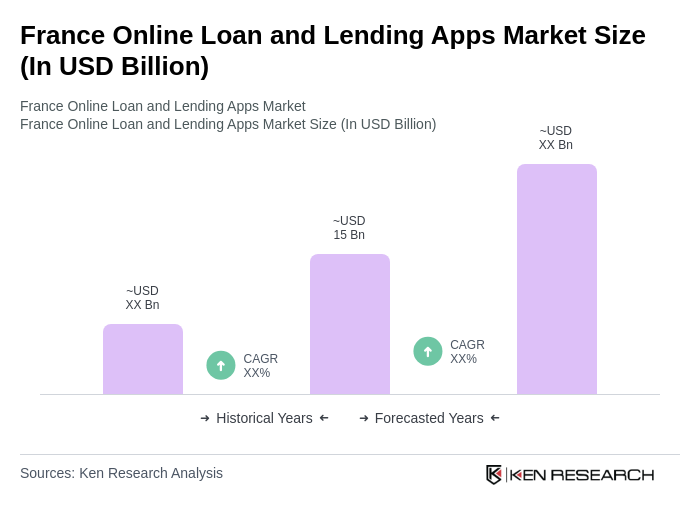

- The France Online Loan and Lending Apps Market is valued at approximately USD 15 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital financial services, a rise in consumer demand for quick and accessible loan options, and the proliferation of mobile technology that facilitates seamless transactions. Additional growth drivers include the expansion of fintech startups, enhanced user experience through artificial intelligence, and the integration of open banking APIs, which streamline loan approvals and disbursements .

- Key cities such as Paris, Lyon, and Marseille dominate the market due to their high population density, economic activity, and the presence of numerous fintech companies. These urban centers are hubs for innovation and technology, attracting both consumers and investors, which further fuels the growth of online lending platforms .

- In 2023, the French government implemented regulations requiring all online lending platforms to adhere to strict transparency standards, ensuring that borrowers are fully informed about loan terms and conditions. The principal binding instrument is the “Arrêté du 30 septembre 2023 relatif à la transparence des plateformes de prêt en ligne,” issued by the Ministère de l’Économie, des Finances et de la Souveraineté industrielle et numérique. This regulation mandates clear disclosure of interest rates, fees, total cost of credit, and borrower rights, with compliance audits and penalties for non-conformance.

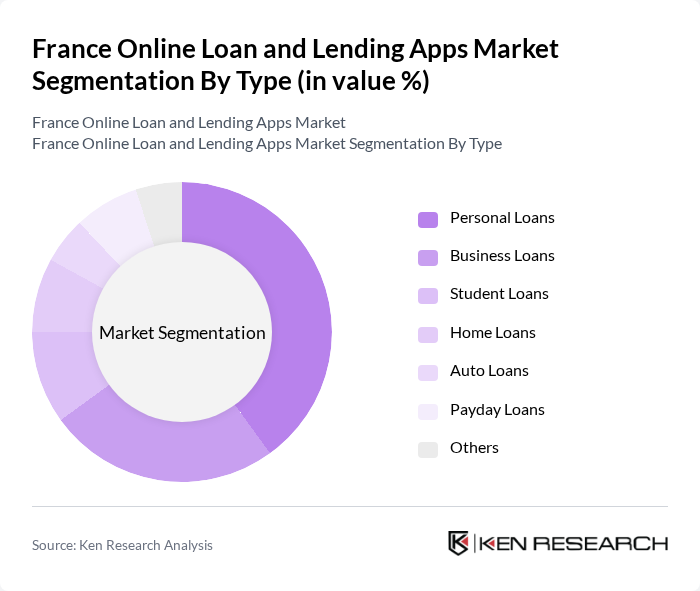

France Online Loan and Lending Apps Market Segmentation

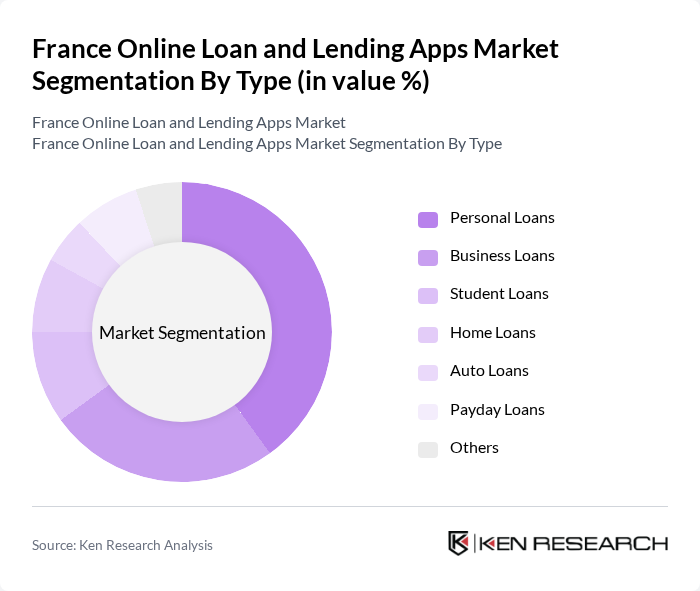

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Student Loans, Home Loans, Auto Loans, Payday Loans, and Others. Personal Loans are currently the most dominant segment, driven by consumer preferences for unsecured borrowing options that offer flexibility in usage. Business Loans are also significant, as SMEs increasingly seek funding for expansion and operational needs. The market is further characterized by the growing popularity of short-term and micro-loans, reflecting evolving consumer borrowing habits .

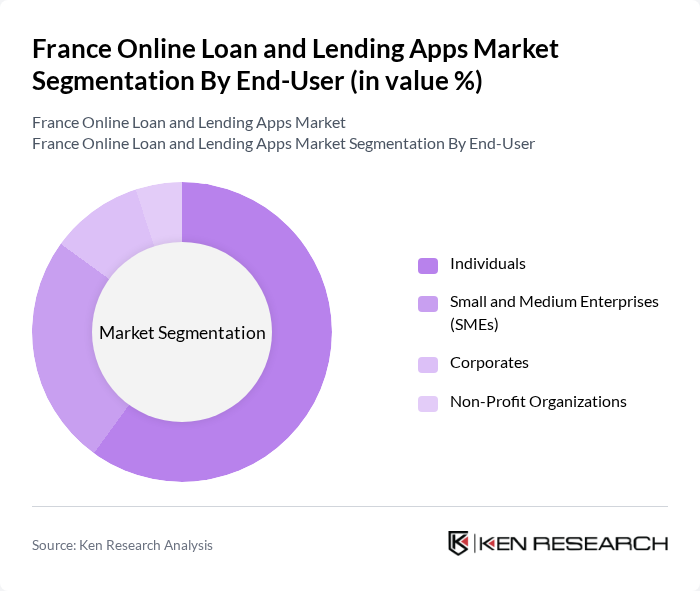

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Corporates, and Non-Profit Organizations. Individuals represent the largest segment, as personal financial needs drive the demand for loans. SMEs are also a significant user group, seeking funding for growth and operational expenses, while Corporates and Non-Profit Organizations utilize loans for specific projects and initiatives. The trend toward digital onboarding and faster credit assessment processes is especially pronounced among individual and SME borrowers .

France Online Loan and Lending Apps Market Competitive Landscape

The France Online Loan and Lending Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Younited Credit, Lendix, Prêt d'Union, Cashper, Franfinance, Cetelem, Sofinco, Banque Casino, Hello Bank!, Boursorama Banque, N26, Revolut, Lydia, Anytime, October, BNP Paribas, Société Générale, Crédit Agricole, Finfrog contribute to innovation, geographic expansion, and service delivery in this space .

France Online Loan and Lending Apps Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:As of future, France boasts a smartphone penetration rate of approximately88%, translating to around58 million users. This widespread adoption facilitates access to online loan and lending apps, enabling consumers to apply for loans conveniently. The growing reliance on mobile technology is further evidenced by a20% increase in mobile banking app usage, indicating a shift towards digital financial solutions that cater to the needs of tech-savvy borrowers.

- Rising Demand for Quick and Accessible Loans:In future, the demand for quick loans in France is projected to reachUSD 16 billion, driven by consumers seeking immediate financial solutions. The average loan processing time has decreased to just24 hours, making it easier for individuals to secure funds for emergencies or unexpected expenses. This trend is particularly prevalent among millennials, who prioritize speed and convenience in financial transactions, further propelling the online lending market.

- Growth of Digital Payment Solutions:The digital payment landscape in France is expanding rapidly, with e-commerce transactions expected to surpassUSD 120 billionin future. This growth is complemented by the increasing adoption of digital wallets and contactless payment methods, which enhance the overall customer experience. As more consumers engage in online transactions, the integration of lending apps with these payment solutions becomes essential, driving the demand for seamless financial services and fostering market growth.

Market Challenges

- Regulatory Compliance Complexities:The online lending sector in France faces stringent regulatory requirements, withover 40 lawsgoverning lending practices. Compliance with these regulations can be costly and time-consuming for lending platforms, particularly for startups. In future, the cost of compliance is estimated to account for15%of operational expenses, posing a significant barrier to entry and limiting the ability of new entrants to compete effectively in the market.

- High Competition Among Lending Platforms:The French online lending market is characterized by intense competition, withover 150 active lending platformsvying for market share. This saturation leads to aggressive pricing strategies, which can erode profit margins. In future, the average interest rate for personal loans is projected to be around5.5%, reflecting the competitive landscape. As platforms strive to differentiate themselves, maintaining profitability while offering attractive rates becomes increasingly challenging.

France Online Loan and Lending Apps Market Future Outlook

The future of the online loan and lending apps market in France appears promising, driven by technological advancements and evolving consumer preferences. As digital transformation continues, lending platforms are expected to leverage artificial intelligence for enhanced risk assessment and personalized offerings. Additionally, the trend towards sustainability in lending practices is likely to gain traction, with more consumers favoring eco-friendly financial solutions. These developments will shape a more inclusive and efficient lending ecosystem, catering to diverse borrower needs.

Market Opportunities

- Expansion into Underserved Demographics:There is a significant opportunity to target underserved demographics, such as low-income individuals and small business owners. In future, approximately13%of the population remains unbanked or underbanked, representing a potential market of over8 million people. Tailoring loan products to meet the specific needs of these groups can drive growth and foster financial inclusion.

- Integration of AI for Better Risk Assessment:The integration of artificial intelligence in credit scoring and risk assessment presents a substantial opportunity for lenders. In future, AI-driven solutions are expected to reduce default rates by up to20%, enabling lenders to make more informed decisions. This technological advancement can enhance customer trust and expand the borrower base, ultimately leading to increased market share for innovative lending platforms.