Region:Global

Author(s):Dev

Product Code:KRAB4253

Pages:94

Published On:October 2025

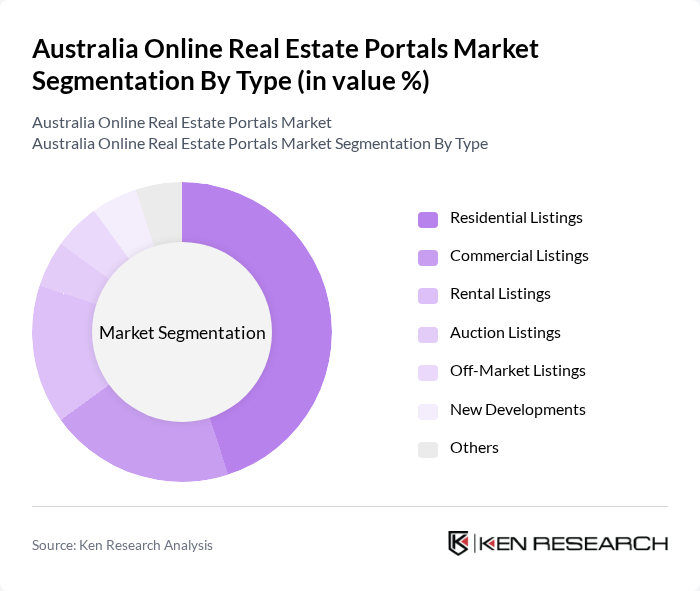

By Type:The market is segmented into various types, including Residential Listings, Commercial Listings, Rental Listings, Auction Listings, Off-Market Listings, New Developments, and Others. Among these, Residential Listings dominate the market due to the high demand for housing and the increasing number of first-time homebuyers. The trend towards urbanization and the growing population further fuel the demand for residential properties, making this sub-segment a key player in the online real estate portals market.

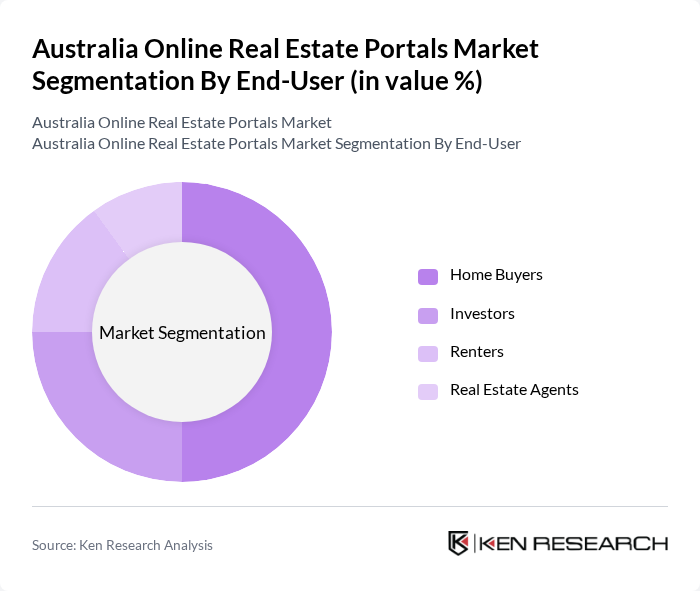

By End-User:The end-user segmentation includes Home Buyers, Investors, Renters, and Real Estate Agents. Home Buyers represent the largest segment, driven by the increasing number of individuals seeking to purchase homes, particularly in urban areas. The trend of millennials entering the housing market and the rise of remote work have also contributed to this growth, as more people are looking to buy homes that suit their lifestyle needs.

The Australia Online Real Estate Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as REA Group Limited, Domain Group, Allhomes, PropertyGuru, Homely, Rent.com.au, Realestate.com.au, LJ Hooker, McGrath Estate Agents, First National Real Estate, Ray White, Harcourts, Belle Property, Stockdale & Leggo, Ouwens Casserly Real Estate contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia online real estate portals market appears promising, driven by technological advancements and evolving consumer preferences. The integration of virtual reality and augmented reality technologies is expected to enhance property viewing experiences, making listings more engaging. Additionally, as the demand for eco-friendly properties rises, portals that highlight sustainable options will likely attract environmentally conscious buyers, further shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Listings Commercial Listings Rental Listings Auction Listings Off-Market Listings New Developments Others |

| By End-User | Home Buyers Investors Renters Real Estate Agents |

| By Sales Channel | Direct Sales Online Platforms Real Estate Agencies Auctions |

| By Property Type | Single-Family Homes Multi-Family Homes Commercial Properties Land |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas Others |

| By User Demographics | First-Time Buyers Luxury Buyers Investors Retirees |

| By Market Segment | Primary Market Secondary Market Rental Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 150 | First-time home buyers, Investors |

| Real Estate Agents | 100 | Licensed agents, Agency owners |

| Property Managers | 80 | Property management firms, Independent managers |

| Commercial Property Investors | 70 | Institutional investors, Private equity firms |

| Online Real Estate Portal Users | 120 | Active users, Casual browsers |

The Australia Online Real Estate Portals Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by increased digitization of transactions, rising property prices, and consumer preference for online platforms for property listings and comparisons.