Region:Africa

Author(s):Geetanshi

Product Code:KRAA4561

Pages:94

Published On:September 2025

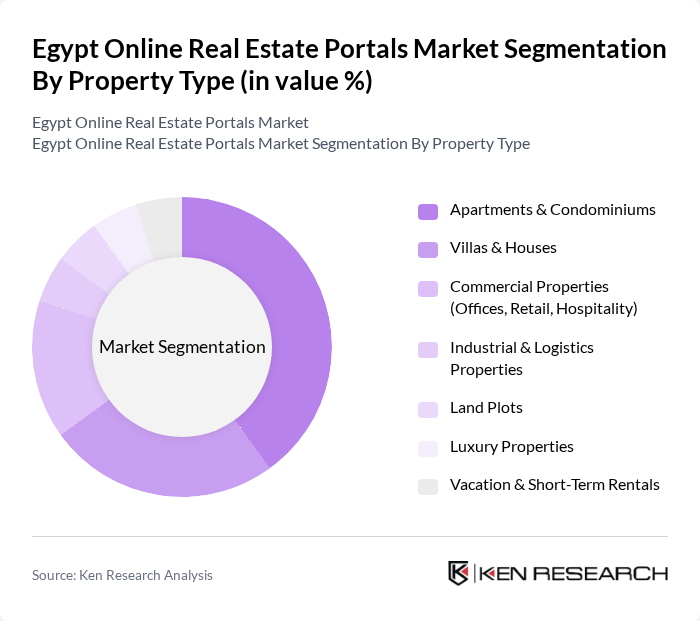

By Property Type:The property type segmentation includes various categories such as Apartments & Condominiums, Villas & Houses, Commercial Properties (Offices, Retail, Hospitality), Industrial & Logistics Properties, Land Plots, Luxury Properties, and Vacation & Short-Term Rentals. Among these, Apartments & Condominiums dominate the market due to their relative affordability, high demand among young professionals and families, and the ongoing trend toward urban living. The influx of expatriates and the expansion of new cities further bolster this segment's growth .

By End-User:The end-user segmentation encompasses Individual Buyers & Renters, Real Estate Investors, Corporates & SMEs, and Government & Institutional Buyers. Individual Buyers & Renters represent the largest segment, driven by Egypt’s growing population, a rising trend of young adults seeking independent living, and the increasing accessibility of digital platforms for property search and transactions. The digital transformation of the real estate sector has empowered individuals to make more informed decisions and facilitated a seamless property acquisition process .

The Egypt Online Real Estate Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Property Finder Egypt, Aqarmap, OLX Egypt, Beeyoot, Coldwell Banker Egypt, RE/MAX Egypt, Nawy, NewHomez, Sakneen, Al Ahly Sabbour Developments, Sakan, ElWaseet, Bayut Egypt, B2B Real Estate, House Solution Egypt contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's online real estate portals is poised for growth, driven by technological advancements and changing consumer preferences. As mobile applications become increasingly popular, more users are expected to engage with real estate platforms via smartphones. Additionally, the integration of AI and virtual reality technologies will enhance user experiences, making property searches more interactive and efficient. These trends indicate a shift towards a more digital and user-friendly real estate market, aligning with global standards and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Property Type | Apartments & Condominiums Villas & Houses Commercial Properties (Offices, Retail, Hospitality) Industrial & Logistics Properties Land Plots Luxury Properties Vacation & Short-Term Rentals |

| By End-User | Individual Buyers & Renters Real Estate Investors Corporates & SMEs Government & Institutional Buyers |

| By Transaction Type | Sale Rent/Lease Auction |

| By Geographic Location | Greater Cairo Alexandria Giza New Cities (e.g., New Administrative Capital, New Alamein) Other Governorates |

| By Price Range | Affordable Mid-Range Premium/Luxury |

| By Platform Access | Web-Based Portals Mobile Applications Hybrid Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 100 | First-time Home Buyers, Investors |

| Commercial Property Developers | 60 | Project Managers, Business Development Managers |

| Real Estate Agents | 80 | Licensed Real Estate Agents, Brokers |

| Online Real Estate Platform Users | 50 | Active Users, Property Seekers |

| Market Analysts and Experts | 40 | Real Estate Analysts, Market Researchers |

The Egypt Online Real Estate Portals Market is valued at approximately USD 2.6 billion, reflecting significant growth driven by increasing demand for digital property listings and urbanization trends.