Region:Global

Author(s):Geetanshi

Product Code:KRAA5267

Pages:83

Published On:September 2025

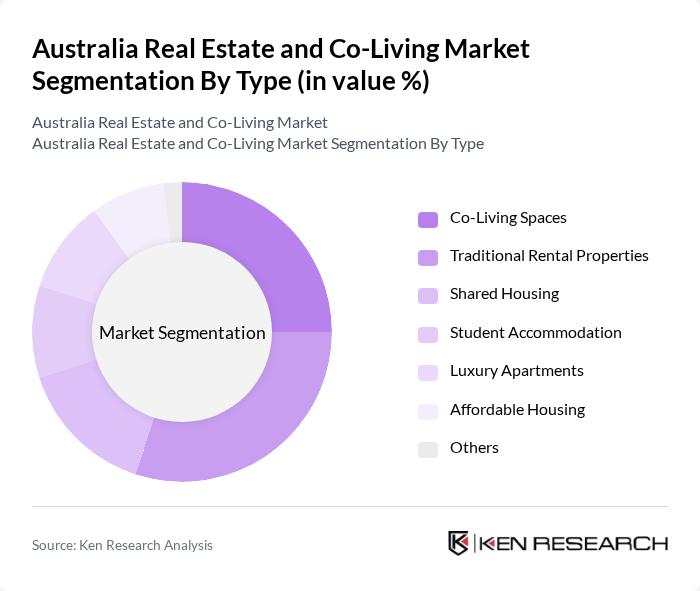

By Type:The market can be segmented into various types, including Co-Living Spaces, Traditional Rental Properties, Shared Housing, Student Accommodation, Luxury Apartments, Affordable Housing, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of the real estate market.

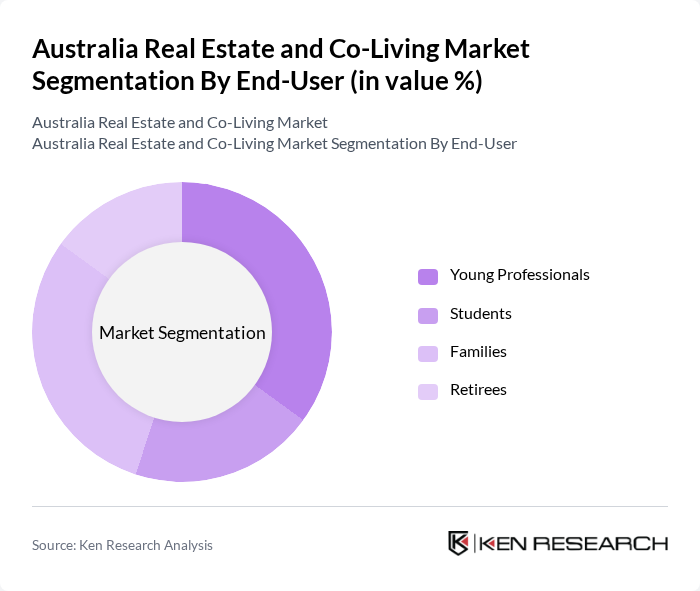

By End-User:The end-user segmentation includes Young Professionals, Students, Families, and Retirees. Each group has distinct preferences and requirements, influencing the types of properties in demand and shaping the overall market dynamics.

The Australia Real Estate and Co-Living Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stockland Corporation Limited, Mirvac Group, Lendlease Group, Frasers Property Australia, Charter Hall Group, Dexus Property Group, Goodman Group, Australian Unity, Aveo Group, Quest Apartment Hotels, The Student Housing Company, Urbanest, Y Suites, The Collective, Ovolo Hotels contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia real estate and co-living market appears promising, driven by ongoing urbanization and evolving lifestyle preferences. As remote work continues to gain traction, the demand for flexible living arrangements is expected to rise. Additionally, the integration of smart home technologies and sustainability initiatives will likely enhance the appeal of co-living spaces, attracting environmentally conscious consumers. Overall, these trends indicate a dynamic market landscape that is responsive to changing societal needs and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Co-Living Spaces Traditional Rental Properties Shared Housing Student Accommodation Luxury Apartments Affordable Housing Others |

| By End-User | Young Professionals Students Families Retirees |

| By Price Range | Low-End Mid-Range High-End |

| By Location | Urban Areas Suburban Areas Regional Areas |

| By Duration of Stay | Short-Term Rentals Long-Term Rentals |

| By Amenities Offered | Furnished vs Unfurnished Utilities Included Community Services |

| By Investment Type | Individual Investors Institutional Investors Real Estate Investment Trusts (REITs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Co-Living Space Operators | 100 | Property Managers, Business Development Executives |

| Potential Co-Living Residents | 150 | Young Professionals, University Students |

| Real Estate Developers | 80 | Project Managers, Investment Analysts |

| Urban Planners | 60 | City Planners, Policy Advisors |

| Housing Policy Experts | 50 | Academics, Government Officials |

The Australia Real Estate and Co-Living Market is valued at approximately USD 1.2 trillion, driven by urbanization, population growth, and the demand for affordable housing solutions, particularly in major cities like Sydney, Melbourne, and Brisbane.