Region:Europe

Author(s):Shubham

Product Code:KRAB1320

Pages:95

Published On:October 2025

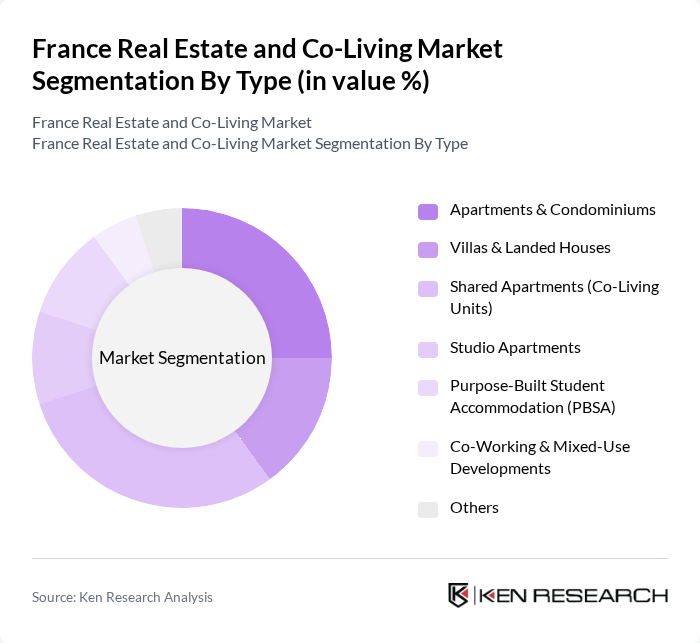

By Type:The market is segmented into Apartments & Condominiums, Villas & Landed Houses, Shared Apartments (Co-Living Units), Studio Apartments, Purpose-Built Student Accommodation (PBSA), Co-Working & Mixed-Use Developments, and Others. Among these,Shared Apartments (Co-Living Units)have emerged as the dominant segment, driven by the increasing popularity of communal living among millennials and young professionals. This segment addresses the need for affordable, flexible housing and fosters a sense of community, making it particularly attractive in urban centers where housing costs are high and social connectivity is valued .

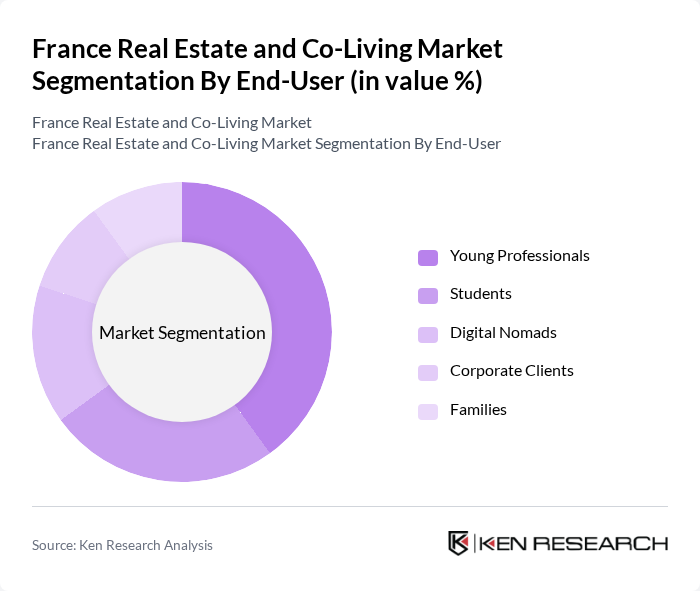

By End-User:The end-user segmentation includes Young Professionals, Students, Digital Nomads, Corporate Clients, and Families.Young Professionalsrepresent the largest segment, reflecting the increasing number of individuals entering the workforce and seeking flexible, amenity-rich living arrangements. This demographic is particularly drawn to co-living spaces that offer community engagement, networking opportunities, and tailored services, making them a primary driver of market growth .

The France Real Estate and Co-Living Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nexity, Bouygues Immobilier, Icade, Unibail-Rodamco-Westfield, Covivio (formerly Foncière des Régions), Les Jardins d'Arcadie, Colonies, The Social Hub (formerly The Student Hotel), WeWork, Homelike, Roomlala, BnBSitter, Co-Liv, Oxygène, Urban Campus contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France real estate and co-living market appears promising, driven by evolving consumer preferences and urbanization. As cities continue to grow, the demand for innovative housing solutions will likely increase. The integration of technology in co-living spaces, such as smart home features, will enhance the living experience. Additionally, partnerships with local governments to promote affordable housing initiatives will further support market growth, ensuring that co-living remains a viable option for diverse demographics in urban areas.

| Segment | Sub-Segments |

|---|---|

| By Type | Apartments & Condominiums Villas & Landed Houses Shared Apartments (Co-Living Units) Studio Apartments Purpose-Built Student Accommodation (PBSA) Co-Working & Mixed-Use Developments Others |

| By End-User | Young Professionals Students Digital Nomads Corporate Clients Families |

| By Region | Île-de-France (Paris Region) Auvergne-Rhône-Alpes Provence-Alpes-Côte d'Azur Occitanie Nouvelle-Aquitaine Hauts-de-France |

| By Price Range | Affordable/Budget Options Mid-Range Options Premium/Luxury Options |

| By Service Offering | Fully Furnished Utilities Included Community Events & Services Smart Home Features |

| By Duration of Stay | Short-Term Rentals Long-Term Rentals |

| By Policy Support | Subsidies for Co-Living Projects Tax Exemptions for Developers Government Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Co-Living Operators | 60 | Property Managers, Business Development Managers |

| Potential Co-Living Residents | 100 | Young Professionals, Students, Digital Nomads |

| Real Estate Developers | 40 | Project Managers, Investment Analysts |

| Urban Planners and Policy Makers | 40 | City Officials, Urban Development Consultants |

| Market Analysts and Researchers | 40 | Real Estate Analysts, Economic Researchers |

The France Real Estate and Co-Living Market is valued at approximately USD 1.1 trillion, reflecting a stabilization of property prices and increased buyer activity, particularly in major cities like Paris, Lyon, and Marseille.