Region:Global

Author(s):Shubham

Product Code:KRAA0931

Pages:89

Published On:August 2025

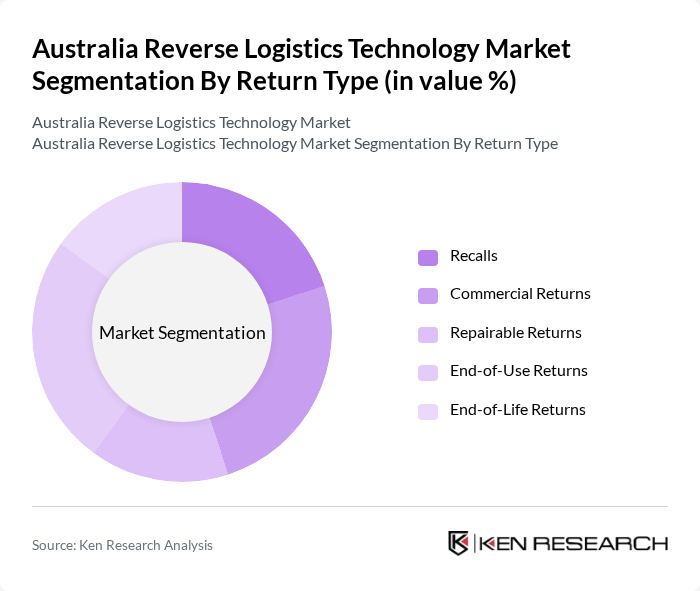

By Return Type:The return type segmentation includes categories such as recalls, commercial returns, repairable returns, end-of-use returns, and end-of-life returns. Each sub-segment addresses specific business needs: recalls manage defective or unsafe products; commercial returns handle customer-initiated returns; repairable returns involve items suitable for refurbishment; end-of-use returns cover products no longer needed by the user but still functional; and end-of-life returns focus on products at the end of their usable lifespan, often for recycling or disposal .

The commercial returns sub-segment is currently dominating the market, driven by the rapid growth of e-commerce and the increasing prevalence of online shopping. Consumers are more likely to return products purchased online, resulting in a higher volume of commercial returns. Retailers are responding with flexible return policies to enhance customer satisfaction and loyalty, prompting businesses to invest in efficient reverse logistics systems for effective management .

By Service:The service segmentation encompasses offerings such as transportation, warehousing, reselling, replacement management, refund management authorization, and others. Transportation involves the movement of returned goods; warehousing covers storage and consolidation; reselling focuses on remarketing returned items; replacement management handles product exchanges; and refund management authorization ensures accurate and timely refunds. Each service is essential for optimizing the reverse logistics process and ensuring efficient handling of returned products .

Transportation services lead the market due to their critical role in the reverse logistics process. Efficient transportation is essential for the timely movement of returned goods to warehouses or manufacturers. The surge in e-commerce has significantly increased return volumes, necessitating robust transportation solutions. Companies are investing in advanced tracking, automation, and routing technologies to optimize transportation networks and reduce costs .

The Australia Reverse Logistics Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toll Group, Australia Post, DB Schenker Australia, DHL Supply Chain Australia, Suez Australia & New Zealand, CouriersPlease, FedEx Express Australia, CEVA Logistics Australia, Remondis Australia, Reconomy Group (Reverse Logistics Solutions), Yusen Logistics (Australia) Pty Ltd, Shippit, Sendle, 2nd Life Technologies, and Returnr contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Australia reverse logistics technology market appears promising, driven by increasing consumer expectations for seamless return processes and sustainability initiatives. As businesses adapt to the growing e-commerce landscape, investments in advanced technologies will likely rise. Additionally, the push for circular economy practices will encourage companies to innovate their reverse logistics strategies, ensuring they remain competitive while meeting regulatory requirements and consumer demands for environmentally responsible solutions.

| Segment | Sub-Segments |

|---|---|

| By Return Type | Recalls Commercial Returns Repairable Returns End-of-Use Returns End-of-Life Returns |

| By Service | Transportation Warehousing Reselling Replacement Management Refund Management Authorization Others |

| By End-User | E-Commerce Automotive Pharmaceutical Consumer Electronics Retail Luxury Goods Reusable Packaging |

| By Geographic Region | New South Wales Victoria Queensland South Australia Western Australia Tasmania Northern Territory |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 60 | Operations Managers, Customer Service Heads |

| Automotive Parts Recovery | 50 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 40 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 50 | eCommerce Managers, Fulfillment Center Supervisors |

The Australia Reverse Logistics Technology Market is valued at approximately USD 13.6 billion, reflecting significant growth driven by e-commerce expansion, consumer demand for easy returns, and a focus on sustainability and waste reduction.