Region:Europe

Author(s):Dev

Product Code:KRAA0402

Pages:95

Published On:August 2025

By Solution Type:The solution type segmentation includes various subsegments that address the full spectrum of reverse logistics needs. The primary subsegments are Return Management Software Platforms, Reverse Logistics Service Providers, Inventory & Asset Recovery Solutions, Transportation & Route Optimization Systems, Warehouse & Fulfillment Management Systems, Data Analytics & Reporting Tools, and Automated Sorting & Robotics Solutions. Among these, Return Management Software Platforms are leading the market due to the increasing need for efficient, transparent, and customer-centric return processes. Companies are increasingly adopting these platforms to streamline operations, leverage real-time data, and enhance the overall customer experience .

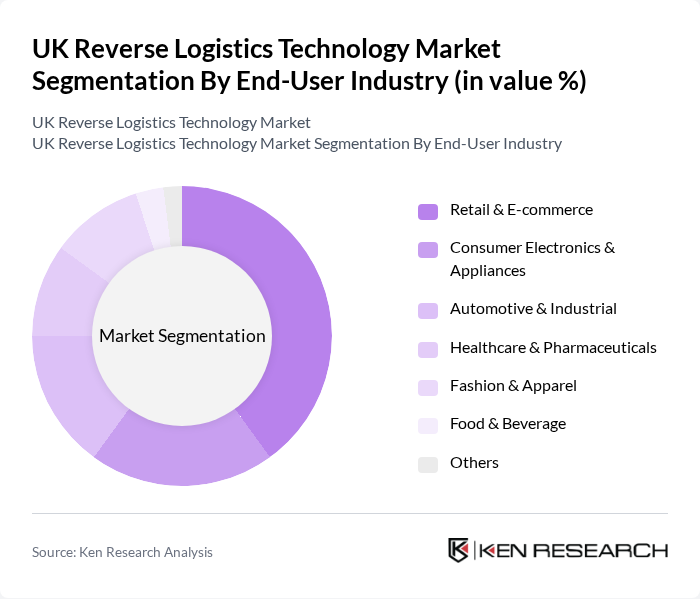

By End-User Industry:The end-user industry segmentation encompasses various sectors that utilize reverse logistics technology. Key subsegments include Retail & E-commerce, Consumer Electronics & Appliances, Automotive & Industrial, Healthcare & Pharmaceuticals, Fashion & Apparel, Food & Beverage, and Others. The Retail & E-commerce sector is the dominant segment, driven by the exponential growth of online shopping, high return rates, and the increasing volume of product returns. Companies in this sector are leveraging advanced reverse logistics solutions to manage returns efficiently, reduce costs, and improve customer satisfaction .

The UK Reverse Logistics Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, UPS Supply Chain Solutions, FedEx Logistics, XPO Logistics, Geodis, Kuehne + Nagel, CEVA Logistics, Ryder System, Inc., DB Schenker, DPDgroup, Yodel, Whistl, InPost, ReBOUND Returns, Optoro, ZigZag Global, Sorted Group, Cycleon, ReturnGO, Happy Returns (a PayPal company) contribute to innovation, geographic expansion, and service delivery in this space.

The UK reverse logistics technology market is poised for significant transformation as businesses increasingly adopt innovative solutions to enhance efficiency and sustainability. The integration of AI and machine learning will enable predictive analytics for better returns management, while blockchain technology will provide transparency in the supply chain. As consumer expectations evolve, companies will prioritize customer experience in returns, leading to more streamlined processes and improved satisfaction rates. This focus on technology and customer-centric strategies will shape the future landscape of reverse logistics in the UK.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Return Management Software Platforms Reverse Logistics Service Providers Inventory & Asset Recovery Solutions Transportation & Route Optimization Systems Warehouse & Fulfillment Management Systems Data Analytics & Reporting Tools Automated Sorting & Robotics Solutions |

| By End-User Industry | Retail & E-commerce Consumer Electronics & Appliances Automotive & Industrial Healthcare & Pharmaceuticals Fashion & Apparel Food & Beverage Others |

| By Service Category | Return Processing & Authorization Remanufacturing & Refurbishment Recycling & Disposal Resale & Recommerce Warranty & Replacement Management Others |

| By Technology Deployment | Cloud-Based Solutions On-Premise Solutions Mobile Applications IoT & Connected Devices AI & Machine Learning Analytics Blockchain Integration Others |

| By Geographic Region | England Scotland Wales Northern Ireland Others |

| By Customer Segment | B2B (Business-to-Business) B2C (Business-to-Consumer) Government & Public Sector Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 60 | Operations Managers, Customer Service Managers |

| Automotive Parts Recovery | 50 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 40 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 50 | eCommerce Managers, Fulfillment Center Supervisors |

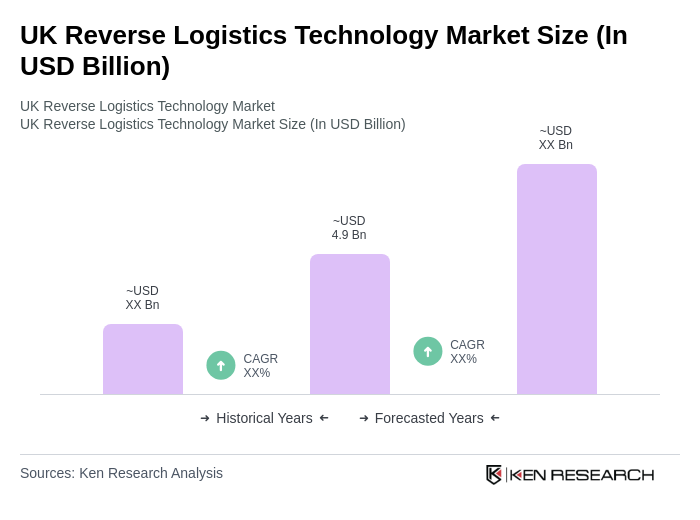

The UK Reverse Logistics Technology Market is valued at approximately USD 4.9 billion, driven by the increasing demand for efficient return management solutions and the growth of e-commerce, alongside a focus on sustainability in supply chain practices.