Region:Global

Author(s):Rebecca

Product Code:KRAA1356

Pages:81

Published On:August 2025

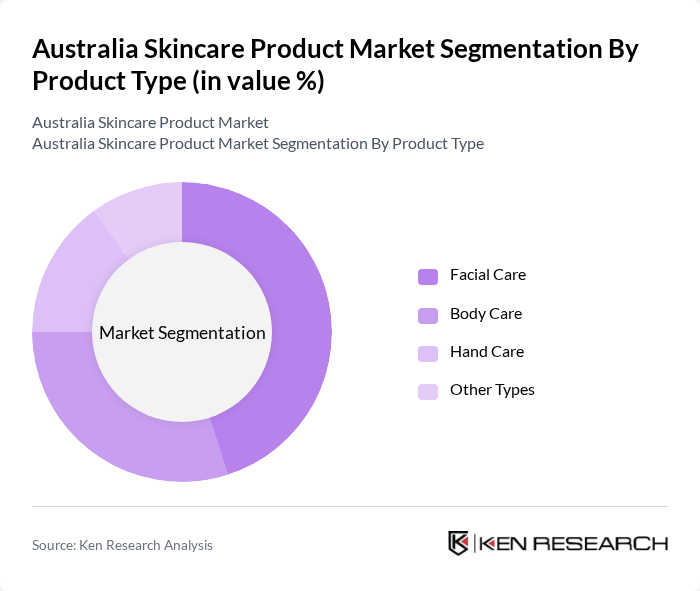

By Product Type:The market is segmented into Facial Care, Body Care, Hand Care, and Other Types. Among these, Facial Care is the leading segment, driven by the increasing demand for anti-aging products and facial moisturizers. Consumers are increasingly investing in skincare routines that focus on facial health, leading to a surge in product offerings in this category. Body Care follows closely, with a growing interest in body lotions and creams that cater to hydration and skin health .

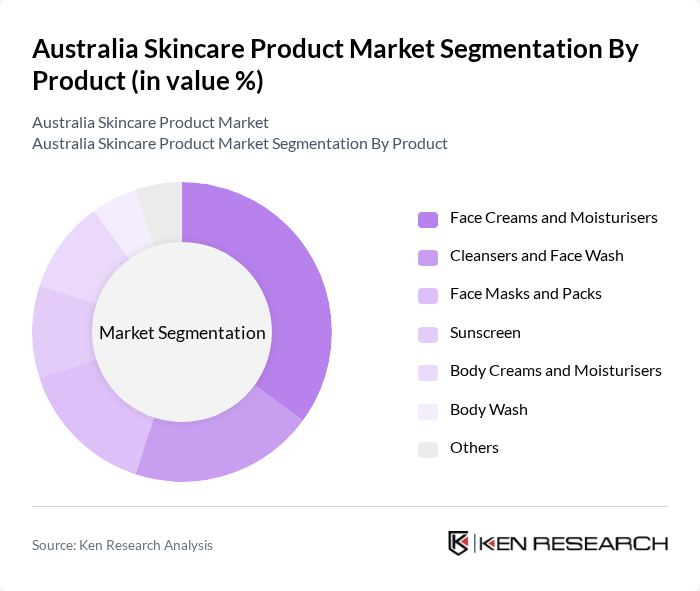

By Product:The product segmentation includes Face Creams and Moisturisers, Cleansers and Face Wash, Face Masks and Packs, Sunscreen, Body Creams and Moisturisers, Body Wash, and Others. Face Creams and Moisturisers dominate the market due to their essential role in daily skincare routines. The increasing awareness of sun protection has also led to a rise in sunscreen products, making it a significant segment in the market .

The Australia Skincare Product Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beiersdorf Australia Ltd., L'Oréal Australia Pty Ltd., Procter & Gamble Australia Pty Ltd., Unilever Australasia, Johnson & Johnson Pacific Pty Ltd., Shiseido Australia Pty Ltd., Estée Lauder Pty Limited, Coty Australia Pty Ltd., Revlon Australia Pty Ltd., Colgate-Palmolive Pty Ltd., Jurlique International Pty Ltd., Natio Pty Ltd., Dermalume Skincare, Kora Organics by Miranda Kerr Pty Ltd., The Body Shop Australia Pty Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Australian skincare market appears promising, driven by evolving consumer preferences and technological advancements. As consumers increasingly seek personalized skincare solutions, brands are likely to invest in research and development to create innovative products. Additionally, the rise of digital marketing and influencer partnerships will continue to shape consumer purchasing behavior, enhancing brand visibility and engagement. Sustainability will also play a crucial role, with brands focusing on eco-friendly practices to meet consumer demand for responsible products.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Facial Care Body Care Hand Care Other Types |

| By Product | Face Creams and Moisturisers Cleansers and Face Wash Face Masks and Packs Sunscreen Body Creams and Moisturisers Body Wash Others |

| By Category | Mass Premium |

| By Ingredient Type | Natural Ingredients Chemical Ingredients |

| By Gender | Male Female Unisex |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Specialist Retail Stores Pharmacies and Drug Stores Online Retail Stores Other Distribution Channels |

| By Region | New South Wales Victoria Queensland Australian Capital Territory Western Australia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Skincare Preferences | 100 | Skincare Users, Age 18-45 |

| Retail Insights on Skincare Products | 60 | Store Managers, Beauty Advisors |

| Dermatologist Recommendations | 40 | Dermatologists, Skincare Specialists |

| Market Trends in Natural Skincare | 50 | Consumers Interested in Organic Products |

| Impact of Social Media on Skincare Choices | 70 | Social Media Influencers, Active Users |

The Australia Skincare Product Market is valued at approximately USD 3.3 billion, reflecting a significant growth trend driven by increased consumer awareness, the rise of e-commerce, and a preference for natural and organic products.