Region:Europe

Author(s):Rebecca

Product Code:KRAA1410

Pages:86

Published On:August 2025

By Product Type:The skincare product market is segmented into various product types, including Facial Care, Body Care, Sun Care, Anti-Aging Products, Acne Treatment Products, Moisturizers, Men's Skincare, Baby & Children's Skincare, and Others. Among these, Facial Care products—which encompass cleansers, creams, serums, masks, and toners—dominate the market due to the increasing focus on skincare routines, the rising demand for anti-aging and dermocosmetic solutions, and the influence of personalized skincare driven by digital tools and social media. The trend toward sustainability and ethical consumption is also accelerating growth in natural and vegan facial care products .

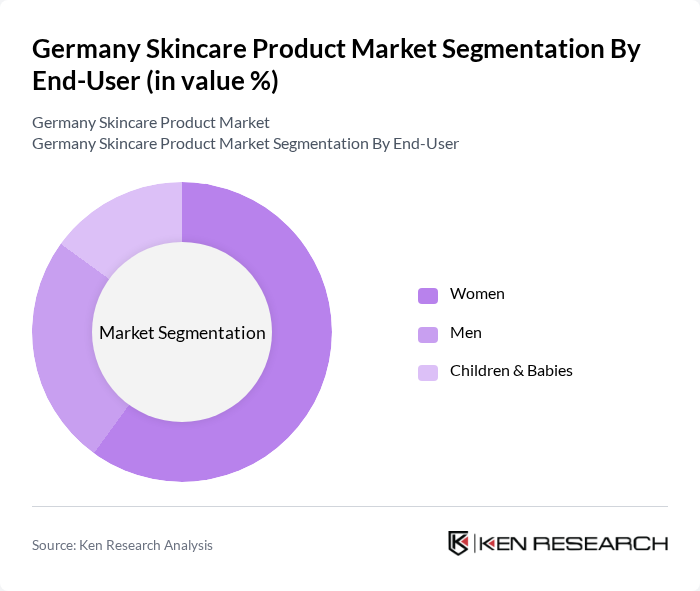

By End-User:The market is segmented by end-user demographics, including Women, Men, and Children & Babies. The Women segment holds the largest share, driven by a strong emphasis on skincare routines, the increasing availability of products tailored to women's specific skin needs, and a high adoption rate of anti-aging and premium skincare. The growing trend of male grooming and demand for specialized men's skincare is contributing to the rise of the Men's Skincare segment, while the Children & Babies segment is gaining traction due to heightened awareness of the importance of gentle and safe skincare for young skin .

The Germany Skincare Product Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beiersdorf AG, L'Oréal Deutschland GmbH, Procter & Gamble Germany GmbH, Unilever Deutschland GmbH, Coty Germany GmbH, Henkel AG & Co. KGaA, Estée Lauder Companies GmbH, Shiseido Germany GmbH, Johnson & Johnson GmbH, Clarins Germany GmbH, Kiehl's (L'Oréal Deutschland GmbH), Dr. Hauschka Skin Care GmbH, Weleda AG, NIVEA (Beiersdorf AG), Bioderma (NAOS Germany GmbH), La Roche-Posay (L'Oréal Deutschland GmbH), Eucerin (Beiersdorf AG), Sebamed (Sebapharma GmbH & Co. KG), Babor GmbH & Co. KG, Laverana GmbH & Co. KG (Lavera) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German skincare market appears promising, driven by evolving consumer preferences and technological advancements. As consumers increasingly prioritize sustainability, brands are expected to innovate with eco-friendly products and packaging. Additionally, the integration of technology, such as AI-driven personalized skincare solutions, is likely to enhance customer engagement. These trends will shape the market landscape, fostering growth and encouraging brands to adapt to the changing demands of consumers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Facial Care (Cleansers, Creams, Serums, Masks, Toners, etc.) Body Care (Lotions, Creams, Oils, etc.) Sun Care (Sunscreens, After-sun Products) Anti-Aging Products Acne Treatment Products Moisturizers Men's Skincare Baby & Children's Skincare Others (e.g., Hand Care, Foot Care) |

| By End-User | Women Men Children & Babies |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Beauty Stores Pharmacies/Drugstores Direct Sales Department Stores Others |

| By Price Range | Premium Mid-Range Budget/Mass Market |

| By Ingredient Type | Natural Ingredients Synthetic Ingredients Organic Ingredients Vegan/Cruelty-Free |

| By Packaging Type | Tube Jar Pump Bottle Sachet/Single-Use Others |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Occasional Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Skincare Preferences | 150 | Skincare Users, Beauty Enthusiasts |

| Retail Insights on Skincare Products | 100 | Store Managers, Beauty Advisors |

| Dermatologist Recommendations | 40 | Dermatologists, Skincare Specialists |

| Market Trends in Natural Skincare | 80 | Natural Product Retailers, Eco-conscious Consumers |

| Impact of Social Media on Skincare Choices | 120 | Social Media Influencers, Digital Marketers |

The Germany Skincare Product Market is valued at approximately USD 4.1 billion, reflecting a significant growth trend driven by consumer awareness, e-commerce expansion, and a preference for natural and premium products.