Region:Asia

Author(s):Dev

Product Code:KRAB0668

Pages:80

Published On:August 2025

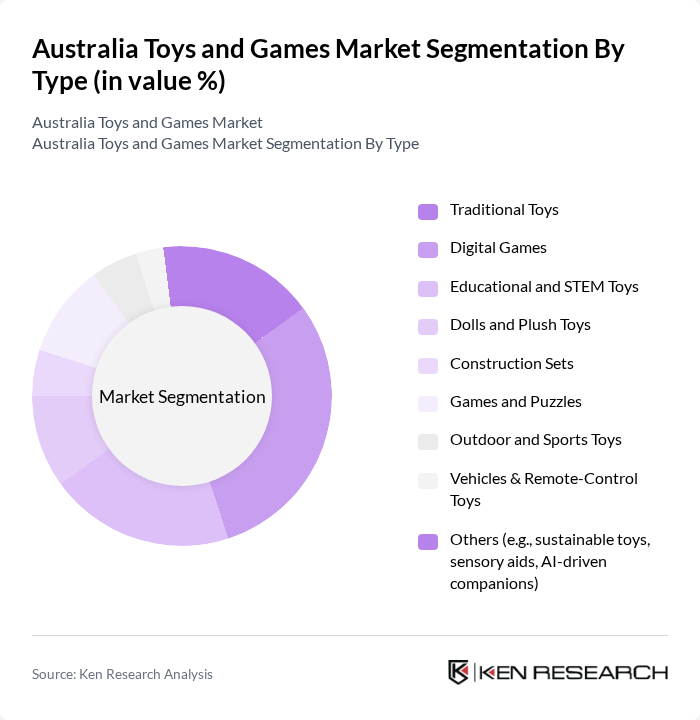

By Type:The toys and games market is segmented into traditional toys, digital games, educational and STEM toys, dolls and plush toys, construction sets, games and puzzles, outdoor and sports toys, vehicles & remote-control toys, and others such as sustainable toys and AI-driven companions. Digital games have experienced robust growth, fueled by the widespread adoption of smartphones, tablets, and gaming consoles. Educational and STEM toys are gaining momentum, as parents increasingly seek products that integrate learning with play, supporting cognitive and social development .

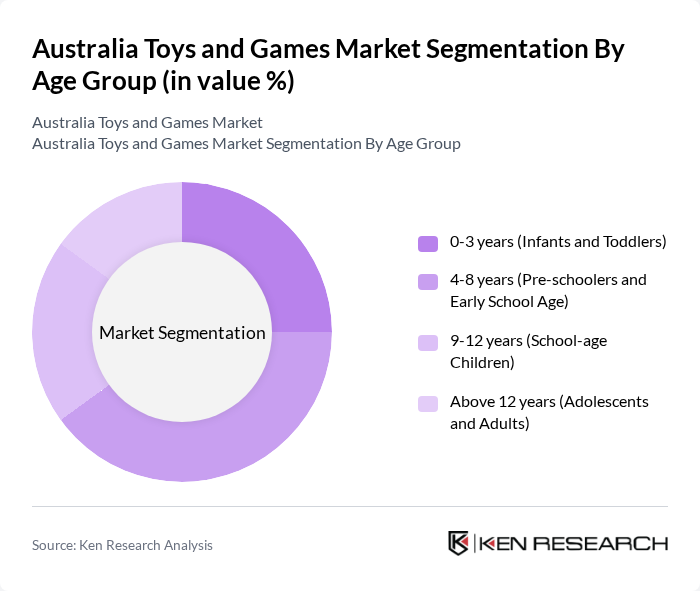

By Age Group:The market is segmented by age group into infants and toddlers (0-3 years), preschoolers and early school age (4-8 years), school-age children (9-12 years), and adolescents and adults (above 12 years). The preschool segment is particularly prominent, as parents prioritize toys that foster early childhood development, creativity, and problem-solving skills. The adult collector segment is also expanding, with premium and limited-edition releases targeting older demographics .

The Australia Toys and Games Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mattel, Inc., Hasbro, Inc., LEGO Group, Spin Master Corp., Bandai Namco Holdings Inc., Playmobil (Geobra Brandstätter Stiftung & Co. KG), Ravensburger AG, VTech Holdings Limited, Tomy Company, Ltd., MGA Entertainment, Inc., Schleich GmbH, Jakks Pacific, Inc., Goliath Games, Funko, Inc., ZURU Ltd., Funtastic Limited (Toys"R"Us ANZ) Limited, Associated Retailers Limited (Toyworld), Moose Toys Pty Ltd., Child Education Pty Ltd., LeapFrog Enterprises, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Australia toys and games market is poised for continued growth, driven by evolving consumer preferences and technological advancements. The increasing focus on STEM education will likely lead to a surge in demand for related toys, while the integration of augmented reality and smart technology into products will enhance engagement. Additionally, the shift towards sustainable practices will encourage manufacturers to innovate eco-friendly toys, aligning with consumer values and regulatory expectations, thus shaping a dynamic market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Toys Digital Games Educational and STEM Toys Dolls and Plush Toys Construction Sets Games and Puzzles Outdoor and Sports Toys Vehicles & Remote-Control Toys Others (e.g., sustainable toys, sensory aids, AI-driven companions) |

| By Age Group | 3 years (Infants and Toddlers) 8 years (Pre-schoolers and Early School Age) 12 years (School-age Children) Above 12 years (Adolescents and Adults) |

| By Sales Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Discount Stores |

| By Price Range | Low Price (<$20) Mid Price ($20-$50) High Price (>$50) |

| By Brand | National Brands Private Labels International Brands |

| By Distribution Mode | Direct Sales Indirect Sales E-commerce Platforms |

| By Product Lifecycle Stage | Introduction Growth Maturity Decline |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Toy Sales | 150 | Store Managers, Retail Buyers |

| Manufacturing Insights | 100 | Production Managers, Quality Assurance Officers |

| Consumer Preferences | 150 | Parents, Guardians, Children aged 5-12 |

| Distribution Channels | 80 | Logistics Coordinators, Supply Chain Analysts |

| Market Trends Analysis | 120 | Market Analysts, Industry Experts |

The Australia Toys and Games Market is valued at approximately USD 1.6 billion, driven by factors such as rising disposable incomes, population growth, and a shift towards online shopping, reflecting changing consumer preferences for innovative and educational toys.