Region:Global

Author(s):Dev

Product Code:KRAA1580

Pages:85

Published On:August 2025

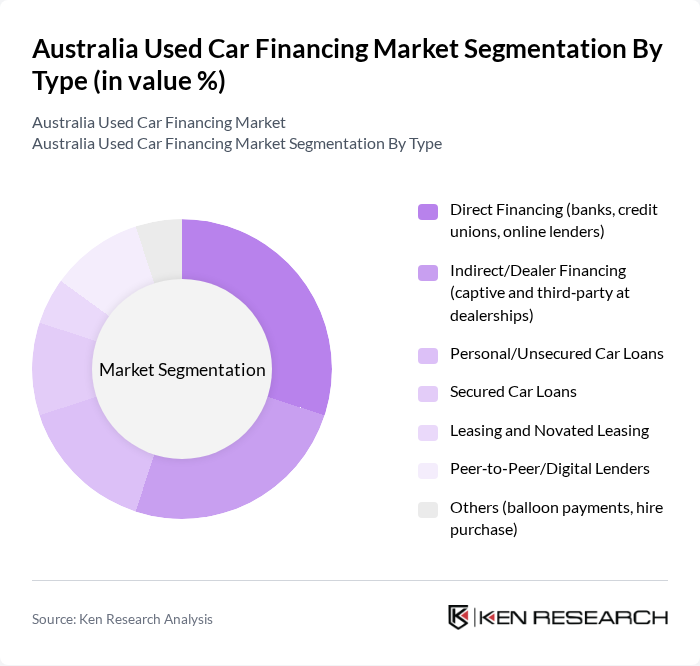

By Type:The market can be segmented into various types of financing options available to consumers. These include Direct Financing, which involves banks, credit unions, and online lenders; Indirect/Dealer Financing, which is facilitated through dealerships; Personal/Unsecured Car Loans; Secured Car Loans; Leasing and Novated Leasing; Peer-to-Peer/Digital Lenders; and other financing options such as balloon payments and hire purchase. Each of these subsegments caters to different consumer needs and preferences.

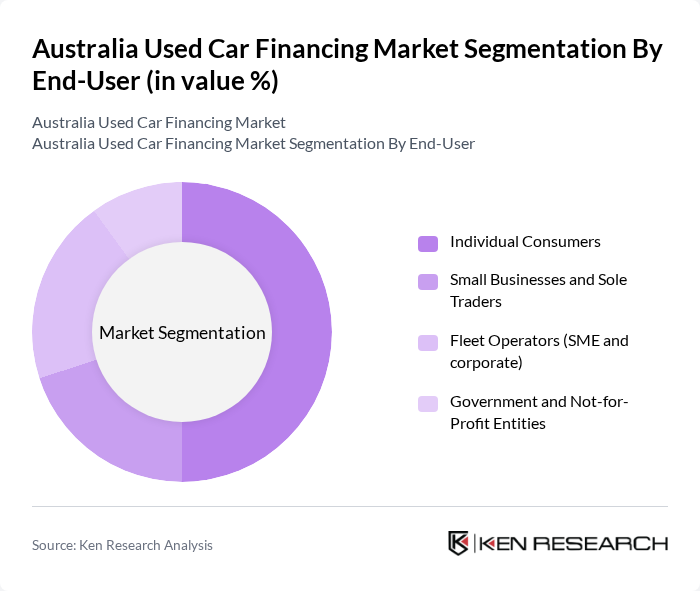

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses and Sole Traders, Fleet Operators (SME and corporate), and Government and Not-for-Profit Entities. Each of these segments has distinct financing needs, with individual consumers typically seeking personal loans, while businesses may require financing for fleet purchases or operational vehicles.

The Australia Used Car Financing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Commonwealth Bank of Australia (CBA), Westpac Banking Corporation, Australia and New Zealand Banking Group Limited (ANZ), National Australia Bank Limited (NAB), Macquarie Bank Limited, St.George Bank, Bendigo and Adelaide Bank Limited, Suncorp-Metway Limited, Latitude Financial Services, Pepper Money Limited, Liberty Financial Group, Wisr Limited, Plenti Group Limited, Money3 Corporation Limited, CarLoans.com.au (Eclipx Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the used car financing market in Australia appears promising, driven by ongoing digital transformation and evolving consumer preferences. As more buyers turn to online platforms for vehicle purchases, financing processes will likely become more streamlined and user-friendly. Additionally, the increasing focus on sustainability may lead to a rise in financing options for electric and hybrid vehicles, catering to environmentally conscious consumers. These trends suggest a dynamic market landscape with significant growth potential in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Direct Financing (banks, credit unions, online lenders) Indirect/Dealer Financing (captive and third?party at dealerships) Personal/Unsecured Car Loans Secured Car Loans Leasing and Novated Leasing Peer?to?Peer/Digital Lenders Others (balloon payments, hire purchase) |

| By End-User | Individual Consumers Small Businesses and Sole Traders Fleet Operators (SME and corporate) Government and Not?for?Profit Entities |

| By Price Range | Under AUD 10,000 AUD 10,000 - AUD 20,000 AUD 20,000 - AUD 30,000 Over AUD 30,000 |

| By Financing Term | Short-term Financing (up to 3 years) Medium-term Financing (3 to 5 years) Long-term Financing (over 5 years) |

| By Credit Score | Prime Borrowers Near-prime Borrowers Subprime Borrowers |

| By Loan Purpose | Personal Use Business Use Investment |

| By Distribution Channel | Online Platforms and Marketplaces Dealerships (franchise and independent) Banks and Credit Unions Non?Bank Lenders and Finance Brokers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Car Dealerships | 100 | Dealership Owners, Sales Managers |

| Financial Institutions | 80 | Loan Officers, Credit Analysts |

| Recent Used Car Buyers | 150 | Consumers aged 25-45, First-time Buyers |

| Automotive Financing Experts | 60 | Financial Advisors, Automotive Analysts |

| Consumer Advocacy Groups | 40 | Consumer Rights Advocates, Financial Educators |

The Australia Used Car Financing Market is valued at approximately AUD 20 billion, driven by increasing consumer demand for affordable mobility and wider availability of credit from various lenders, including banks and digital platforms.